Dow Jones ekes out 35 points gain as broader market slips

Lola Evans

16 Aug 2025, 01:36 GMT+10

- A disappointing University of Michigan consumer sentiment survey kept buyers at bay Friday.

- "Consumer sentiment fell back about 5 percent in August, declining for the first time in four months."

- "This deterioration largely stems from rising worries about inflation."

NEW YORK, New York - U.S. stocks tread water on Friday with the Standard and Poor's 500 and Nasdaq Composite drifting lower, while the Dow Jones, inspired by a large lift in United Health, on the back of purchases by Warren Buffett's Berkshire Hathaway, finished with a reasonable gain.

A disappointing University of Michigan consumer sentiment survey kept buyers at bay Friday. "Consumer sentiment fell back about 5 percent in August, declining for the first time in four months. This deterioration largely stems from rising worries about inflation," Surveyors of Consumers Director at Michigan University Joanne Hsu said in a statement Friday.

"Buying conditions for durables plunged 14 percent, its lowest reading in a year, on the basis of high prices. Current personal finances declined modestly amid growing concerns about purchasing power. In contrast, expected personal finances inched up a touch along with a slight firming in income expectations, which remain subdued," oversal Hsu said. "Overall, consumers are no longer bracing for the worst-case scenario for the economy feared in April when reciprocal tariffs were announced and then paused. However, consumers continue to expect both inflation and unemployment to deteriorate in the future."

The Dow Jones Industrial Average posted a modest gain, while the S&P 500 and Nasdaq Composite edged lower.

Major Index Closings – Friday

-

S&P 500 closed at 6,449.80, falling 18.74 points, or 0.29 percent, amid broad-based weakness in technology and consumer discretionary sectors. The index was under pressure as investors rotated out of growth stocks following mixed earnings reports.

-

Dow Jones Industrial Average ended at 44,946.12, up 34.86 points, or 0.08 percent, supported by gains in industrials and financials. The Dow showed resilience as blue-chip stocks continued to benefit from stable economic outlooks and strong dividend appeal.

-

NASDAQ Composite finished the day at 21,622.98, dropping 87.69 points, or 0.40 percent, reflecting a decline in high-growth tech shares. Investors appeared cautious ahead of upcoming chipmaker earnings and regulatory developments in the AI sector

Investor Focus Shifts to Fed and Global Data

With earnings season winding down, traders are now turning their attention to upcoming U.S. economic indicators and Federal Reserve speeches for hints on interest rate direction. Globally, attention remains on China's economic outlook and geopolitical tensions that could shape risk appetite heading into the new week.

Global Currency Markets Mixed as Euro Rises, Yen Strengthens Against Dollar

Currency markets saw the U.S. dollar weaken on Friday, with the euro making notable gains, while the Japanese yen also strengthened. Traders digested economic data and central bank commentary amid growing speculation around interest rate paths across key economies.

Key FX Pairs – Friday's Closing Quotes:

-

EUR/USD (Euro / US Dollar) rose to 1.1701, marking a 0.47 percent gain on the day. The euro found support amid improving eurozone inflation expectations and a weaker dollar tone heading into the weekend.

-

USD/JPY (U.S. Dollar / Japanese Yen) declined to 147.23, down 0.35 percent, as the yen rebounded on safe-haven demand and speculation the Bank of Japan may consider policy adjustments later this quarter.

-

USD/CAD (U.S. Dollar / Canadian Dollar) edged slightly lower to 1.3810, a 0.04 percent decline. The loonie remained range-bound amid stable crude oil prices and cautious investor sentiment.

-

GBP/USD (British Pound / U.S. Dollar) rose to 1.3551, climbing 0.18 percent. The pound gained modestly on strong UK retail sales data, though political uncertainty limited broader upside.

-

USD/CHF (U.S. Dollar / Swiss Franc) slipped to 0.8062, down 0.14 percent, as the franc appreciated in line with broader eurozone strength and modest risk-off flows.

-

AUD/USD (Australian Dollar / U.S. Dollar) moved up to 0.6507, a 0.23 percent gain. The Aussie dollar was buoyed by positive labor market figures and rising commodity prices.

-

NZD/USD (New Zealand Dollar / U.S. Dollar) closed at 0.5924, gaining 0.15 percent, supported by a firmer tone in risk assets and expectations for steady monetary policy in Wellington.

Market Outlook

Traders continue to monitor signals from the U.S. Federal Reserve and other major central banks for clues on rate trajectory as inflation pressures cool in several economies. Volatility may increase in the coming sessions as markets respond to upcoming economic releases and geopolitical developments.

Global Equity Markets Roundup – Friday's Closings

Canada UK

-

S&P/TSX Composite Index (Canada) settled at 27,905.49, down 10.50 points, or 0.04 percent. The Canadian market remained relatively flat, weighed down by energy and materials, even as financials offered some offsetting strength.

UK

-

FTSE 100: closed at 9,138.90, down 38.34, a decline of 0.42 percent.

Germany

-

DAX Performance‑Index (DAX P): finished at 24,359.30, a decrease of 18.20, down 0.07 percent.

France

-

CAC 40: ended at 7,923.45, up 53.11, a gain of 0.67 percent.

Eurozone

-

EURO STOXX 50: closed at 5,448.61, rising 13.91, up 0.26 percent.

-

Euronext‑100: ended at 1,612.80, increased by 5.17, or 0.32 percent.

Belgium

-

BEL 20: wrapped up at 4,774.31, down 4.82, a drop of 0.10 percent.

China (Shanghai)

-

SSE Composite Index (000001.SS): ended at 3,696.77, up 30.33, a gain of 0.83 percent (volume: 3.428 billion).

Japan

-

Nikkei 225: closed at 43,378.31, up 729.05, a strong advance of 1.71 percent.

Hong Kong

-

Hang Seng Index: finished at 25,270.07, lower by 249.25, down 0.98 percent.

Singapore

-

STI Index: closed at 4,230.53, fell 25.99, a decrease of 0.61 percent.

Australia

-

S&P/ASX 200: ended at 8,938.60, up 64.80, a gain of 0.73 percent.

-

All Ordinaries: closed at 9,212.10, higher by 63.00, up 0.69 percent.

India

-

S&P BSE Sensex: finished at 80,597.66, rising 57.75, a slight gain of 0.07 percent.

Indonesia

-

IDX Composite (Jakarta): ended at 7,898.38, down by 32.88, a drop of 0.41 percent.

Malaysia

-

FTSE Bursa Malaysia KLCI (approx.): closed at 1,576.34, down 4.71, a decline of 0.30 percent.

New Zealand

-

S&P/NZX 50 (Gross): ended at 12,889.38, up 55.30, or 0.43 percent.

South Korea

-

KOSPI Composite Index: finished at 3,225.66, gaining 1.29, a mild rise of 0.04 percent (volume: 441,468).

Taiwan

-

TWSE Capitalization‑Weighted Index (TWII): closed at 24,334.48, up 96.38, a gain of 0.40 percent.

South Africa

-

Unlabeled, but likely the JSE All‑Share Index or JSE Top‑40: closed at 5,779.79, rising 6.53, up 0.11 percent.

Regional Highlights & Insights

-

Asia led the charge, with Japan's Nikkei 225 showing the strongest surge—up 1.71 percent—suggesting solid investor confidence possibly fueled by earlier economic data or corporate earnings.

-

China's Shanghai Composite also turned in a robust performance, gaining 0.83 percent.

-

In Australia and New Zealand, markets ended notably higher, each posting gains around 0.7 percent, reflecting continued regional momentum.

-

By contrast, Hong Kong's Hang Seng declined nearly 1 percent—the most significant drop among major indices—act as a reminder of lingering volatility in Chinese markets.

-

European indices showed mixed results: while France's CAC 40 and Euro STOXX 50 posted moderate gains, the UK's FTSE 100 and Germany's DAX trimmed slightly.

Related stories:

Thursday 14 August 2025 | Dow Jones slips 11 points as PPI index reignites inflation fears | Big News Network

Wednesday 13 Augusr 2025 | Another record-breaking day on Wall Street Wednesday | Big News Network

Tuesday 12 August 2025 | Wall Street jumps as CPI slows to 2.7 percent | Big News Network

Monday 11 August 2025 | U.S. stock markets weaken Monday ahead of CPI data | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

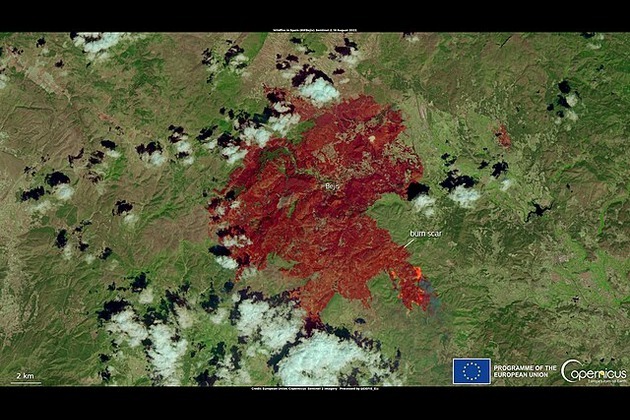

SectionHeatwave-driven wildfires force mass evacuations across Europe

PATRAS, Greece,/MADRID: Wildfires intensified across southern Europe, with extreme heat, strong winds, and suspected arson driving...

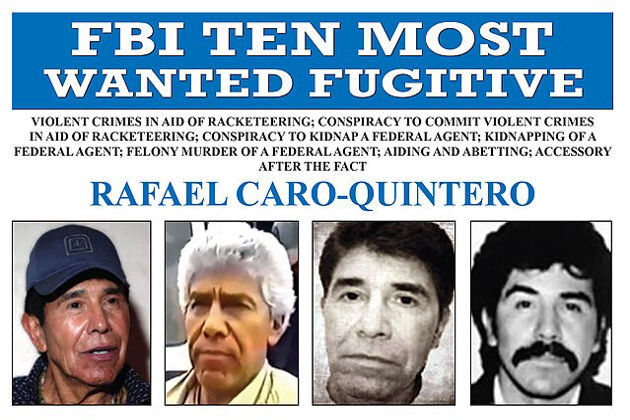

26 top drug cartel members from Mexico extradited to US

WASHINGTON, D.C.: Mexico has handed over 26 top cartel members to the United States this week, in the latest major cooperation deal...

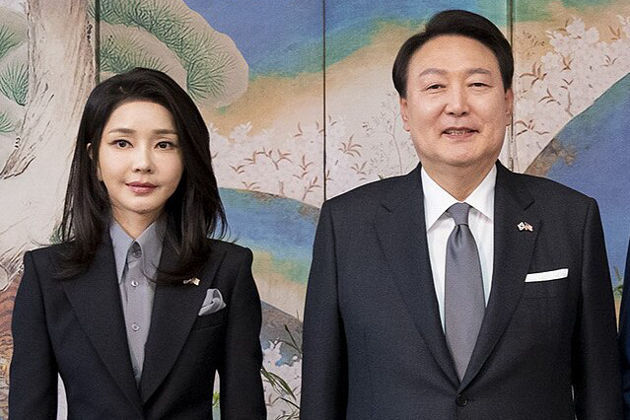

Wife of jailed former president Yoon arrested for bribery, stock fraud

SEOUL, South Korea: South Korea's former first lady, Kim Keon Hee — wife of impeached and jailed ex-president Yoon Suk Yeol — has been...

Ukraine vows to hold remaining 30% of Donetsk despite peace offer

KYIV, Ukraine: Ukrainian President Volodymyr Zelenskyy has firmly rejected a proposal that would see Ukraine withdraw from the roughly...

800 National Guard troops sent to Washington D.C.

WASHINGTON, D.C.: U.S. President Donald Trump this week deployed 800 National Guard troops to Washington, D.C., temporarily assuming...

India’s Supreme Court orders ‘sheltering’ of stray dogs in New Delhi

NEW DELHI, India: On August 11, India's Supreme Court ordered New Delhi's civic authorities to immediately begin capturing 5,000 stray...

Wisconsin

SectionEli Lilly accused by Texas AG of bribing providers to push drugs

WASHINGTON, D.C.: Texas Attorney General Ken Paxton has filed a lawsuit against U.S. pharmaceutical giant Eli Lilly, alleging the company...

Tariff pause extended as US, China seek breakthrough on trade deal

WASHINGTON/BEIJING: The United States and China have agreed to extend their current tariff truce for another 90 days, sidestepping...

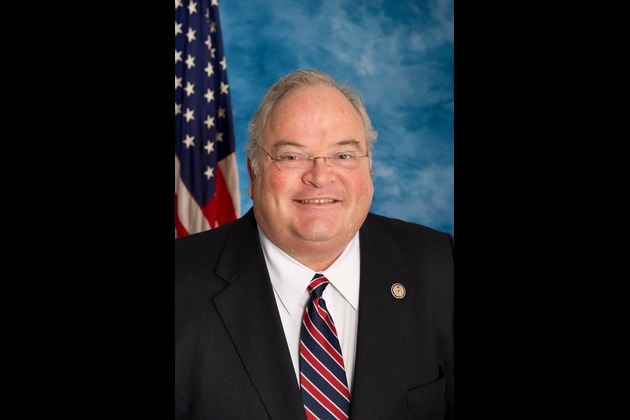

Billy Long out as IRS commissioner after less than two months

WASHINGTON, D.C.: President Donald Trump has removed former U.S. Rep. Billy Long from his post as IRS commissioner less than two months...

Before series with Brewers, Cubs host lowly Pirates

(Photo credit: Jeff Curry-Imagn Images) The Chicago Cubs return home Friday for a pivotal week-long, eight-game homestand that includes...

Dominant Brewers take on playoff-hopeful Reds in 3-game set

(Photo credit: Michael McLoone-Imagn Images) The hottest team in baseball bids to continue its sizzling play against a division rival...

49ers place OL Andre Dillard (ankle) on injured reserve

(Photo credit: Christopher Hanewinckel-Imagn Images) The San Francisco 49ers placed veteran offensive lineman Andre Dillard on season-ending...