Wall Street ends Wednesday on divided note

Lola Evans

11 Sep 2025, 01:41 GMT+10

- The NASDAQ Composite inched higher by 6.57 points, or 0.03 percent, closing at 21,886.06.

- The Standard and Poor's 500 climbed 19.43 points, or 0.30 percent, to close at 6,532.04.

- The Dow Jones Industrial Average, however, fell 220.42 points, or 0.48 percent, to finish at 45,490.92.

NEW YORK, New York - U.S. equity markets closed Wednesday on a mixed note, with the S&P 500 extending its rally to fresh highs, while the Dow Jones Industrial Average retreated. The NASDAQ Composite posted a marginal gain as investors balanced optimism in tech with profit-taking in blue-chip names.

The Standard and Poor's 500 climbed 19.43 points, or 0.30 percent, to close at 6,532.04, marking another record close as tech and consumer discretionary sectors continued to lead. Year-to-date, the S&P 500 has surged from its January low of 4,835.04.

The Dow Jones Industrial Average, however, fell 220.42 points, or 0.48 percent, to finish at 45,490.92. The index moved between 45,380.06 and 45,731.50 during the day, pulling back from Tuesday's all-time high of 45,770.20 as investors rotated out of some industrial and financial names.

The NASDAQ Composite inched higher by 6.57 points, or 0.03 percent, closing at 21,886.06. The tech-heavy index touched a high of 22,000.97 intraday before easing slightly, reflecting cautious optimism ahead of upcoming earnings from several large-cap tech companies. The index remains sharply higher on the year, having risen from 14,784.03.

"The fundamentals remain very strong in the equity markets, domestically. But we also have to acknowledge that valuations are extended at this point and serve as some natural tension to a continued upward trajectory," Bill Northey, senior investment director at U.S. Bank Wealth Management in Billings, Montana. told Reuters Wednesday.

Global FX Markets Wrap – Wednesday's Close

Major currencies saw relatively calm trading on Wednesday, with the U.S. dollar showing a mixed performance against global peers as investors weighed inflation signals and upcoming central bank policy decisions.

The euro weakened slightly against the greenback, with the EUR/USD pair slipping by 0.09 percent to 1.1697, as the European Central Bank maintained a cautious tone amid persistent price pressures.

The USD/JPY pair remained flat on the day at 147.41, as the Japanese yen showed little reaction to domestic data and the Bank of Japan held steady on its ultra-loose monetary policy stance.

The U.S. dollar edged higher against the Canadian dollar, with USD/CAD rising 0.18 percent to 1.3866, amid softer crude oil prices and mixed economic signals out of Canada.

Sterling saw a modest gain versus the dollar, with GBP/USD inching up 0.01 percent to 1.3527, as markets awaited further guidance from the Bank of England on interest rate trajectories.

The Swiss franc weakened against the dollar, pushing USD/CHF up by 0.32 percent to 0.7992, reflecting diverging policy outlooks between the Federal Reserve and the Swiss National Bank.

Among commodity-linked currencies, the Australian dollar strengthened, with AUD/USD rising 0.46 percent to 0.6614, supported by improving sentiment in Asian markets. The New Zealand dollar also advanced, with NZD/USD gaining 0.29 percent to finish at 0.5942.

Global Markets Wrap – Wednesday's Close

The day saw mixed to positive performance across global markets. European indices from London to Paris were mostly lower, while Asian and Pacific markets showed strength: Hong Kong's Hang Seng, Singapore's STI, Australia's indices, and South Korea's KOSPI all posted gains of 1 percent or higher. Meanwhile, heavyweight markets like India, Indonesia, and Taiwan also closed higher, albeit more modestly. Egypt and South Africa recorded moderate gains. Only a handful of indices, such as the DAX, Euro Stoxx 50, BEL 20, and Israel's TA‑125, ended the session in the red.

Following is a round-up of the closing quotes for major stock indices from around the globe::

Canada (S&P TSX)

In Toronto, the S&P/TSX Composite Index gained 116.38 points, or 0.40 percent, to close at 29,179.39, supported by strength in energy and materials stocks. The index saw steady upward momentum throughout the session, with trading volume reaching 282.497 million shares.

London (FTSE 100)

The FTSE 100 closed at 9,225.39, down 17.14 points, or 0.19 percent. It traded in a range between 9,222.35 and 9,290.55.

Frankfurt (DAX)

Germany's DAX fell to 23,632.95, down 85.45 points, or 0.36 percent. Its trading range was 23,600.47 to 23,883.58.

Paris (CAC 40)

The CAC 40 climbed to 7,761.32, gaining 11.93 points, or 0.15 percent.

Euro Stoxx 50

Closing at 5,361.47, the Euro Stoxx 50 slipped by 7.35 points, or 0.14 percent.

Euronext 100

The N100 ended the session at 1,602.96, up 2.34 points, or 0.15 percent. Intraday, it fluctuated between 1,601.70 and 1,612.93.

Belgium (BEL 20)

The BEL 20 edged down to 4,785.75, losing 20.60 points, or 0.43 percent.

Hong Kong (Hang Seng Index)

The Hang Seng soared to 26,200.26, rising by 262.13 points, or 1.01 percent.

Singapore (STI Index)

Singapore's STI climbed to 4,346.46, adding 48.89 points, or 1.14 percent.

Australia (S&P/ASX 200)

In Australia, the S&P/ASX 200 finished at 8,830.40, gaining 26.90 points, or 0.31 percent, within a range of 8,790.40 to 8,837.40.

Australia (All Ordinaries)

The All Ordinaries closed at 9,095.20, up 14.50 points, or 0.16 percent.

India (S&P BSE SENSEX)

India's benchmark reached 81,425.15, rising 323.83 points, or 0.40 percent.

Indonesia (IDX Composite)

The IDX Composite ended at 7,699.01, up by 70.40 points, or 0.92 percent.

Malaysia (^KLSE)

The index closed at 1,590.75, advancing 3.94 points, or 0.25 percent.

New Zealand (S&P/NZX 50 Gross Index)

New Zealand's index ended at 13,276.24, higher by 22.51 points, or 0.17 percent, within a session range of 13,215.26 to 13,314.02.

South Korea (KOSPI Composite)

The KOSPI Composite soared to 3,314.53, up 54.48 points, or 1.67 percent.

Taiwan (TWSE Index)

Taiwan's index jumped to 25,192.59, gaining 337.41 points, or 1.36 percent.

Israel (TA‑125)

The TA‑125 fell to 3,196.76, down 7.39 points, or 0.23 percent.

Egypt (EGX 30)

Egypt's index ended at 34,670.10, up 283.80 points, or 0.83 percent.

South Africa (JN0U.JO)

The index climbed to 5,921.91, adding 33.79 points, or 0.57 percent.

China (Shanghai Composite)

China's benchmark closed at 3,812.22, up by 4.93 points, or 0.13 percent, with a volume of 1.914 billion.

Japan (Nikkei 225)

In Tokyo, the Nikkei 225 ended at 43,837.67, rising 378.38 points, or 0.87 percent.

Related stories;

Tuesday 9 September 2025 | U.S. stock markets extend rally Tuesday, dollar rebounds | Big News Network

Monday 8 September 2025 | U.S. stocks forge ahead in start to new week, Dow Jones up 114 points | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionPeronists rout Argentinian President Milei’s party in key election

BUENOS AIRES, Argentina: Argentine President Javier Milei suffered a significant political blow on September 7 after his libertarian...

Aung San Suu Kyi needs urgent medical care, says son

LONDON, U.K.: Myanmar's jailed former leader Aung San Suu Kyi is suffering from worsening heart problems and urgently requires medical...

Microsoft reroutes Azure traffic after undersea fiber damage

LONDON, U.K.: Internet access across Asia and the Middle East faced widespread disruption after damage to subsea cables in the Red...

Israel shatters hostages hopes with assassination attempts on negotiators

DOHA, Qatar - In a significant and dramatic escalation that has sent shockwaves through the Middle East, the Israeli military has confirmed...

Nepal PM resigns as protesters storm parliament

KATHMANDU, Nepal: Prime Minister K. P. Sharma Oli has resigned amid the violence that continued for a second day Tuesday, which saw...

Israel to intensify operations in Gaza, West Bank and wider region

JERUSALEM - Israeli Prime Minister Benjamin Netanyahu has vowed to continue his country's war in Gaza, and in Jerusalem, following...

Wisconsin

SectionMedical groups say Kennedy endangers Americans, call for resignation

WASHINGTON, D.C.: U.S. Health Secretary Robert F. Kennedy Jr. is facing intensifying pressure to resign after more than 20 leading...

NFL Week 1 delivers big ratings to networks

(Photo credit: Tina MacIntyre-Yee/Democrat and Chronicle / USA TODAY NETWORK via Imagn Images) Television networks reported a record...

Reports: Free agent Jadeveon Clowney visiting Cowboys

(Photo credit: Jim Dedmon-Imagn Images) Free agent pass-rusher Jadeveon Clowney is meeting with the Dallas Cowboys, multiple outlets...

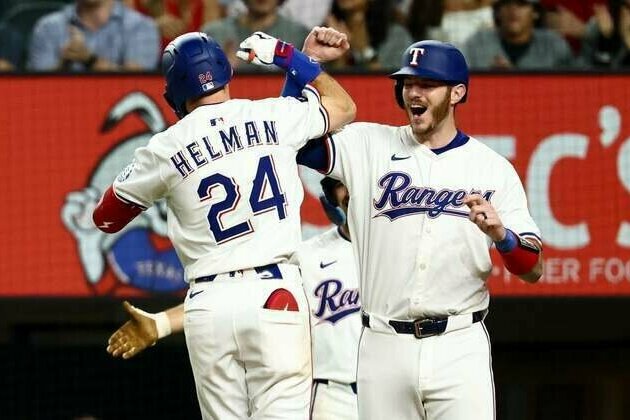

Hard-charging Rangers chase sweep of majors-leading Brewers

(Photo credit: Kevin Jairaj-Imagn Images) The Texas Rangers will look to sweep the best team in baseball when they square off against...

MLB roundup: Blue Jays rally in 9th, top Astros in 10th

(Photo credit: Nick Turchiaro-Imagn Images) Tyler Heineman's fielder's choice grounder in the bottom of the 10th scored the winning...

Report: Packers extend WR Christian Watson

(Photo credit: Mark Hoffman / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Green Bay Packers receiver Christian...