Fed cuts rates again. Here’s how it affects your money

Anabelle Colaco

14 Dec 2025, 06:57 GMT+10

- With inflation still above target and the job market losing momentum, the Federal Reserve lowered interest rates again on December 10

- The Fed’s benchmark rate influences borrowing costs across the economy and is a tool used to balance two goals: stable prices and maximum employment

- This time, officials are navigating a tricky mix: price pressures remain elevated even as hiring cools, and a government shutdown delayed critical economic data in recent months

NEW YORK CITY, New York: With inflation still above target and the job market losing momentum, the Federal Reserve lowered interest rates again on December 10, cutting its benchmark rate by a quarter point to about 3.6 percent, the third reduction since September and the lowest level in nearly three years.

The Fed's benchmark rate influences borrowing costs across the economy and is a tool used to balance two goals: stable prices and maximum employment. It shapes everything from credit card APRs and auto loans to mortgage rates and savings yields.

Typically, the Fed raises rates to curb inflation and lowers them to support growth. But officials are navigating a tricky mix: price pressures remain elevated even as hiring cools, and a government shutdown delayed critical economic data in recent months.

Here's how the latest cut could affect your finances:

Savings Yields Will Keep Drifting Down

Rates on certificates of deposit and high-yield savings accounts have already begun slipping. Three of the major online banks — Ally, American Express, and Synchrony — trimmed savings rates after the Fed's October cut, says Ken Tumin of DepositAccounts.com.

Top high-yield accounts still offer around 4.35 percent to 4.6 percent, far above the national average of 0.61 percent for traditional savings. These accounts remain a good choice for short-term savings, even as rates soften.

Mortgage Relief Will be Gradual

Mortgage rates have already priced in the rate cut and continue to hover near their lowest levels in over a year. They tend to move with the 10-year Treasury yield, which reflects expectations for growth and inflation.

"While there's no guarantee that the Fed's move will push mortgage rates lower, there's reason to be optimistic that homebuyers could see rates below 6.00 percent in the next year, even if only briefly," said LendingTree's Matt Schulz.

Lower rates could prompt refinancing and bring more buyers back into the market.

Credit Card APRs May Ease but Slowly

Average credit card rates have dipped to 19.80 percent from a record 20.79 percent in August 2024. Any further relief from the Fed's cut will take time to show up.

"The reductions could mean hundreds of dollars in savings for debtors," Schulz said. But high balances remain costly, and experts recommend aggressively paying down debt or seeking lower-APR offers while rates are falling.

Lower borrowing costs could also slow the recent rise in delinquencies, said TransUnion's Michele Raneri, though she noted that households still face "persistent affordability challenges."

Auto Loan Rates Will Stay Elevated for Now

Despite the Fed's reductions, analysts say car loan rates won't fall meaningfully in the near term. Borrowers are already struggling: 6.65 percent of subprime borrowers were at least 60 days late in October — the highest rate since the early 1990s, according to Fitch.

New and used vehicles remain expensive, and average rates on a 60-month new-car loan are around 7.05 percent, Bankrate says.

A Positive Signal for Job-seekers

Cheaper borrowing can encourage companies to expand and hire.

"Overall, we've seen a slowing demand for workers," said Cory Stahle of the Indeed Hiring Lab. "By lowering the interest rate, you make it a little more financially reasonable for employers to hire additional people."

He added that the signal from the Fed is as important as the cut itself: it shows policymakers are focused on supporting the labor market as economic data sends mixed messages.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionMachado’s daughter accepts Nobel Peace Prize in mother’s absence

CARACAS, Venezuela: Venezuelan opposition leader María Corina Machado's daughter accepted the Nobel Peace Prize on December 10 as her...

Judge tells Trump to end National Guard deployment in Los Angeles

SAN FRANCISCO, California: A federal judge ordered the Trump administration on December 10 to remove the California National Guard...

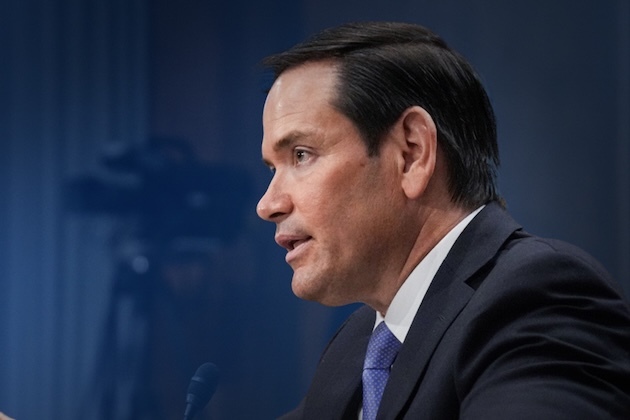

US diplomatic files to revert to Times New Roman font under Rubio

WASHINGTON, D.C.: All diplomatic correspondence and U.S. government documents will no longer use the Calibri font and will revert to...

Pakistan army chief issues ultimatum to Afghan Taliban

ISLAMABAD, Pakistan: Pakistan's newly appointed armed forces chief asked Afghanistan's Taliban government this week to choose between...

DoJ can unseal Ghislaine Maxwell’s sex trafficking records

NEW YORK CITY, New York: The Department of Justice received approval from a federal judge to publicly release grand jury transcripts...

Australian under-16s bid goodbye to social media under new law

SYDNEY, Australia: On December 10, Australia became the first country in the world to ban social media for children under 16 by blocking...

Wisconsin

SectionFarmers hit by Trump’s China trade war get $12 billion in emergency aid

WASHINGTON, D.C.: Facing rising anxiety among farmers squeezed by his tariffs on China, President Donald Trump on December 8 announced...

Short-handed Bucks look to build momentum against Nets

(Photo credit: Benny Sieu-Imagn Images) The Milwaukee Bucks put together one of their best stretches without Giannis Antetokounmpo...

Reports: Brewers acquire lefty reliever Angel Zerpa from Royals

(Photo credit: David Richard-Imagn Images) The Milwaukee Brewers beefed up their bullpen on Saturday by acquiring left-handed reliever...

Lauren Coughlin, Andrew Novak lead going into final day at Grant Thornton

(Photo credit: Mark Hoffman / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Lauren Coughlin and Andrew Novak shot...

Women's Top 25 roundup: No. 9 Oklahoma handles No. 23 Oklahoma State

(Photo credit: NATE BILLINGS/FOR THE OKLAHOMAN / USA TODAY NETWORK via Imagn Images) Raegan Beers produced 22 points and 12 rebounds...

Victor Wembanyama returns as Spurs face Thunder in NBA Cup semis

(Photo credit: Kirby Lee-Imagn Images) The Oklahoma City Thunder have matched the best 25-game start in NBA history and will seek...