U.S. stocks end with splity decision after Federal Reserve acts

Lola Evans

18 Sep 2025, 01:44 GMT+10

- The Dow Jones Industrial Average (^DJI) was the day's standout performer, advancing 260.42 points, or 0.57 percent.

- The NASDAQ Composite (^IXIC) struggled under the weight of declining mega-cap stocks. The index fell 72.63 points, a loss of 0.33 percent.

- The broad Standard and Poor's 500 (^GSPC), which tracks 500 of the largest companies in the U.S., edged slightly lower.

NEW YORK, New York - Wall Street delivered a split decision on Wednesday, with the blue-chip Dow Jones Industrial Average climbing to a strong gain while technology stocks lagged, pulling the Nasdaq Composite into negative territory.

The day's action was inspired by the Federal Reserve's decision to cut interest rates by a quaryer point, a move almost universally anticipated.

"Net, net, Fed officials did not hit the panic button as they chose to cut rates by the smallest possible magnitude at the September meeting,"Christopher S. Rupkey, chief economist at FWDBONDS told CNBC Wednesday. "The one rate cut per meeting pace shows they no longer feel tariff-based inflation is a serious threat and that the economic growth slowdown with companies onboarding fewer new employees is increasingly the bigger risk. Stagflation is out and labor market concerns are moved to the front-burner."

The Dow Jones Industrial Average (^DJI) was the day's standout performer, advancing 260.42 points, or 0.57 percent, to close at 46,018.32. The gain was fueled by a rally in industrial and financial shares, which offset concerns in other sectors of the market.

In contrast, the tech-heavy NASDAQ Composite (^IXIC) struggled under the weight of declining mega-cap stocks. The index fell 72.63 points, a loss of 0.33 percent, finishing the session at 22,261.33.

The broad Standard and Poor's 500 (^GSPC), which tracks 500 of the largest companies in the U.S., edged slightly lower. The index dipped 6.41 points, a marginal decline of 0.10 percent, to settle at 6,600.35.

The mixed session suggested a market in digestion mode, with investors rotating out of some high-growth technology names that have led the market higher this year and into more value-oriented sectors. The divergence between the Dow's significant gain and the Nasdaq's decline highlights the ongoing sector rotation beneath the surface of major indexes.

"Today's action is all about sector dynamics," said Maria Rodriguez, a market strategist at ClearWater Capital. "We're seeing money move into areas that benefit from a steady economy, while some of the high-flying tech names are taking a breather. It's a sign of a healthy market broadening out, rather than a broad-based sell-off."

Trading volumes were robust, with the S&P 500 seeing nearly 3 billion shares exchanged.

Investors are now looking ahead to key economic data releases later in the week, including the latest inflation figures, which could provide further clues on the health of the economy and influence market direction.

U.S. Dollar Edges Higher in Whiplash Session After Fed's Dovish Pivot

The U.S. dollar advanced against a basket of major currencies on Wednesday in a volatile trading session, as markets digested the Federal Reserve's decision to cut interest rates by 25 basis points and the accompanying guidance that signaled a cautious approach to further easing.

In a move widely anticipated by the market, the Federal Open Market Committee (FOMC) lowered its benchmark rate, aiming to insulate the U.S. economy from growing global headwinds. However, the dollar, which typically weakens on lower rates, reversed initial losses and climbed as Chair Jerome Powell stopped short of committing to a definitive easing cycle, characterizing the cut as a "mid-cycle adjustment."

The reaction was swift. The Euro (EURUSD) slipped against the greenback, falling 0.35 percent to buy $1.1825. The British Pound (GBPUSD) also softened, edging down 0.05 percent to $1.3638.

Commodity-linked currencies, often sensitive to global growth expectations and yield differentials, were among the hardest hit. The Australian Dollar (AUDUSD) slid 0.41 percent to $0.6657, while the New Zealand Dollar (NZDUSD) fell 0.30 percent to $0.5967.

"The initial reaction was a classic 'sell the rumor, buy the fact' dynamic in the dollar," said Lisa Chen, a chief strategist at Horizon Capital. "The Fed delivered the cut, but the market was positioned for a more dovish tone. Powell's reluctance to promise a series of cuts took the wind out of the bearish dollar trade and sent yields off their lows, making the dollar more attractive."

The dollar's strength was broad-based. It gained 0.32 percent against the Swiss Franc (USDCHF) to trade at 0.7883 and rose 0.25 percent against the Canadian Dollar (USDCAD) to C$1.3772. Against the Japanese Yen (USDJPY), the dollar advanced 0.21 percent to ¥146.78, as the rate cut did little to dampen the wide yield advantage U.S. assets hold over their Japanese counterparts.

Analysts suggest that while the rate cut is intended to be supportive of risk assets and global growth, the market's immediate interpretation focused on the relative hawkishness of the Fed compared to other major central banks like the European Central Bank, which is expected to enact more aggressive easing.

"The Fed is trying to walk a very fine line," added Chen. "By cutting rates but maintaining a data-dependent stance, they've given themselves flexibility. For forex markets, this means the dollar's haven status and yield appeal remain largely intact for now, keeping it well-supported against its peers."

Traders will now scrutinize incoming economic data for clues on whether this single "insurance cut" will be sufficient or if a weakening global economy will force the Fed's hand into further action later this year.

Global Equity Markets Show Mixed Performance as FTSE and DAX Eke Out Minor Gains

World financial markets presented a fragmented picture on Wednesday, with notable strength in parts of Asia contrasting with modest declines across much of Europe and the Pacific.

Canada Inches Up

Canada's main benchmark mirrored the S&P 500's muted tone. The S&P/TSX Composite Index (^GSPTSE) eked out a minimal gain, adding 6.43 points, or 0.02 percent, to close at 29,321.66.

UK and European Markets Mixed

UK and Minor European bourses struggled for direction. The UK's FTSE 100 (^FTSE) edged higher, gaining 12.71 points to close at 9,208.37, a rise of 0.14 percent. Germany's DAX (^GDAXI) followed a similar path, adding 0.13 percent to finish at 23,359.18.

However, the momentum wasn't universal. France's CAC 40 (^FCHI) was a notable decliner, dropping 31.24 points, or 0.40 percent, to settle at 7,786.98. The broader EURO STOXX 50 (^STOXX50E) was virtually unchanged, dipping a slight 0.05 percent. Belgium's BEL 20 (^BFX) and the Euronext 100 (^N100) also finished with minor losses of 0.07 percent and 0.33 percent, respectively.

Asia-Pacific Shows Divergence

Performance in the Asia-Pacific region was sharply divided. Japan's benchmark Nikkei 225 (^N225) took a breather from its recent record run, slipping 0.25 percent to close at 44,790.38.

Losses were more significant elsewhere. Australia's S&P/ASX 200 (^AXJO) fell 0.67 percent, and South Korea's KOSPI (^KS11) was one of the day's weakest performers, tumbling 1.05 percent. Taiwan's TWII index retreated 0.75 percent, and Singapore's STI (^STI) declined by 0.32 percent. New Zealand's S&P/NZX 50 (^NZ50) ended essentially flat, down a negligible 0.05 percent.

This weakness was more than offset by robust gains elsewhere. Hong Kong's Hang Seng Index (^HSI) was a standout, surging 1.78 percent, or 469.88 points, to 26,908.39. Mainland China's Shanghai Composite (000001.SS) also finished in positive territory, advancing 0.37 percent.

India's BSE SENSEX (^BSESN) continued its climb, adding 0.38 percent. The session's top performer in the region was Indonesia, where the IDX Composite (^JKSE) jumped 0.85 percent to close at a record high of 8,025.18. Malaysia's KLSE (^KLSE) also posted a strong gain of 0.72 percent.

Middle East and Africa

In the Middle East, Egypt's EGX 30 (^CASE30) continued its upward trajectory, gaining 0.38 percent. Conversely, Israel's TA-125 (^TA125.TA) experienced a sharp correction, plunging 1.99 percent.

South Africa's Top 40 USD Net TRI Index (^JN0U.JO) advanced 0.39 percent.

In currency markets, the U.S. Dollar Index (DX-Y.NYB) strengthened by 0.23 percent. The Euro Currency Index (^XDE) and Japanese Yen Index (^XDN) softened, falling 0.23 percent and 0.16 percent, respectively. The British Pound Index (^XDB) was nearly unchanged, while the Australian Dollar Index (^XDA) held at 66.64.

The broad MSCI Europe Index (^125904-USD-STRD) declined by 0.17 percent, reflecting the cautious mood across the continent.

Related stories;

Tuesday 16 September 2025 | Wall Street retreats from record highs ahead of Fed rate decision | Big News Network

Monday 15 September 2025 | Nasdaq Composite and S&P 500 close at record highs Monday | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionUnchallenged Israeli hegemony expands across Gulf

In the predawn silence of September 9, 2025, the skies over Doha briefly lit up—not with the brilliance of sunrise, but with the unmistakable...

Pakistan Army raids Taliban hideouts; dozens dead in fierce fighting

PESHAWAR, Pakistan: Pakistani security forces have carried out three major raids against Pakistani Taliban hideouts near the Afghan...

Trump’s UK visit to feature tech pact, atomic projects, tariff push

LONDON, U.K.: The United States and Britain are preparing to unveil a package of tech and energy deals during U.S. President Donald...

Workers learn the limits of speech after Kirk’s death comments

NEW YORK CITY, New York: After the fatal shooting of conservative activist Charlie Kirk, the fallout has stretched far beyond politics...

Massive air strikes as Israeli tanks pour into Gaza City

GAZA CITY - Massive air strikes erupted over Gaza City on Monday night as Israel's full scale invasion of the city gained momentum....

Fake gunman calls spark panic at US colleges nationwide

MISSION, Kansas: In recent weeks, roughly 50 college campuses across the United States have been rattled by waves of hoax calls reporting...

Wisconsin

SectionUnchallenged Israeli hegemony expands across Gulf

In the predawn silence of September 9, 2025, the skies over Doha briefly lit up—not with the brilliance of sunrise, but with the unmistakable...

Ford shifts HQ to new Dearborn campus, bids farewell to Glass House

DEARBORN, Michigan: Ford Motor Company is preparing for a historic move, shifting its world headquarters for the first time in nearly...

Commanders ready Marcus Mariota with Jayden Daniels (knee) idle

(Photo credit: Tork Mason-USA TODAY Network via Imagn Images) Quarterback Marcus Mariota is preparing to start for the Commanders...

Packers WR Jayden Reed has clavicle, foot surgeries

(Photo credit: Wm. Glasheen-USA TODAY Network via Imagn Images) Green Bay Packers wideout Jayden Reed is recovering from surgeries...

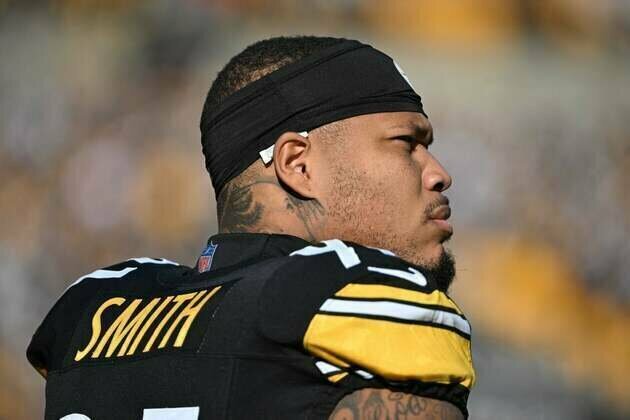

Commanders sign DE Preston Smith to aid defense

(Photo credit: Barry Reeger-Imagn Images) The Washington Commanders reunited with defensive end Preston Smith on Wednesday, signing...

Magic number at 7, Brewers vie to inch closer to NL Central crown vs. Angels

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) The playoff-bound Milwaukee Brewers...