U.S. stocks rally despite Nvidia earnings, firing of Lisa Cook

Lola Evans

29 Aug 2025, 01:38 GMT+10

- The NASDAQ Composite advanced 115.02 points to close at 21,705.16, marking a gain of 0.53 percent.

- The Dow Jones Industrial Average added 71.67 points, closing at 45,636.90, up 0.16 percent.

- The Standard and Poor's 500 rose 20.46 points to finish at 6,501.86, a gain of 0.32 percent.

NEW YORK, New York - U.S. stocks rose Thursday despite a dip in Nvidia following its earnings results which were below expectations. Nonetheless, technology stocks led the charge, although the stand-out index was the Standard and Poor's 500 which closed above 6,500 for the first time - notching up a new record high for the second day in a row.

Wall Street Overview

-

The S&P 500 rose 20.46 points to finish at 6,501.86, a gain of 0.32 percent. The index hit a fresh high as gains in information technology and communication services outweighed softness in consumer staples.

-

The Dow Jones Industrial Average added 71.67 points, closing at 45,636.90, up 0.16 percent. The blue-chip index saw support from industrial and healthcare names but lagged behind the broader market's pace.

-

The NASDAQ Composite advanced 115.02 points to close at 21,705.16, marking a gain of 0.53 percent. Tech giants continued to outperform amid optimism around AI-driven revenue growth and solid earnings momentum across the sector.

Volume was strong across the board, with over 2.5 billion shares traded on the S&P 500 and nearly 6.9 billion shares changing hands on the NASDAQ.

Thursday's Forex Market Update:

The global foreign exchange market saw a mixed session on Thursday, with the U.S. dollar weakening against several major currencies as investors continued to react to President Trump's decision to weaken the independence of the Federal Reserve by firing Governor Lisa Cook. The firing is now being challenged in a court action by Cook, which will be heard on Friday. Commodity-linked currencies such as the Australian and New Zealand dollars posted the strongest gains.

Major Currency Pairs: Performance Overview

-

The Euro / US Dollar (EUR/USD) rose to 1.1683, gaining 0.39 percent. The euro advanced as eurozone bond yields edged higher and traders bet on a more hawkish tone from the European Central Bank in upcoming communications.

-

The US Dollar / Japanese Yen (USD/JPY) slipped to 146.91, down 0.32 percent. The yen benefited from a risk-off tilt in Asian markets and mild dollar softness.

-

The US Dollar / Canadian Dollar (USD/CAD) declined to 1.3751, a move of 0.28 percent lower. A recovery in oil prices and stronger-than-expected Canadian economic data supported the loonie.

-

The British Pound / US Dollar (GBP/USD) ticked up to 1.3511, gaining 0.10 percent. Sterling was supported by a modest rebound in UK consumer confidence and stabilization in gilt markets.

-

The US Dollar / Swiss Franc (USD/CHF) edged lower to 0.8015, down 0.06 percent. The Swiss franc held firm as traders continued to view it as a safe-haven amid geopolitical uncertainties.

-

The Australian Dollar / US Dollar (AUD/USD) climbed to 0.6531, a strong gain of 0.41 percent. The Aussie dollar rallied alongside commodities and improving sentiment in Asia-Pacific equities.

-

The New Zealand Dollar / US Dollar (NZD/USD) advanced to 0.5885, up 0.45 percent, marking the strongest performance among major currency pairs. The kiwi gained on a combination of risk appetite and short covering.

Summary Table: Thursday FX Moves

| Pair | Rate | Daily Change |

|---|---|---|

| EUR/USD | 1.1683 | +0.39 percent |

| USD/JPY | 146.91 | −0.32 percent |

| USD/CAD | 1.3751 | −0.28 percent |

| GBP/USD | 1.3511 | +0.10 percent |

| USD/CHF | 0.8015 | −0.06 percent |

| AUD/USD | 0.6531 | +0.41 percent |

| NZD/USD | 0.5885 | +0.45 percent |

Global Stock Market Wrap: Thursday, August 28, 2025

Global stock markets saw a mixed session on Thursday, with modest movements across Europe, Asia, and other major markets. While some indices showed strength, others pulled back amid sector-specific pressures and cautious investor sentiment.

Canada

-

The S&P/TSX Composite Index in Toronto closed at 28,434.80, up just 1.80 points, or 0.01 percent. Resource and energy names were mixed, while bank shares showed mild strength following earnings updates from two major lenders.

UK and Europe

The European markets delivered a mostly flat-to-lower performance, with gains in France and the broader Eurozone offset by weakness in the UK and Belgium.

-

The FTSE 100 (UK) closed at 9,216.82, down 38.68 points, a decline of 0.42 percent. Losses in the utilities and tech sectors weighed heavily on the index.

-

The DAX (Germany) ended at 24,039.92, slipping 6.29 points, or 0.03 percent.

-

The CAC 40 (France) advanced to 7,762.60, up 18.67 points, or 0.24 percent.

-

The EURO STOXX 50 finished at 5,396.73, gaining 3.66 points, or 0.07 percent.

-

The Euronext 100 rose slightly to 1,600.72, adding 0.88 points, or 0.06 percent.

-

The BEL 20 (Belgium) dropped 12.85 points to close at 4,823.97, a fall of 0.27 percent.

Asia and Pacific

Asia-Pacific markets delivered a more positive tone overall, though some regional indices, including Taiwan and India, faced notable declines.

-

The Nikkei 225 (Japan) climbed to 42,828.79, rising 308.52 points, or 0.73 percent.

-

The Shanghai Composite (China) closed at 3,843.60, up 43.25 points, a gain of 1.14 percent.

-

The Hang Seng Index (Hong Kong) fell sharply to 24,998.82, down 202.94 points, or 0.81 percent.

-

The KOSPI Composite Index (South Korea) ended at 3,196.32, gaining 9.16 points, or 0.29 percent.

-

The TWSE (Taiwan) slid to 24,236.45, a decline of 283.45 points, or 1.16 percent.

-

The S&P/ASX 200 (Australia) rose 19.50 points to 8,980.00, an increase of 0.22 percent.

-

The All Ordinaries (Australia) added 10.00 points, closing at 9,241.10, up 0.11 percent.

-

The S&P BSE Sensex (India) dropped to 80,080.57, losing 705.97 points, or 0.87 percent.

-

The IDX Composite (Indonesia) ended at 7,952.09, up 15.91 points, a gain of 0.20 percent.

-

The KLSE (Malaysia) dipped 0.84 points to 1,587.07, down 0.05 percent.

-

The S&P/NZX 50 (New Zealand) gained 41.24 points to close at 12,903.08, an increase of 0.32 percent.

-

The STI Index (Singapore) advanced 8.21 points to 4,253.78, up 0.19 percent.

Middle East & Africa

Markets in the Middle East and Africa were generally stable, with slight movements on either side.

-

The TA‑125 Index (Israel) closed at 3,129.62, down 3.97 points, or 0.13 percent.

-

The EGX 30 (Egypt) rose to 35,727.20, gaining 51.00 points, a 0.14 percent increase.

-

The JSE Top 40 (South Africa) closed at 5,725.38, up 13.64 points, or 0.24 percent.

Market Drivers

In the UK, the FTSE was pressured by steep declines in utilities and tech shares. Drax Group dropped nearly 9.7 percent, with other utility names including Centrica, SSE, and United Utilities also falling between 1.4 and 1.7 percent. A broader European tech selloff—exacerbated by disappointing earnings from Nvidia—also dragged on sentiment.

In Asia, Japan's Nikkei led the region with strong gains, supported by buying in large-cap tech and manufacturing names. Meanwhile, Taiwan's TWSE fell over 1 percent, making it one of the region's worst performers for the day.

Index Summary Table

| Region | Index | Close | Change | Percent Move |

|---|---|---|---|---|

| Europe | The FTSE 100 | 9,216.82 | –38.68 | –0.42 percent |

| The DAX | 24,039.92 | –6.29 | –0.03 percent | |

| The CAC 40 | 7,762.60 | +18.67 | +0.24 percent | |

| The EURO STOXX 50 | 5,396.73 | +3.66 | +0.07 percent | |

| The Euronext 100 | 1,600.72 | +0.88 | +0.06 percent | |

| The BEL 20 | 4,823.97 | –12.85 | –0.27 percent | |

| Asia-Pacific | The Nikkei 225 | 42,828.79 | +308.52 | +0.73 percent |

| The Shanghai Composite | 3,843.60 | +43.25 | +1.14 percent | |

| The Hang Seng Index | 24,998.82 | –202.94 | –0.81 percent | |

| The KOSPI | 3,196.32 | +9.16 | +0.29 percent | |

| The TWSE | 24,236.45 | –283.45 | –1.16 percent | |

| The S&P/ASX 200 | 8,980.00 | +19.50 | +0.22 percent | |

| The All Ordinaries | 9,241.10 | +10.00 | +0.11 percent | |

| The Sensex | 80,080.57 | –705.97 | –0.87 percent | |

| The IDX Composite | 7,952.09 | +15.91 | +0.20 percent | |

| The KLSE | 1,587.07 | –0.84 | –0.05 percent | |

| The NZX 50 | 12,903.08 | +41.24 | +0.32 percent | |

| The STI Index | 4,253.78 | +8.21 | +0.19 percent | |

| Middle East & Africa | The TA‑125 | 3,129.62 | –3.97 | –0.13 percent |

| The EGX 30 | 35,727.20 | +51.00 | +0.14 percent | |

| The JSE Top 40 | 5,725.38 | +13.64 | +0.24 percent |

Related stories:

Wednesday 27 August 2025 | U.S. stocks jump Wednesday, Dow Jones adds 147 points | Big News Network

Tuesday 26 August 2025 | Wall Street advances despite Trump's attempt to undermine Fed | Big News Network

Monday 25 August 2025 | Dow Jones drops 349 points Monday as stock markets cool | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionCDC to lay off 600 staff after court ruling, violence prevention hit

NEW YORK CITY, New York: Hundreds of employees at the U.S. Centers for Disease Control and Prevention (CDC) are being permanently laid...

Former Sri Lankan president Wickremesinghe held in corruption probe

COLOMBO, Sri Lanka: Sri Lankan police this week arrested former President Ranil Wickremesinghe on allegations that he misused public...

Africa-wide Interpol operation cracks down on online fraud

DAKAR, Senegal: Interpol announced this week that a sweeping cybercrime operation across Africa has resulted in the arrest of more...

Germany says Israeli attack on journalists, 'a consequence', 'unavoidable'

BERLIN, Germany - German Chancellor Friedrich Merz says he doesn't believe Israel targeted journalists in the attack on Gaza's Nasser...

Mass visa review targets immigration violations in US

WASHINGTON, D.C.: The Trump administration announced this week that it is conducting a sweeping review of more than 55 million people...

Defamation charges against Thailand’s Ex-PM Thaksin dismissed

BANGKOK, Thailand: Former Thai Prime Minister Thaksin Shinawatra was acquitted on August 22 in a royal defamation case that could have...

Wisconsin

SectionNFC East Primer: Sleeping Giants in New York?

(Photo credit: Vincent Carchietta-Imagn Images) Finding a passing lane in the NFC East might be a pipe dream. Based on the talent...

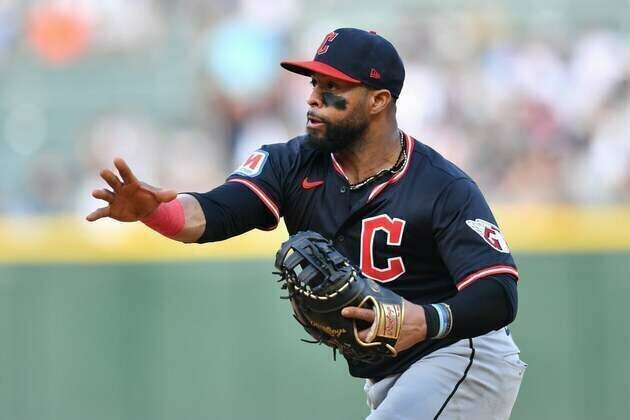

Guardians release veteran 1B Carlos Santana

(Photo credit: Patrick Gorski-Imagn Images) The Cleveland Guardians released veteran first baseman Carlos Santana on Thursday, ending...

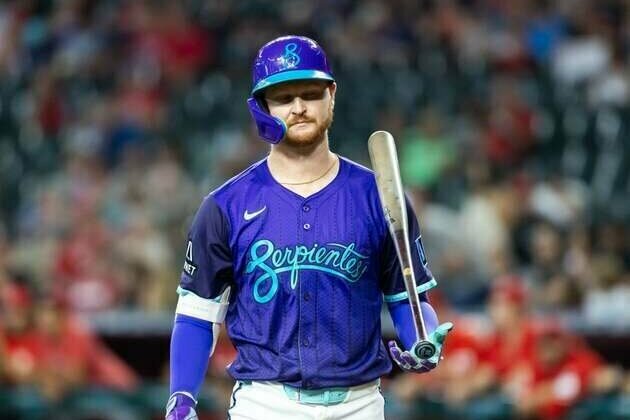

D-backs 1B/DH Pavin Smith (quad) headed to IL

(Photo credit: Mark J. Rebilas-Imagn Images) The Arizona Diamondbacks are expected to place first baseman/designated hitter Pavin...

Louisville assembling many new parts as Cardinals entertain Eastern Kentucky

(Photo credit: Scott Utterback/Courier Journal / USA TODAY NETWORK via Imagn Images) Louisville made a name for itself as a football...

Cubs eager to avert three-game sweep in San Francisco

(Photo credit: Stan Szeto-Imagn Images) The Chicago Cubs and the host San Francisco Giants were headed in opposite directions when...

Brewers aim to rediscover clutch hitting vs. D-backs

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) The Milwaukee Brewers had little issue...