Rupee slide, FII outflows drag Indian equity indices into red

ANI

03 Dec 2025, 17:34 GMT+10

Mumbai (Maharashtra) [India], December 3 (ANI): Indian equity indices ended Wednesday in negative territory, possibly due to the rupee's weakness against the US dollar, Foreign Institutional Investor (FII) outflows, and ongoing trade uncertainties.

At the closing of the trade, BSE Sensex ended at the 85,106.81 level, slipping 31.46 points, or 0.04 per cent, while the NSE's Nifty declined 46.20 points, or 0.18 per cent, to end at the 25,986 level.

All the sectoral indices closed in the red zone, with the metal, oil & gas, private Banks, consumer durables, and media indices down 0.5 per cent each.

In a major development, the Indian rupee breached the 90 mark against the USD on Wednesday morning, extending its depreciation run through sessions now and hitting a fresh all-time low for the Indian currency.

At the time of filing this report, the Rupee was trading at 90.21 per US dollar. So far this year, the currency has depreciated by over 5 per cent on a cumulative basis.

Observing the market's movement, Vinod Nair, Head of Research, Geojit Investments Limited, said, 'Indian equities continued to consolidate as the rupee slid to a record low, weighed down by FII outflows and ongoing trade uncertainties.'

He added that industrial activity moderated in November, with the manufacturing PMI indicating slow new orders, softer export demand, and a spike in the trade deficit.

Ponmudi R, CEO of Enrich Money, a SEBI-registered online trading and wealth tech firm, said, 'Equity markets ended lower as the continued slide in the Indian rupee -- which hit a fresh record low against the US dollar -- prompted foreign portfolio investors to lock in profits, with the currency weakness weighing on their dollar-adjusted returns.'

Sectors that had rallied sharply in recent sessions, particularly PSU banks, automobiles, and consumer durables, witnessed the heaviest bout of profit-taking.

'Earlier, record-low inflation had boosted hopes of a rate cut in the ongoing RBI policy meeting. However, the stronger-than-expected Q2 GDP data has injected fresh uncertainty around the central bank's policy trajectory, adding to the cautious tone among investors,' Enrich Money CEO added.

In today's trade, early selling pressure pulled the index lower, but steady buying near the lower support zone limited further downside. In the final hour, Nifty once again attempted to reclaim 26,000, but persistent supply at this level capped the recovery, resulting in a close below this key resistance. The index has now logged five consecutive lower closes, indicating short-term weakness. The formation of lower highs and lower lows continues to reflect selling pressure on intraday pullbacks.

'For any meaningful recovery and a potential move toward the 26,300 zone, Nifty must decisively reclaim and sustain above 26,100. Until then, the market remains in a corrective and consolidation phase,' Enrich Money CEO further added.

Global markets were mixed as investors assessed the outlook ahead of the Fed & ECB monetary policy and amid currency volatility. At the same time, sentiment remained cautious after a jump in Japanese bond yields on expectations of BOJ tightening and increased government spending.

According to analysts, the RBI's policy decision this week will be crucial, especially for banks, as the probability of a rate cut has reduced following the strong Q2 GDP data. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionTrump administration granted asylum to Washington, D.C. gunman

WASHINGTON, D.C.: Even as the Trump administration this week blamed vetting failures by the Biden-era for the admission of an Afghan...

Ukraine’s top presidential aide Yermak resigns after home is searched

KYIV, Ukraine: Andrii Yermak, Ukraine's powerful chief of staff and President Volodymyr Zelenskyy's lead negotiator in talks with the...

21-year jail term for ousted Bangladesh PM in three cases

DHAKA, Bangladesh: A Dhaka Special Court sentenced Bangladesh's ousted prime minister, Sheikh Hasina, this week to 21 years in prison...

Britain to hold Spanish pork at border as ASF cases emerge

LONDON, U.K.: Britain will begin holding fresh pork and related products arriving from Spain at border inspection posts after Madrid...

PBOC warns of crypto resurgence, targets illegal stablecoin activity

BEIJING, China: China's central bank has warned of renewed activity in virtual currencies and pledged to step up enforcement against...

Guinea-Bissau gets military ruler, president ousted in coup

BISSAU, Guinea-Bissau: Major General Horta Inta-a was installed as the transitional president this week by Guinea-Bissau's military,...

Wisconsin

SectionUS families ‘adopt’ turkeys as ethical Thanksgiving alternative

ERIE, Colorado: An increasing number of farm animal sanctuaries across the country are promoting an alternative Thanksgiving tradition...

No. 9 BYU working on slow starts, bench help with Cal Baptist on tap

(Photo credit: Nathan Ray Seebeck-Imagn Images) No. 9 BYU has turned the Delta Center into a tough environment for opponents this...

Kansas G Darryn Peterson (hamstring) out vs. No. 5 UConn

(Photo credit: Bob Donnan-Imagn Images) Star freshman Darryn Peterson will sit out his seventh straight game on Tuesday when No....

CJ McCollum, Wizards surge past Bucks in 4th quarter

(Photo credit: Geoff Burke-Imagn Images) CJ McCollum scored 28 points while leading the Washington Wizards to an improbable second-half...

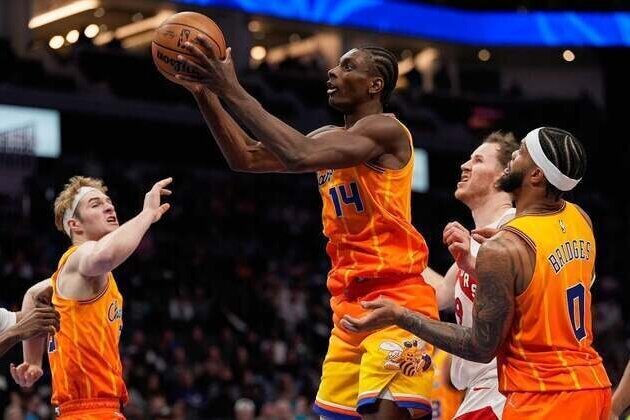

Hornets visit Brooklyn as Nets seek first home win

(Photo credit: Jim Dedmon-Imagn Images) The Charlotte Hornets and Brooklyn Nets are experiencing their share of difficulties this...

Bucks face Wizards with losing streak behind them

(Photo credit: Benny Sieu-Imagn Images) Khris Middleton will be intent on slowing down old friends when the Washington Wizards play...