Trump weighs order to fine banks for dropping political clients

Anabelle Colaco

07 Aug 2025, 17:14 GMT+10

- The White House is preparing to take action against banks accused of cutting off clients over political views, with a draft executive order that would direct federal agencies to investigate and penalize such behavior

- The order, which could be signed as soon as this week, would authorize a range of disciplinary tools, including fines, consent decrees, and other penalties against violators

- It also calls on regulators to remove any internal policies that may have contributed to banks' disengagement from specific clients

WASHINGTON, D.C.: The White House is preparing to take action against banks accused of cutting off clients over political views, with a draft executive order that would direct federal agencies to investigate and penalize such behavior, the Wall Street Journal reported this week.

Citing a draft of the order, the Journal said it would instruct regulators to examine whether any financial institutions are violating existing laws—including the Equal Credit Opportunity Act, antitrust statutes, and consumer financial protection rules—by dropping customers based on political beliefs or affiliations.

The order, which could be signed as soon as this week, would authorize a range of disciplinary tools, including fines, consent decrees, and other penalties against violators. It also calls on regulators to remove any internal policies that may have contributed to banks' disengagement from specific clients. Additionally, the Small Business Administration would be required to review the conduct of banks involved in its loan guarantee programs, according to the report.

The White House declined to comment when contacted by Reuters.

The pending executive action comes amid growing pressure from Republican lawmakers and conservative activists who accuse central U.S. banks of practicing "woke capitalism" by cutting ties with politically controversial industries, such as firearms, fossil fuels, and conservative advocacy groups.

U.S. President Donald Trump has previously accused top banks of discriminating against right-leaning clients. In January, he claimed that the CEOs of JPMorgan Chase and Bank of America refused to offer services to conservatives. Both banks denied that political beliefs influence their business decisions.

The right has grown critical of Wall Street in recent years, particularly in response to banks' internal ESG (environmental, social, and governance) policies and climate commitments. Several Republican-led states have taken legal or legislative action against financial firms over perceived discrimination against industries such as oil, gas, and firearms manufacturing.

The proposed executive order would mark a significant expansion of the administration's push to reshape financial regulation. Trump officials argue that existing rules often punish businesses arbitrarily or limit innovation, and they are pursuing a broader deregulatory agenda that includes revisiting capital requirements for banks.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionTrump weighs order to fine banks for dropping political clients

WASHINGTON, D.C.: The White House is preparing to take action against banks accused of cutting off clients over political views, with...

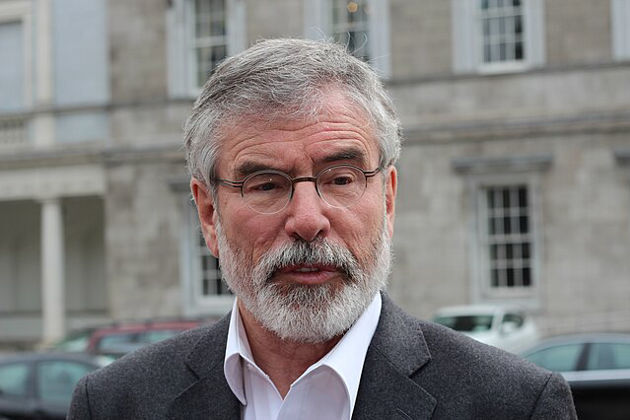

Gerry Adams slams ‘deplorable’ delay in court-ordered damages

BELFAST, Northern Ireland: The BBC is facing criticism for failing to pay court-ordered damages to former Sinn Féin president Gerry...

Pets fill LA shelters as owners detained in immigration raids

LANCASTER/DOWNEY, California: As immigration raids intensify across Los Angeles County, local animal shelters are dealing with an unexpected...

Visit by Israeli far-right minister stirs tensions in Jerusalem

TEL AVIV, Israel: Israel's far-right national security minister, Itamar Ben-Gvir, sparked renewed outrage over the weekend by leading...

Boeing faces strike as jet builders reject new labor agreement

NEW YORK CITY, New York: Thousands of Boeing workers who build the company's fighter jets are preparing to go on strike, after voting...

Chinese independents ramp up Iraq oil bets amid contract shift

SINGAPORE/BAGHDAD: While global oil giants scale back operations in Iraq, a new group of players is quietly filling the gap. Independent...

Wisconsin

SectionAfter hit-fest and pitchers' duel, A's, National conclude series

(Photo credit: Rafael Suanes-Imagn Images) The visiting Athletics and the Washington Nationals will play the decisive game of their...

MLB roundup: Jays cap epic sweep with 20-1 rout of Rockies

(Photo credit: Ron Chenoy-Imagn Images) Davis Schneider hit two of Toronto's five home runs to back seven strong innings by Kevin...

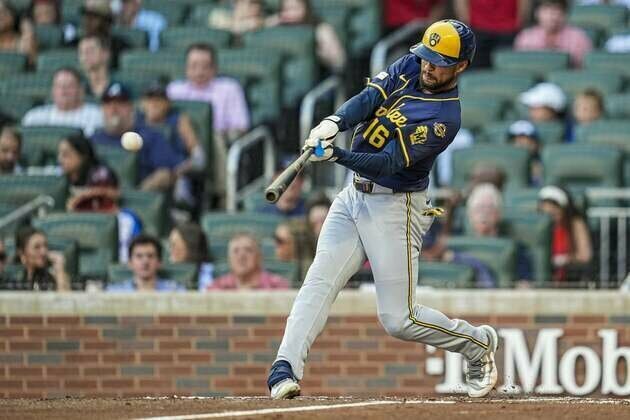

Majors-best Brewers sweep Braves, complete 6-0 trip

(Photo credit: Dale Zanine-Imagn Images) Andrew Vaughn and Blake Perkins hit home runs to support the solid effort of starter Jose...

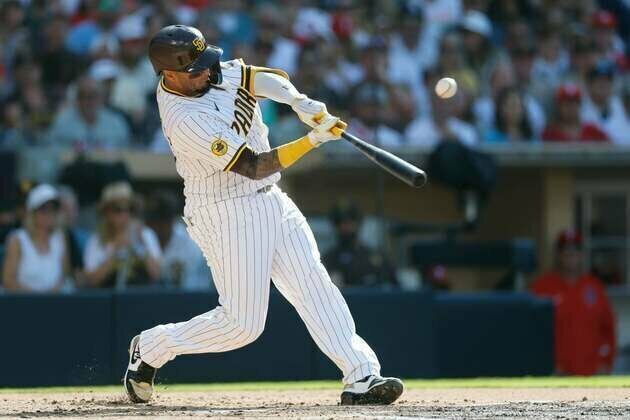

Padres release Martin Maldonado, outright Tyler Wade to Triple-A

(Photo credit: David Frerker-Imagn Images) The San Diego Padres released catcher Martin Maldonado and outrighted utility player Tyler...

Padres send Nestor Cortes out to face Diamondbacks

(Photo credit: Wendell Cruz-Imagn Images) When left-hander Nestor Cortes joined San Diego at the trade deadline last week, he marveled...

Behind Jose Quintana, Brewers aim for series sweep vs. Braves

(Photo credit: Jonathan Hui-Imagn Images) Jose Quintana wasn't even sure he was going to be with Milwaukee before the trade deadline...