U.S. stock markets continue higher to new records

Big News Network.com

14 Aug 2025, 01:38 GMT+10

- U.S. stocks continued their record-breaking run on Wednesday with both the Standard and Poor's 500 and Nasdaq Composite reaching new record highs.

- Global stock markets delivered a mostly positive performance on Wednesday, led by strong gains across Asia.

- The euro firmed against the U.S. dollar, with the EUR/USD pair rising 0.22 percent to 1.1699.

NEW YORK, New York - U.S. stocks continued their record-breaking run on Wednesday with both the Standard and Poor's 500 and Nasdaq Composite reaching new record highs, while the Dow Jones advanced several hundred points, nearing an all-time high hit in December 2024.

"This has been a really impressive earning season, which showcases kind of a corporate resilience from all the headwinds that we saw across the summer," Ross Mayfield, investment strategist at Baird told CNBC Wednesday. "You also had just a really nice kind of breadth."

Dow Leads U.S. Markets

The Dow Jones Industrial Average surged 463.66 points to close at 44,922.27, a gain of 1.04 percent. The index was lifted by strong results from major industrial and financial firms, with investors appearing increasingly confident in the outlook for large-cap U.S. companies.

The S&P 500 rose 20.82 points to finish at 6,466.58, up 0.32 percent. Gains were broad-based, with strength in energy, consumer discretionary, and healthcare sectors offsetting minor weakness in utilities.

The NASDAQ Composite edged higher by 31.24 points, closing at 21,713.14, a rise of 0.14 percent. Tech shares showed a mixed performance, with chipmakers gaining slightly while some high-growth software stocks traded flat to lower.

Wednesday's Closing Summary:

-

S&P 500: 6,466.58, up 20.82 points, +0.32 percent

-

Dow Jones Industrial Average: 44,922.27, up 463.66 points, +1.04 percent

-

NASDAQ Composite: 21,713.14, up 31.24 points, +0.14 percent

Investors will now turn their focus to Thursday's U.S. retail sales report and jobless claims data, which may offer additional clues about the Federal Reserve's next moves on interest rates. Markets are also watching global developments closely, particularly in China and Europe, where inflation and growth concerns remain in focus.

Most Major Currencies Rise against U.S. Dollar on Wednesday Amid Shifting U.S. Interest Rate Expectations

The global foreign exchange market saw a positive day for most of the majors on Wednesday, as traders reacted to evolving interest rate outlooks and macroeconomic data from major economies. The U.S. dollar lost ground against most major peers, while the British pound and the euro posted notable gains.

Euro and Pound Strengthen

The euro firmed against the U.S. dollar Wednesday, with the EUR/USD pair rising 0.22 percent to 1.1699. The gain came as eurozone inflation data showed modest improvement, adding to speculation that the European Central Bank may hold interest rates steady in the near term.

The British pound outperformed, with GBP/USD advancing 0.53 percent to 1.3569. Stronger-than-expected UK GDP growth figures supported sterling, alongside easing political uncertainty following the passage of a new fiscal package.

Yen Gains as Dollar Retreats

The U.S. dollar fell 0.29 percent against the Japanese yen, with USD/JPY sliding to 147.41. Investors sought safer assets as risk sentiment softened in afternoon trading. The yen's strength also reflected caution ahead of key Japanese inflation data due later this week.

Commodity Currencies Trade Firmer

The Australian dollar edged up 0.22 percent versus the greenback Wednesday, last trading at 0.6543. Similarly, the New Zealand dollar rose 0.39 percent to settle at 0.5973. Gains in both currencies were supported by signs of recovery in commodity demand and improving investor risk appetite.

The Canadian dollar held relatively steady. USD/CAD dipped just 0.03 percent to 1.3768, as oil prices hovered near recent highs but lacked clear momentum.

Swiss Franc Strengthens Modestly

The U.S. dollar weakened slightly against the Swiss franc. USD/CHF fell 0.08 percent to 0.8055, as investors continued to position defensively amid global growth concerns and steady safe-haven demand for the franc.

Summary of Wednesday's Major FX Pairs:

-

EUR/USD: 1.1699, up 0.22 percent

-

USD/JPY: 147.41, down 0.29 percent

-

USD/CAD: 1.3768, down 0.03 percent

-

GBP/USD: 1.3569, up 0.53 percent

-

USD/CHF: 0.8055, down 0.08 percent

-

AUD/USD: 0.6543, up 0.22 percent

-

NZD/USD: 0.5973, up 0.39 percent

Forex markets remain sensitive to upcoming central bank commentary and economic releases. Traders are now looking ahead to Thursday's U.S. retail sales figures and speeches from Federal Reserve officials for further cues on rate direction and dollar positioning.

Global Markets Close Mixed on Wednesday as Asia Leads Gains

Global stock markets delivered a mostly positive performance on Wednesday, led by strong gains across Asia, while European markets followed with moderate increases. However, Australian indices dipped, showing signs of regional divergence.

TSX Tracks Higher in Canada

Canada's benchmark S&P/TSX Composite Index added 72.17 points to close at 27,993.43, an increase of 0.26 percent. Energy and materials stocks were among the top performers, helped by firm commodity prices and continued optimism around global demand. Financials also contributed to the index's gains, with several major Canadian banks seeing buying interest.

UK and Europe

UK European indices ended the day on firmer footing:

-

FTSE 100 rose 17.42 points to close at 9,165.23, up 0.19 percent

-

DAX (Germany) gained 160.81 points to end at 24,185.59, up 0.67 percent

-

CAC 40 (France) increased by 51.55 points to 7,804.97, up 0.66 percent

-

EURO STOXX 50 closed higher Wednesday at 5,388.25, adding 52.28 points, up 0.98 percent

-

Euronext 100 (N100) climbed 10.12 points to finish at 1,597.29, up 0.64 percent

-

BEL 20 (Belgium) advanced 21.52 points to close at 4,746.15, up 0.46 percent

Asia

Asian markets showed robust gains, with Hong Kong and Japan leading the charge:

-

Hang Seng Index surged 643.99 points to 25,613.67, up 2.58 percent

-

Nikkei 225 (Japan) jumped 556.50 points on Wednesday to close at 43,274.67, up 1.30 percent

-

S&P BSE Sensex (India) climbed 304.31 points to 80,539.91, up 0.38 percent

-

KOSPI (South Korea) rose 34.46 points to 3,224.37, up 1.08 percent

-

TWSE Index (Taiwan) gained 211.66 points to reach 24,370.02, up 0.88 percent

-

IDX Composite (Indonesia) rose 101.21 points to 7,892.91, up 1.30 percent

-

KLSE (Malaysia) ended at 1,586.60, rising 18.70 points, up 1.19 percent

-

STI Index (Singapore) added 52.04 points to 4,272.76, up 1.23 percent

-

Shanghai Composite gained 17.55 points to finish at 3,683.46, up 0.48 percen

Australia and New Zealand

In contrast to broader regional gains, Australian indices declined Wednesday, while in New Zealand, stocks edged up:

-

S&P/ASX 200 dropped 53.70 points to 8,827.10, down 0.60 percent

-

All Ordinaries fell 47.20 points to 9,103.10, down 0.52 percent

-

S&P/NZX 50 (New Zealand) saw a modest rise of 6.86 points to 12,766.54, up 0.05 percent

Middle East & Africa

-

EGX 30 (Egypt) slipped 148.40 points to 35,855.30, down 0.41 percent

-

TA‑125 (Israel) advanced 65.47 points to 3,006.53, up 2.23 percent

-

JSE Top 40 (South Africa) rose 100.11 points to 5,823.06, up 1.75 percent

Market Overview

Market sentiment was broadly positive across Europe and Asia on Wednesday as investors responded to easing inflation data, resilient earnings reports, and regional stimulus hopes—particularly in China and Japan.

The standout performance of the Hang Seng Index reflects renewed investor interest in Hong Kong tech and financial sectors, while Japan's Nikkei 225 reached fresh highs on the back of a weaker yen and strong export outlook. In Tel Aviv, stocks rebounded with a more than two percent gain.

Meanwhile, Australian markets underperformed amid commodity price uncertainty and mixed economic signals, while Egypt's EGX 30 also slipped, reflecting localized investor caution.

Related stories:

Tuesday 12 August 2025 | Wall Street jumps as CPI slows to 2.7 percent | Big News Network

Monday 11 August 2025 | U.S. stock markets weaken Monday ahead of CPI data | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionUkraine vows to hold remaining 30% of Donetsk despite peace offer

KYIV, Ukraine: Ukrainian President Volodymyr Zelenskyy has firmly rejected a proposal that would see Ukraine withdraw from the roughly...

800 National Guard troops sent to Washington D.C.

WASHINGTON, D.C.: U.S. President Donald Trump this week deployed 800 National Guard troops to Washington, D.C., temporarily assuming...

India’s Supreme Court orders ‘sheltering’ of stray dogs in New Delhi

NEW DELHI, India: On August 11, India's Supreme Court ordered New Delhi's civic authorities to immediately begin capturing 5,000 stray...

Typhoon Podul prompts Taiwan evacuations, mass flight cancellations

TAIPEI, Taiwan: Southern and eastern Taiwan came to a standstill on August 13 as authorities cancelled hundreds of flights, shut down...

Gazans to give up 'Riviera of Middle East' for South Sudan?

TEL AVIV, Israel - The Associated Press is reporting that Israel is in talks with South Sudan about relocating much of the Gazan population...

Fatal attack on Atlanta police officer sparks massive police response

ATLANTA, Georgia: A tragic shooting unfolded outside the U.S. Centers for Disease Control and Prevention (CDC) headquarters in Atlanta...

Wisconsin

SectionTariff pause extended as US, China seek breakthrough on trade deal

WASHINGTON/BEIJING: The United States and China have agreed to extend their current tariff truce for another 90 days, sidestepping...

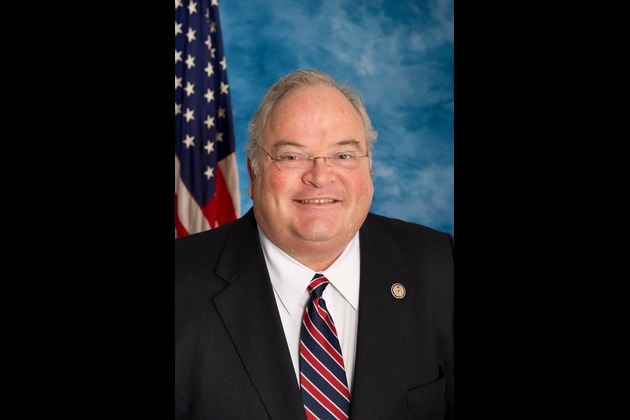

Billy Long out as IRS commissioner after less than two months

WASHINGTON, D.C.: President Donald Trump has removed former U.S. Rep. Billy Long from his post as IRS commissioner less than two months...

Dominant Brewers take on playoff-hopeful Reds in 3-game set

(Photo credit: Michael McLoone-Imagn Images) The hottest team in baseball bids to continue its sizzling play against a division rival...

49ers place OL Andre Dillard (ankle) on injured reserve

(Photo credit: Christopher Hanewinckel-Imagn Images) The San Francisco 49ers placed veteran offensive lineman Andre Dillard on season-ending...

Mets can't afford another blown lead against Braves

(Photo credit: Wendell Cruz-Imagn Images) It's almost certainly too late for the Atlanta Braves to save their playoff hopes. For...

MLB roundup: Angels earn season sweep of rival Dodgers

(Photo credit: Kiyoshi Mio-Imagn Images) Logan O'Hoppe hit a go-ahead two-run single with two outs in the eighth inning, rallying...