Dow Jones dives 397 points as tech stocks take a tumble

Lola Evans

07 Nov 2025, 02:42 GMT+10

- The tech-heavy NASDAQ Composite bore the brunt of Thursday's selling pressure, tumbling a steep 445.80 points, or 1.90 percent.

- The blue-chip Dow Jones Industrial Average proved relatively more resilient but still finished solidly in negative territory, declining 397.35 points.

- The broader Standard and Poor's 500, a key benchmark for the U.S. market, also fell decisively, dropping 75.91 points, or 1.12 percent.

NEW YORK, New York - Artificial Intelligence stocks were sold off again Thursday, resulting in all the key U.S. indices closing sharply lower.

"So much of this stuff from a valuation standpoint was so lofty and priced for perfection that we're seeing in the market a bit of a dichotomy between companies that are are beating and raising versus those that maybe are beating on the top line but providing tepid guidance on the bottom line or from an operating profit standpoint," Mike Mussio, president at FBB Capital Partners told CNBC Thursday.

"That's the difference between some of these companies on earnings being up double digits versus being down double digits, and there's not a lot of in-between."

The tech-heavy NASDAQ Composite bore the brunt of Thursday's selling pressure, tumbling a steep 445.80 points, or 1.90 percent, to end the day at 23,053.99. The decline reflected growing investor caution towards high-growth sectors amid shifting economic expectations.

The broader Standard and Poor's 500, a key benchmark for the U.S. market, also fell decisively, dropping 75.91 points, or 1.12 percent, to close at 6,720.38.

The blue-chip Dow Jones Industrial Average proved relatively more resilient but still finished solidly in negative territory, declining 397.35 points, or 0.84 percent, to settle at 46,913.65.

Analysts pointed to a recalibration of interest rate expectations and mixed corporate earnings as the primary drivers behind the day's pullback. The pronounced weakness in the NASDAQ suggests a flight from riskier assets, setting a cautious tone as the trading week nears its end.

U.S. Dollar Shows Mixed Performance in Thursday Trading, Weakens Against Euro and Pound

The U.S. dollar delivered a mixed performance on foreign exchange markets on Thursday, strengthening against several major currencies but ceding significant ground to European counterparts.

The euro and British pound led the charge against the greenback. The EUR/USD pair rallied sharply, climbing 0.47 percent to trade at 1.1545. The GBP/USD pair saw an even stronger gain, rising 0.64 percent to reach 1.3132.

In contrast, the U.S. dollar found strength against the Japanese yen. The USD/JPY pair retreated by 0.65 percent, yet it held firmly above the 153 level at 153.09. The dollar also advanced against the Swiss franc, with the USD/CHF pair falling 0.47 percent to 0.8061.

Commodity-linked currencies struggled against the resurgent greenback. The Australian dollar weakened, as the AUD/USD pair fell 0.40 percent to 0.6477. The New Zealand dollar faced similar pressure, with the NZD/USD pair declining 0.49 percent to 0.5633.

The U.S. dollar's move against the Canadian dollar was minimal, with the USD/CAD pair inching up a mere 0.06 percent to 1.4116.

The day's activity painted a picture of a bifurcated market, with the dollar losing out to European currencies amid regional economic shifts while maintaining its dominance over the yen and commodity-driven currencies. Traders are now closely watching for upcoming economic data releases for further direction on interest rate policies.

European Markets Slide as Asia-Pacific Shares Mostly Rally on Thursday

Global markets delivered a mixed performance in Thursday's trading session, with European indices facing significant pressure while their Asia-Pacific counterparts largely climbed, led by a strong rally in Hong Kong.

The European trading day was painted red, with the region's major benchmarks closing deep in negative territory. Germany's DAX experienced a sharp decline, falling 315.72 points, or 1.31 percent, to close at 23,734.02. France's CAC 40 was not far behind, dropping 109.46 points, or 1.36 percent, to finish at 7,964.77.

The broader EURO STOXX 50 retreated 57.95 points, a loss of 1.02 percent, settling at 5,611.18. The pan-European Euronext 100 Index followed suit, falling 15.59 points, or 0.91 percent, to 1,691.96.

Canada's main benchmark mirrored the downward trend. The S&P/TSX Composite index fell 234.89 points, or 0.78 percent, closing at 29,868.59 as losses in key sectors like energy and materials weighed on the market.

The UK's FTSE 100 proved somewhat more resilient but still ended the day in the red, dipping 41.30 points, or 0.42 percent, to close at 9,735.78. The lone standout in Western Europe was Belgium's BEL 20, which managed a gain of 27.29 points, or 0.56 percent, closing at 4,926.50.

The story was markedly different in the Asia-Pacific region, where optimism prevailed. Hong Kong's Hang Seng Index was the session's standout performer, surging 550.49 points, or 2.12 percent, to end at 26,485.90. Singapore's STI Index also posted a strong gain, rising 67.87 points, or 1.54 percent, to 4,484.99.

Japan's Nikkei 225 continued its strong run, advancing 671.41 points, or 1.34 percent, to close at 50,883.68. Australia's benchmarks saw modest gains, with the S&P/ASX 200 edging up 0.30 percent to 8,828.30 and the All Ordinaries also rising 0.30 percent to 9,098.60.

Other Asian markets also finished positively. South Korea's KOSPI gained 0.55 percent, Taiwan's TWSE Index rose 0.66 percent, and Indonesia's IDX Composite added 0.22 percent. China's SSE Composite Index neared the 4,100 mark, climbing 0.97 percent to 4,007.76.

In other markets, India's S&P BSE Sensex bucked the regional trend, dipping slightly by 0.18 percent. Egypt's EGX 30 was a notable gainer, jumping 2.09 percent, while Israel's TA-125 fell 0.61 percent. The Johannesburg Top 40 USD Index rose 1.39 percent.

The day's split highlighted divergent regional investor sentiments, with European markets reacting to local economic concerns while Asian traders found reasons for optimism.

Related stories:

Wednesday 5 November 2025 | Dow Jones jumps 226 points as Wall Street raly extends | Big News Network.com

Tuesday 4 November 2025 | Nasdaq Composite plunges 458 points as U.S. stocks melt | Big News Network.com

Monday 3 November 2025 | Nasdaq Composite up 120 points, but broader markets end mixed | Big News Network.com

Photo credit: Good Money Guide

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionReuters: Facebook, Instagram, WhatsApp showing 15bn scam ads a day

Meta internally projected that a significant share of its 2024 income — about 10 percent of overall annual revenue, or roughly $16...

UPS plane erupts into fireball near Louisville airport, 12 dead

LOUISVILLE, Kentucky: A UPS cargo jet bound for Honolulu crashed shortly after takeoff from Louisville Muhammad Ali International Airport...

Diplomatic rift between Peru, Mexico over asylum to ex-PM Chávez

LIMA, Peru: Peru has announced it is cutting diplomatic ties with Mexico, escalating a dispute over Mexico's decision to grant asylum...

University of Pennsylvania probes data breach, seeks FBI help

WASHINGTON, D.C.: The University of Pennsylvania has requested assistance from the Federal Bureau of Investigation after offensive...

Top Israeli military legal chief in custody amid scandal

JERUSALEM, Israel: Controversy has erupted over the dramatic chain of events that included the sudden resignation, a brief disappearance,...

US says new nuclear tests won’t include explosions

WEST PALM BEACH, Florida: U.S. Energy Secretary Chris Wright said over the weekend that new tests of America's nuclear weapons system,...

Wisconsin

SectionShutdown threatens food aid for 42 million, retailers brace for pain

WASHINGTON, D.C.: U.S. supermarkets and food companies are bracing for a sharp downturn in sales next month as the Supplemental Nutrition...

Taking measure of playoff teams with the most work to do this offseason

(Photo credit: Orlando Ramirez-Imagn Images) The baseball offseason waits for no one. Opt-outs, managerial hirings and free agent...

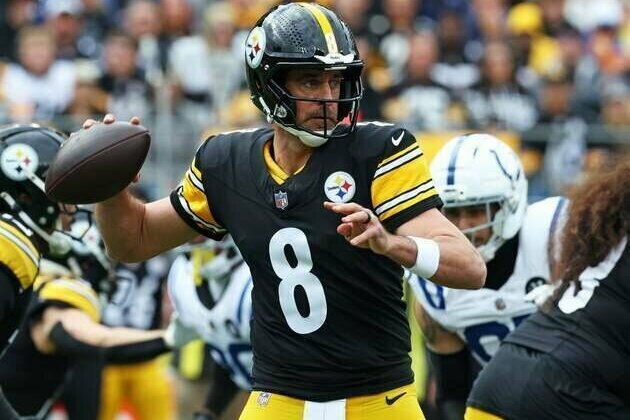

Aaron Rodgers, Steelers seek to quiet noise vs. Chargers

(Photo credit: Charles LeClaire-Imagn Images) Aaron Rodgers wasn't the least bit unnerved when Tuesday's trading deadline came and...

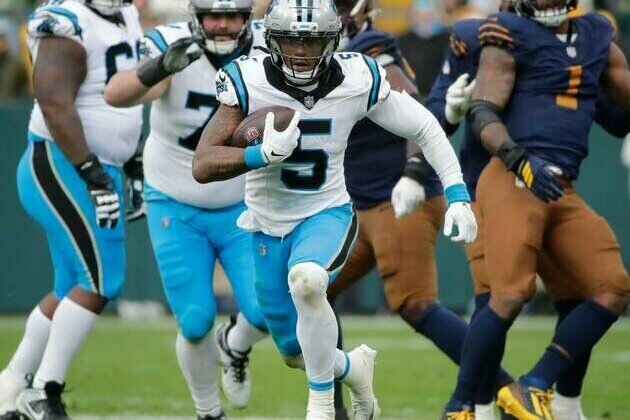

Panthers RB Rico Dowdle fined for pelvic-thrust celebration

(Photo credit: Dan Powers/USA TODAY NETWORK-Wisconsin / USA TODAY NETWORK via Imagn Images) Carolina Panthers running back Rico Dowdle...

No. 9 Oregon tries to avoid upset at Iowa on path to CFP

(Photo credit: Ben Lonergan/The Register-Guard / USA TODAY NETWORK via Imagn Images) A four-game stretch to end the regular season...

No. 23 Washington plots to improve standing at Wisconsin's expense

(Photo credit: Rick Osentoski-Imagn Images) No. 23 Washington will look to move into the upper echelon of the Big Ten standings on...