Dow Jones closes 409 points higher Wednesday

Big News Network.com

04 Dec 2025, 02:38 GMT+10

- The Dow Jones Industrial Average delivered the strongest performance among the major US indices.

- The tech-heavy Nasdaq Composite edged higher by 0.17 percent, rising 40.42 points to close at 23,454.09.

- The Standard and Poor's 500 advanced 0.30 percent to close at 6,849.98.

NEW YORK, New York - A disappointing jobs report sent stocks higher on Wednesday. While the economy shed 32,000 jobs in November, investors saw the data as further impetus for the Federal Reserve to cut rates.

"Job creation has been flat during the second half of 2025 and pay growth has been on a downward trend. November hiring was particularly weak in manufacturing, professional and business services, information, and construction," the ADP report released Wednesday said,.

Businesses with 50 employees or more saw gains in November, however the small busines ssector (50 employees or less) lost 120,000 jobs. "Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment. And while November's slowdown was broad-based, it was led by a pullback among small businesses, Dr Nela Richardson, ADP's chief economist said Wednesday..

The Standard and Poor's 500 advanced 0.30 percent to close at 6,849.98, after trading between an intraday low of 6,810.43 and a high of 6,862.42. The broad-based index recorded a gain of 20.61 points, with buying interest spread across multiple sectors.

The Dow Jones Industrial Average delivered the strongest performance among the major US indices, surging 0.86 percent, or 408.68 points, to finish at 47,883.14. The blue-chip index touched a session high of 47,969.64 and a low of 47,371.62, underpinned by solid performances from industrial and financial stocks.

Meanwhile, the technology-heavy Nasdaq Composite edged higher by 0.17 percent, rising 40.42 points to close at 23,454.09, as gains in select large-cap technology shares were partially offset by profit-taking across growth stocks.

U.S. dollar tumbles Wednesday as majors record across-the-board gains

The U.S. dollar traded broadly lower against major global currencies on Wednesday, as investors adjusted positions amid shifting expectations around interest rates and global economic momentum.

The euro strengthened against the greenback, with the EUR/USD pair rising 0.40 percent to trade at 1.16689, supported by firmer sentiment toward the eurozone outlook.

The Japanese yen also gained ground, with the USD/JPY rate easing 0.43 percent to 155.19, as safe-haven demand underpinned the currency during Asian trading hours.

In North America, the US dollar slipped modestly against the Canadian dollar, with USD/CAD down 0.11 percent at 1.3949, tracking movements in commodity prices and broader market risk sentiment.

The British pound recorded one of the strongest performances of the session, with GBP/USD jumping 1.06 percent to 1.3349, buoyed by expectations that UK interest rates will remain higher for longer.

The Swiss franc also firmed, with USD/CHF falling 0.37 percent to 0.7995, reflecting continued demand for low-risk assets.

In the Asia-Pacific region, the Australian dollar advanced 0.60 percent against the US dollar to 0.6601, while the New Zealand dollar outperformed many of its peers, climbing 0.79 percent to 0.5773.

In currency-linked benchmarks, the US Dollar Index weakened by 0.51 percent to 98.85.

Overall, Wednesday's foreign exchange markets were characterised by broad-based US dollar softness, with commodity-linked and European currencies leading gains as investors weighed global growth prospects and monetary policy trajectories.

Shares in Asia and Australasia shine on world markets Wednesday

Global share markets ended Wednesday's session mixed, as gains across Asia-Pacific and selected European benchmarks were offset by losses in London, Frankfurt and several emerging markets.

Canadian equities ended the day in positive territory. The S and P/TSX Composite Index climbed 0.36 percent, adding 111.26 points to close at 31,160.54, supported by strength in the financials and resource sectors.

In the UK, the FTSE 100 in London edged lower, closing down 0.10 percent at 9,692.07, after touching an intraday high of 9,711.34 and a low of 9,677.67.

Germany's DAX also slipped, easing 0.07 percent to finish at 23,693.71.

In France the CAC 40 managed a modest rise of 0.16 percent, ending the session at 8,087.42.

The broader regional picture on Wednesday was mixed. The EURO STOXX 50 added 0.15 percent to close at 5,694.56, while the Euronext 100 advanced 0.29 percent to 1,707.23.

Belgium's BEL 20, however, fell 0.30 percent to 4,995.35.

In Asia, markets were largely positive despite weakness in Hong Kong. The Hang Seng Index dropped sharply by 1.28 percent to 25,760.73, as selling pressure weighed on large-cap technology and property stocks. In contrast, Singapore's STI gained 0.36 percent to end at 4,554.52.

Mainland China's SSE Composite Index declined 0.51 percent to finish at 3,878.00, reflecting continued caution over domestic economic conditions. In Japan on Wednessday, the Nikkei 225 delivered one of the strongest performances of the session, rallying 1.14 percent to close at 49,864.68.

In the Pacific, Australian equities strengthened, with the S and P/ASX 200 rising 0.18 percent to 8,595.20, while the broader All Ordinaries index climbed 0.19 percent to close at 8,894.20.

Across the Tasman, New Zealand shares posted solid gains, with the S and P/NZX 50 Gross Index jumping 0.59 percent to 13,582.54.

India's S and P BSE Sensex edged slightly lower Wednesday, easing 0.04 percent to 85,106.81.

In Indonesia the IDX Composite also slipped 0.06 percent to 8,611.79, and Malaysia's FTSE Bursa Malaysia KLCI dropped 0.48 percent to 1,622.84.

South Korea's KOSPI Composite Index outperformed the region, climbing 1.04 percent to 4,036.30, while in Taiwan the TWSE Capitalization Weighted Index surged 0.83 percent to close at 27,793.04.

In the Middle East, Israel's TA-125 fell 0.76 percent to 3,511.20. By contrast, Egypt's EGX 30 recorded strong gains, rallying 1.76 percent to 41,342.00.

In Africa on Wednesday, South Africa's Top 40 USD Net TRI Index added 0.89 percent to close at 6,535.97.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Tuesday 2 December 2025 | U.S. stocks close higher after volatile day | Big News Network.com

Monday 1 December 2025 | U.S. stock markets kick off December with modest losses | Big News Network.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionAlbanese becomes first Australian PM to marry in office

CANBERRA, Australia: Australian Prime Minister Anthony Albanese married his partner Jodie Haydon in an intimate ceremony over the weekend...

Trump administration granted asylum to Washington, D.C. gunman

WASHINGTON, D.C.: Even as the Trump administration this week blamed vetting failures by the Biden-era for the admission of an Afghan...

Ukraine’s top presidential aide Yermak resigns after home is searched

KYIV, Ukraine: Andrii Yermak, Ukraine's powerful chief of staff and President Volodymyr Zelenskyy's lead negotiator in talks with the...

21-year jail term for ousted Bangladesh PM in three cases

DHAKA, Bangladesh: A Dhaka Special Court sentenced Bangladesh's ousted prime minister, Sheikh Hasina, this week to 21 years in prison...

Britain to hold Spanish pork at border as ASF cases emerge

LONDON, U.K.: Britain will begin holding fresh pork and related products arriving from Spain at border inspection posts after Madrid...

PBOC warns of crypto resurgence, targets illegal stablecoin activity

BEIJING, China: China's central bank has warned of renewed activity in virtual currencies and pledged to step up enforcement against...

Wisconsin

SectionUS families ‘adopt’ turkeys as ethical Thanksgiving alternative

ERIE, Colorado: An increasing number of farm animal sanctuaries across the country are promoting an alternative Thanksgiving tradition...

No. 9 BYU working on slow starts, bench help with Cal Baptist on tap

(Photo credit: Nathan Ray Seebeck-Imagn Images) No. 9 BYU has turned the Delta Center into a tough environment for opponents this...

Kansas G Darryn Peterson (hamstring) out vs. No. 5 UConn

(Photo credit: Bob Donnan-Imagn Images) Star freshman Darryn Peterson will sit out his seventh straight game on Tuesday when No....

CJ McCollum, Wizards surge past Bucks in 4th quarter

(Photo credit: Geoff Burke-Imagn Images) CJ McCollum scored 28 points while leading the Washington Wizards to an improbable second-half...

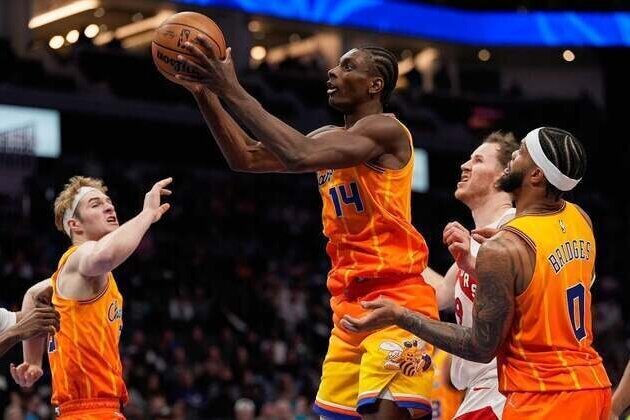

Hornets visit Brooklyn as Nets seek first home win

(Photo credit: Jim Dedmon-Imagn Images) The Charlotte Hornets and Brooklyn Nets are experiencing their share of difficulties this...

Bucks face Wizards with losing streak behind them

(Photo credit: Benny Sieu-Imagn Images) Khris Middleton will be intent on slowing down old friends when the Washington Wizards play...