The euro is plunging - and probably won't bounce back soon

The Conversation

24 Nov 2021, 00:10 GMT+10

The euro has weakened against the US dollar since the beginning of 2021, from around US$1.23 to its current exchange rate of US$1.13. That's a fall of about 9%, which is significant, especially since these are the two major currencies of the world. The drop has also intensified in November, falling 3% since the turn of a month, which has seen violence in European capitals over COVID restrictions, migrant problems at the Belarus-Poland border and Russian troops amassing on the border of Ukraine.

The decline should be seen in a broader context, though. The euro is still stronger than a couple of years ago, when it was about US$1.10. It also went through some heavy weekly volatility from February to April 2020 in the early part of the COVID pandemic, bouncing between about US$1.07 and US$1.13 at a time when lots of investors were fleeing to the US dollar for safety and there was much uncertainty about what lockdowns would mean.

Euro vs US dollar chart

Explaining currency movements on a weekly or even monthly basis is well known to be extremely difficult, especially when it comes to major economies like the US and the countries in the eurozone. But certainly we need to look at what is happening in both regions and not just one or the other. Using this simple idea, there are several explanations for the recent euro depreciation.

Inflation differences

The first explanation relates to the Federal Reserve and the European Central Bank (ECB) stimulating their economies using quantitative easing (QE), which is essentially creating money to buy financial assets such as government bonds from banks and other major investors. Both central banks have been doing this extensively since the start of the pandemic.

However, with annual inflation in the US now reaching a serious level of 6.2%, compared with a less troublesome 4.1% in the eurozone, the feeling is that the Fed will end its asset purchases sooner. This is because increasing the money supply has the potential to stoke inflation. Indeed, the Fed has recently already started "tapering" or slowing down the rate of QE with a view to stopping it in the second half of 2022. On the other hand, the ECB has been discussing a replacement for its US$2.2 trillion (Pound 1.7 trillion) QE programme when it ends in March 2022.

Connected to this is an increasing expectation that the US may also have to begin a series of rises to interest rates from the middle of 2022 to curb inflation, while ECB president Christine Lagarde has just made it clear that the ECB is unlikely to start raising rates until at least 2023. These emerging differences in the monetary-policy stances of the US and eurozone have clearly favoured a strengthening of the dollar (since QE and lower interest rates tend to make a currency depreciate).

COVID and politics

A second pivotal factor has been the recent relative strength of the US economy in its recovery from the pandemic compared with the eurozone. In 2021, the US is forecast by the International Monetary Fund to grow 6% compared to 5% in the eurozone, while in 2022 they are respectively expected to grow 5.2% and 4.3%. Again, this points to dollar strength.

More COVID lockdowns in the US seem unlikely (even though cases are rising again), though not in the eurozone area, where the rate of infections has been picking up sharply in recent weeks in countries like Germany, France, the Netherlands, Austria and Belgium. Austria is now back in lockdown, and other eurozone countries could follow suit.

A final driver of the recent strength of the dollar is greater political stability. The Biden administration still has three years in office and has recently succeeded in passing its US$1.7 trillion Build Back Better stimulus package.

By contrast, countries in the eurozone face a period of greater political instability. Germany is seeing the 16 years of relative stability under Angela Merkel coming to an end. The question of whether Emmanuel Macron will succeed in the French elections in April 2022 against Marine Le Pen is also weighing on investors' minds, as are the continued trade frictions between the EU and the UK over Brexit.

It is happening at a time when Russia's build-up of forces close to Ukraine raises the prospect of military conflict on the edge of Europe - not to mention that Russia has already been limiting the region's gas supply and one of its main pipelines runs through Ukraine. In addition, there have been significant anti-vaccine protests in France, the Netherlands, Germany and Italy, and European governments are now under intense pressure to bring their spending under control.

So while short-term currency movements are very difficult to predict, there are many reasons to believe that the recent period of euro weakness will continue. This is making imports to the eurozone more expensive - not least energy - and while it has some benefits for a major exporter like Germany, it also undermines the credibility of the eurozone as a global economic force.

The gamechanger might be if the ECB acknowledged that there is an inflation problem that needs to be tackled, by ending its experiment with QE and beginning the process of raising interest rates. That, however, does not look likely any time soon.

Author: Keith Pilbeam - Professor of Economics, City, University of London

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionGermany says Israeli attack on journalists, 'a consequence', 'unavoidable'

BERLIN, Germany - German Chancellor Friedrich Merz says he doesn't believe Israel targeted journalists in the attack on Gaza's Nasser...

Mass visa review targets immigration violations in US

WASHINGTON, D.C.: The Trump administration announced this week that it is conducting a sweeping review of more than 55 million people...

Defamation charges against Thailand’s Ex-PM Thaksin dismissed

BANGKOK, Thailand: Former Thai Prime Minister Thaksin Shinawatra was acquitted on August 22 in a royal defamation case that could have...

Outrage from global press groups as 6 more journalists are killed in Gaza

GAZA - In two separate attacks, the Israeli army has killed six more journalists. In the first attack, 5 journalists, including one...

Israel warns Gaza City could be razed without Hamas surrender

JERUSALEM, Israel: Israel's defense minister warned on August 22 that Gaza City faces destruction unless Hamas accepts Israel's conditions,...

Supreme Court revises ruling on stray dogs, scraps shelter relocation

NEW DELHI, India: India's Supreme Court has amended an earlier order on stray dogs, ruling that animals picked up in Delhi and surrounding...

Wisconsin

SectionWhite House credits Trump with multiple ceasefires, experts skeptical

WASHINGTON, D.C.: Since returning to the White House in January, President Donald Trump has cast himself as a global peacemaker, repeatedly...

D-backs' Ryne Nelson faces Brewers in quest of overdue victory

(Photo credit: Jerome Miron-Imagn Images) The visiting Arizona Diamondbacks will turn to right-hander Ryne Nelson against the Milwaukee...

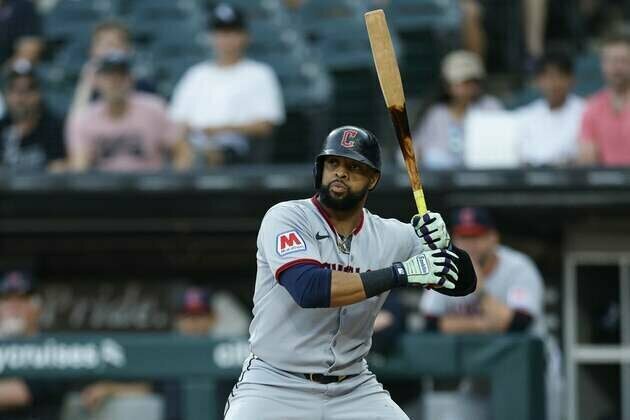

MLB roundup: Parker Messick, Guardians blank Rays

(Photo credit: David Richard-Imagn Images) Parker Messick struck out six over seven innings for his first win in the majors as the...

Brewers salvage blown lead with walk off over Diamondbacks

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Isaac Collins delivered a walk-off sacrifice...

Reports: Guardians place Carlos Santana on outright waivers

(Photo credit: Kamil Krzaczynski-Imagn Images) The Cleveland Guardians placed longtime first baseman Carlos Santana on outright waivers...

Justin Verlander gets second win as Giants put away Cubs

(Photo credit: Ed Szczepanski-Imagn Images) Wilmer Flores and Matt Chapman smacked home runs, Heliot Ramos collected three hits and...