Industry welcomes RBI's decision to keep repo rate unchanged with cautious optimism

ANI

01 Oct 2025, 15:36 GMT+10

New Delhi [India], October 1 (ANI): Industry chambers have welcomed the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) decision to maintain the repo rate at 5.5 per cent with a neutral stance, citing it as a signal of stability and growth support in the backdrop of moderate inflation and strong GDP performance.

Hemant Jain, President of PHDCCI, said, 'Monetary Policy Committee of the Reserve Bank has decided to maintain the status quo on the policy repo rate at 5.5 per cent given the backdrop of moderate headline inflation and high GDP growth in Q1 FY 26 at 7.8 per cent amidst tariff related uncertainties,' Jain said. He added that good monsoon conditions, direct tax cuts, and monetary push are expected to lead to an upward revision of India's real GDP growth for the year.

Jain further noted that a healthy southwest monsoon, higher kharif sowing, adequate reservoir levels and comfortable foodgrain stocks have led to a projection of headline CPI inflation at 2.6 per cent for FY 2025-26. He also welcomed the RBI's announcement of 22 measures to improve ease of doing business, strengthen banking resilience, simplify foreign exchange management, enhance consumer satisfaction, and support the internationalisation of the Indian rupee.

Ranjeet Mehta, CEO and Secretary General of PHDCCI, said the RBI's commitment to remain 'proactive, objective and consistent' in its communication and actions provides confidence in the adaptability of its policy framework.

ASSOCHAM President Sanjay Nayar said the RBI's decision underlines 'a cautious yet supportive approach' by balancing growth with price stability. He said stable interest rates will help corporates plan investments and provide predictability for consumers on borrowing costs, while key sectors such as banking, infrastructure, and automobiles will benefit from steady demand conditions.

Echoing the view, ASSOCHAM Secretary General Manish Singhal said the move will help MSMEs access affordable loans and also maintain rupee stability in foreign exchange markets. 'Stable rates support the Indian rupee, attract foreign investment, and manage external pressures like import costs and global capital flows,' he said.

Pankaj Chadha, Chairman of EEPC India, called the move a 'cautious approach' in view of current global uncertainties. He added that while the decision is welcome, a rate cut in the coming months could ease borrowing costs for exporters, especially as India's engineering exports saw a 5 per cent decline in August due to the 50 per cent tariff imposed by the US. He urged the government to reinstate the Interest Equalisation Scheme to support MSMEs in the export sector. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionNew K visa offers foreign STEM grads entry without job offer in China

BEIJING, China: China's new visa programme aimed at attracting foreign tech workers launches this week, a move seen as boosting Beijing's...

Trump to cop multi-million dollar pay-out from YouTube

SAN FRANCISCO, California - YouTube has agreed to pay $24.5 million to settle a lawsuit filed by President Donald Trump, who alleged...

Record outage sparks fears at Europe’s largest nuclear facility

KYIV, Ukraine: Ukraine's Russian-occupied Zaporizhzhia nuclear power plant has been on emergency generators for more than a week, heightening...

Romance, sextortion scams targeted in Interpol operation in Africa

DAKAR, Senegal: Interpol says a coordinated crackdown on cybercrime across 14 African countries has led to the arrest of 260 people...

Netanyahu on plan for Gaza: 'achieves the impossible'

WASHINGTON, DC - Israeli Prime Minister Benjamin Netanyahu is enthusiastic about the Gaza peace plan finalized on Monday at the White...

UK Labour Party votes to sanction Israel over genocide

LIVERPOOL, UK – In a significant rebellion against its own leadership, the UK's governing Labour Party has voted to formally declare...

Wisconsin

SectionImmigration uncertainty forces Indian students to rethink US plans

BENGALURU/HYDERABAD/NEW DELHI, India: For thousands of Indian students, the American dream of world-class education, lucrative careers,...

United Airlines resumes flights after short-lived FAA ground stop

CHICAGO, Illinois: United Airlines briefly grounded flights across the U.S. and Canada on September 24, after a technical problem prompted...

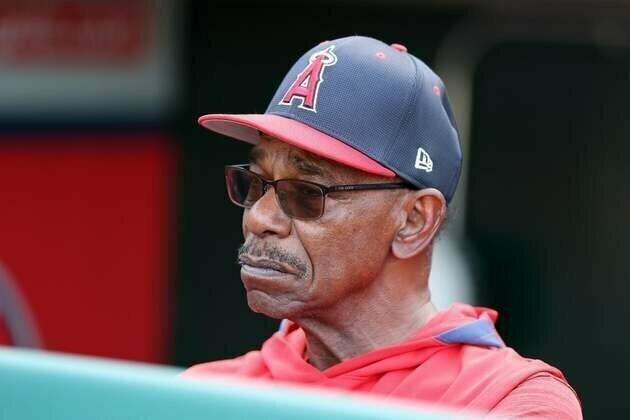

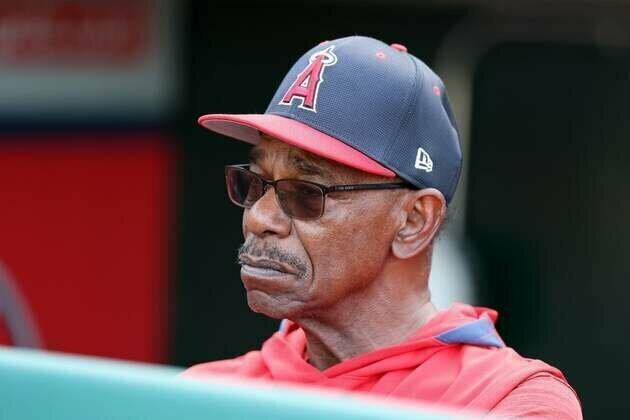

Angels move on from manager Ron Washington, interim Ray Montgomery

(Photo credit: Kiyoshi Mio-Imagn Images) Neither Ron Washington nor Ray Montgomery will return to manage the Los Angeles Angels in...

Cubs belt back-to-back HRs in Game 1 win over Padres

(Photo credit: David Banks-Imagn Images) Seiya Suzuki and Carson Kelly belted back-to-back homers to lead off the fifth inning, lifting...

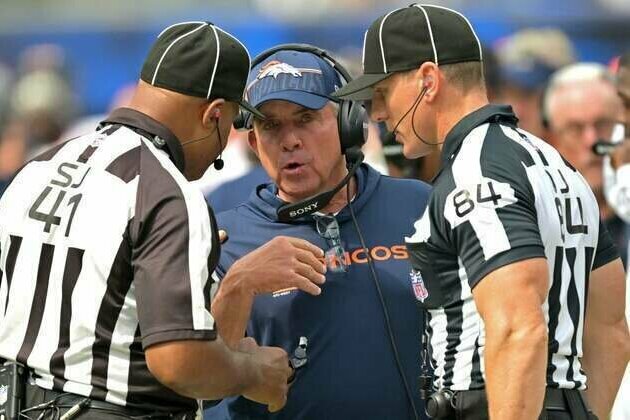

Broncos' Sean Payton calls B.S. on 'tush push' critics

(Photo credit: Jayne Kamin-Oncea-Imagn Images) If the Philadelphia Eagles successfully execute the 'tush push' against Denver on...

Report: Angels making manager change after last-place finish

(Photo credit: Kiyoshi Mio-Imagn Images) Neither Ron Washington nor Ray Montgomery will return to manage the Los Angeles Angels in...