Mutual Funds catching up with FIIs in shareholdings of companies, gap narrows sharply: PRIME Database

ANI

06 Nov 2025, 13:06 GMT+10

New Delhi [India], November 6 (ANI): Domestic Mutual Funds (MFs) are rapidly closing the gap with Foreign Institutional Investors (FIIs) in their shareholding of companies listed on the National Stock Exchange (NSE), according to data released by primeinfobase.com, an initiative of PRIME Database Group.

The report shows that as of September 30, 2025, the gap between FII and MF shareholding had narrowed to just 5.78 percentage points, a decline of 71 basis points over the previous quarter.

The gap has nearly halved in two years, from 10.32 per cent in June 2023. At its highest, the gap stood at 17.15 per cent in March 2015, when FIIs held 20.71 per cent compared to MFs' 3.56 per cent.

As per the report, the share of FIIs fell to a 13-year low of 16.71 per cent at the end of September 2025, down from 17.05 per cent in the previous quarter. Meanwhile, MFs' share reached an all-time high of 10.93 per cent, up from 10.56 per cent, marking the ninth straight quarter of increase.

'Indian markets are continuing their steadfast march towards even more atmanirbharta (self-reliance), with the day not too far when the share of MFs alone shall be greater than that of FIIs,' said Pranav Haldea, Managing Director, PRIME Database Group. He noted that this trend began with demonetisation and accelerated during the COVID-19 pandemic.

According to the data, MFs invested a net Rs 1.64 lakh crore during the quarter, buoyed by strong retail inflows through Systematic Investment Plans (SIPs). In contrast, FIIs recorded net outflows of Rs 76,619 crore, comprising outflows of Rs 98,216 crore from the secondary market and inflows of Rs 21,597 crore into the primary market.

The rise in MF shareholding also bolstered Domestic Institutional Investors (DIIs), whose combined share, including MFs, insurance companies, AIFs, PMS, and other financial institutions, hit a record 18.26 per cent at the end of September 2025, up from 17.82 per cent three months earlier. DIIs made net investments worth Rs 2.21 lakh crore in the quarter.

Insurance companies, AIFs, and Portfolio Management Services contributed net buys of Rs 5,498 crore, Rs 3,661 crore, and Rs 3,324 crore, respectively.

However, investment by retail investors saw a marginal decline. The share of small retail investors (holding up to Rs 2 lakh per company) fell to 7.43 per cent from 7.53 per cent, while that of High Net Worth Individuals (HNIs) rose slightly to 2.09 per cent from 2.05 per cent. Combined, retail and HNI holdings slipped to 9.52 per cent, with individual investors turning net sellers of Rs 9,562 crore during the period.

Haldea noted that FIIs have long been the dominant non-promoter shareholders influencing market direction. 'This is no longer the case. DIIs, along with retail and HNIs, have now been playing a strong countervailing role,' he said. Their combined share reached an all-time high of 27.78 per cent as of September 2025, signalling reduced foreign dominance in Indian equity markets.

DIIs increased exposure mostly to Consumer Discretionary stocks, up from 15.16 to 16.31 per cent, and reduced it most in Information Technology stocks from 8.74 to 8.07 per cent. FIIs followed a similar pattern, raising allocations to Consumer Discretionary stocks from 16.15 to 17.36 per cent, while trimming Financial Services from 31.38 to 30.92 per cent.

Private promoters share edged up slightly to 40.70 per cent, reversing three quarters of decline, though it remains down from 45.16 per cent at the end of 2021. There were 16 companies where promoters, FIIs, and DIIs have increased their holdings during the quarter. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionDiplomatic rift between Peru, Mexico over asylum to ex-PM Chávez

LIMA, Peru: Peru has announced it is cutting diplomatic ties with Mexico, escalating a dispute over Mexico's decision to grant asylum...

University of Pennsylvania probes data breach, seeks FBI help

WASHINGTON, D.C.: The University of Pennsylvania has requested assistance from the Federal Bureau of Investigation after offensive...

Top Israeli military legal chief in custody amid scandal

JERUSALEM, Israel: Controversy has erupted over the dramatic chain of events that included the sudden resignation, a brief disappearance,...

US says new nuclear tests won’t include explosions

WEST PALM BEACH, Florida: U.S. Energy Secretary Chris Wright said over the weekend that new tests of America's nuclear weapons system,...

US not considering Tomahawk transfer to Ukraine, Trump says

WEST PALM BEACH, Florida: U.S. President Donald Trump said over the weekend that he is currently not considering a plan that would...

Air travel chaos grows in US as shutdown starves controllers of pay

WASHINGTON, D.C.: Flight delays stretched across the U.S. as the government shutdown entered its second month, deepening air traffic...

Wisconsin

SectionShutdown threatens food aid for 42 million, retailers brace for pain

WASHINGTON, D.C.: U.S. supermarkets and food companies are bracing for a sharp downturn in sales next month as the Supplemental Nutrition...

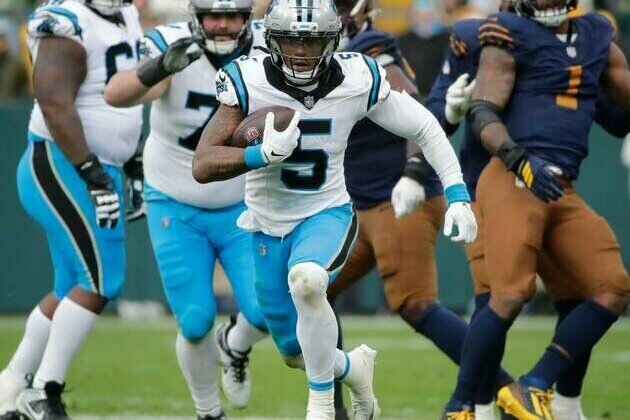

Panthers RB Rico Dowdle fined for pelvic-thrust celebration

(Photo credit: Dan Powers/USA TODAY NETWORK-Wisconsin / USA TODAY NETWORK via Imagn Images) Carolina Panthers running back Rico Dowdle...

No. 9 Oregon tries to avoid upset at Iowa on path to CFP

(Photo credit: Ben Lonergan/The Register-Guard / USA TODAY NETWORK via Imagn Images) A four-game stretch to end the regular season...

No. 23 Washington plots to improve standing at Wisconsin's expense

(Photo credit: Rick Osentoski-Imagn Images) No. 23 Washington will look to move into the upper echelon of the Big Ten standings on...

NBA roundup: Nikola Vucevic, Bulls pull off stunning rally vs. 76ers

(Photo credit: Kamil Krzaczynski-Imagn Images) Nikola Vucevic drilled a go-ahead corner 3-pointer with 3.2 seconds left and Josh...

Scottie Barnes, RJ Barrett lead red-hot Raptors in rout of Milwaukee

(Photo credit: John E. Sokolowski-Imagn Images) RJ Barrett and Scottie Barnes scored 23 points each Tuesday night and the Toronto...