U.S. stocks slide on jobless claims, Dow Jones drops 174 points

Lola Evans

26 Sep 2025, 01:44 GMT+10

- The Dow Jones Industrial Average fell 173.96 points, a loss of 0.38 percent, to 45,947.32.

- The NASDAQ Composite slid 113.16 points, or 0.50 percent, to settle at 22,384.70.

- The Standard and Poor's 500dipped 33.25 points, or 0.50 percent, to close at 6,604.72.

NEW YORK, New York - U.S. stock markets closed lower on Thursday, with major indexes surrendering ground as investors weighed mixed corporate earnings and economic data showing a fall in jobless claims. The broad-based sell-off pulled the S&P 500 and Nasdaq down half a percent.

"In the week ending September 20, the advance figure for seasonally adjusted initial claims was 218,000, a decrease of 14,000 from the previous week's revised level," the Labor Department said in a statement Thursday. "The previous week's level was revised up by 1,000 from 231,000 to 232,000. The 4-week moving average was 237,500, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 240,000 to 240,250," the statement said.

The Standard and Poor's 500 (^GSPC) declined 33.25 points, or 0.50 percent, to close at 6,604.72.

The Dow Jones Industrial Average (^DJI) fell 173.96 points, a loss of 0.38 percent, finishing the session at 45,947.32.

The tech-heavy NASDAQ Composite (^IXIC) mirrored the S&P 500, dropping 113.16 points, or 0.50 percent, to settle at 22,384.70.

The downturn on Wall Street was broad-based, with market analysts pointing to renewed concerns about the timing of future interest rate cuts from the Federal Reserve. The losses suggest a cautious mood among investors following the recent rally to record highs.

U.S. Dollar Strengthens Broadly on Thursday as Euro and Pound Slump

The U.S. dollar posted significant gains against a basket of major currencies on Thursday, driven by shifting investor expectations regarding interest rate policies. The dollar's strength was particularly evident against European and commodity-linked currencies.

The Euro (EUR/USD) fell sharply, declining 0.65 percent to trade at 1.1661. The British Pound (GBP/USD) faced even stronger selling pressure, dropping 0.80 percent to 1.3337.

The dollar's rally was not limited to Europe. The Australian Dollar (AUD/USD) weakened by 0.68 percent to 0.6537, and the New Zealand Dollar (NZD/USD) fell 0.78 percent to 0.5764.

Additionally, the U.S. Dollar (USD/JPY) surged against the Japanese Yen, climbing 0.59 percent to 149.77, a fresh multi-decade high

Canadian, European and Asian Markets Mostly Lower on Thursday; Nikkei Bucks the Trend

Major global stock indices closed mostly in negative territory on Thursday, as investor caution prevailed amid ongoing economic concerns. While European markets saw broad-based declines, trading in Asia was mixed, with Japan's Nikkei 225 managing a modest gain.

Canada's main benchmark showed relative resilience. The S&P/TSX Composite Index (^GSPTSE) edged down a modest 24.97 points, or 0.08 percent, to close at 29,731.98.

In London, the FTSE 100 (^FTSE) edged down 36.45 points, or 0.39 percent, to close at 9,213.98. The sell-off was more pronounced across the European continent. Germany's DAX (^GDAXI) fell 131.98 points, a decline of 0.56 percent, finishing at 23,534.83. France's CAC 40 (^FCHI) dropped 32.03 points, or 0.41 percent, to settle at 7,795.42.

The broader European benchmark, the EURO STOXX 50 (^STOXX50E), mirrored the trend, closing at 5,444.89 after a loss of 19.67 points, or 0.36 percent. The Euronext 100 (^N100) saw a smaller dip, falling 0.27 percent to 1,635.70. Belgium's BEL 20 (^BFX) was among the session's weakest performers in Europe, sliding 39.27 points, or 0.84 percent, to 4,642.33.

Asian markets presented a mixed picture. Hong Kong's Hang Seng Index (^HSI) finished with a minor loss of 0.13 percent at 26,484.68. Singapore's STI Index (^STI) declined 0.39 percent to 4,273.86.

Japan's Nikkei 225 (^N225) bucked the overall negative trend, advancing 124.62 points, or 0.27 percent, to close at a fresh multi-decade high of 45,754.93. Mainland China's SSE Composite Index (000001.SS) finished essentially flat at 3,853.30, down a negligible 0.01 percent.

Australia's markets provided a bright spot, albeit with modest gains. The S&P/ASX 200 (^AXJO) inched up 0.10 percent to 8,773.00, while the broader All Ordinaries Index (^AORD) added 0.06 percent to close at 9,063.40.

Elsewhere in the Asia-Pacific region, India's S&P BSE Sensex (^BSESN) fell 0.68 percent to 81,159.68. Indonesia's IDX Composite (^JKSE) was a notable decliner, dropping 1.06 percent to 8,040.67. Malaysia's FTSE Bursa Malaysia KLCI (^KLSE) was nearly flat, down just 0.07 percent. New Zealand's S&P/NZX 50 (^NZ50) retreated 0.21 percent to 13,153.79, and South Korea's KOSPI (^KS11) ended virtually unchanged, down a marginal 0.03 percent.

Taiwan's TWSE Index (^TWII) fell 0.66 percent to 26,023.85. In the Middle East, Egypt's EGX 30 (^CASE30) declined 0.77 percent. Conversely, Israel's TA-125 (^TA125.TA) was a strong performer, rising 1.26 percent to 3,069.27. after returing from the New Year holidays.

Recent related reports;

Wednesday 24 September 2025 | Dow Jones slides 172 points as stocks continue selling off | Big News Network

Tuesday 23 September 2025 | U.S. stocks retreat from record highs Tuesday | Big News Network

Monday 22 September 2025 | Wall Street marks back-to-back record gains | big News Network

Friday 19 September 2025 | Record-breaking day ends jubilant week on Wall Street | Big News Network

Thursday 18 September 2025 | Wall Street extends gains, dollar rebounds some more | Big News Network

Wednesday 17 September 2025 | Dow Jones jumps 260 points, dollar climbs, after Fed move | Big News Network

Tuesday 16 September 2025 | Wall Street retreats from record highs ahead of Fed rate decision | Big News Network

Monday 15 September 2025 | Nasdaq Composite and S&P 500 close at record highs Monday | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionTech giant ends Israeli mass surveillance of Palestinian civilians

REDMOND, Washington – Microsoft has severed ties with an Israeli military intelligence unit after determining the agency was using...

North Korea for talks with US but rejects sanctions-for-nukes deal

SEOUL, South Korea: North Korean leader Kim Jong Un has signaled that dialogue with the United States remains possible, but only if...

Ragasa, strongest storm of 2025, shutters Hong Kong and southern China

HONG KONG: Hong Kong went into lockdown on September 23 as Super Typhoon Ragasa — the world's most powerful storm of 2025 — closed...

Kabul dismisses US bid to return after chaotic withdrawal

JALALABAD, Afghanistan: The Taliban government has firmly rejected U.S. President Donald Trump's renewed call to regain control of...

Brussels cancels half its flights after cyberattack hits check-in

BRUSSELS, Belgium: A cyberattack that crippled check-in systems at several major European airports is still disrupting travel, forcing...

Trump names Murdochs, Michael Dell as potential TikTok deal players

WASHINGTON, D.C.: President Donald Trump said media mogul Rupert Murdoch, his son Lachlan Murdoch, and Dell Technologies founder Michael...

Wisconsin

SectionTrump’s $100K H-1B visa fee applies only to new applicants, WH says

WASHINGTON, D.C.: The White House rushed to calm fears among immigrant workers after President Donald Trump's plan to impose a $100,000...

Packers, Cowboys downplay Micah Parsons' return to Dallas

(Photo credit: Jeff Hanisch-Imagn Images) Cowboys coach Brian Schottenheimer claims Week 4 is just another week in Dallas, with a...

Strength vs. strength as Lions offense prepares for Browns defense

(Photo credit: Junfu Han / USA TODAY NETWORK via Imagn Images) The Detroit Lions racked up 90 points and 937 yards over the past...

Reds can't afford another slip-up against Pirates

(Photo credit: Katie Stratman-Imagn Images) The Cincinnati Reds will try to salvage the finale of a three-game home series against...

MLB roundup: Cal Raleigh hits 60th homer as Mariners clinch AL West

(Photo credit: Stephen Brashear-Imagn Images) Cal Raleigh hit two home runs, giving him a major-league-leading 60 this season, as...

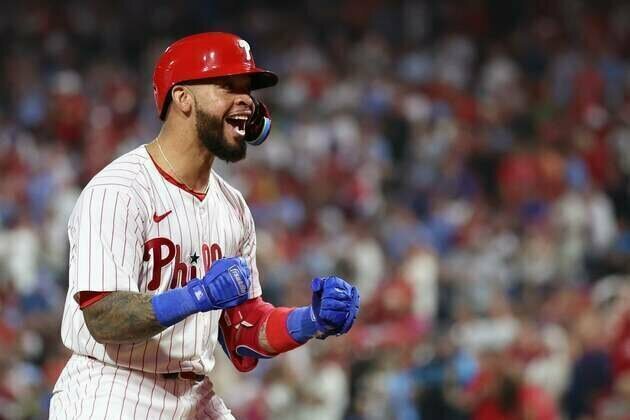

Phillies rout Marlins with record 8 homers, clinch first-round bye

(Photo credit: Bill Streicher-Imagn Images) Edmundo Sosa hit three of the Philadelphia Phillies' franchise-record eight home runs...