MPC likely to remain on extended pause; further rate cuts hinge on inflation trend: Report

ANI

21 Dec 2025, 15:30 GMT+10

New Delhi [India], December 21 (ANI): The Reserve Bank of India's Monetary Policy Committee (MPC) is likely to remain on an extended policy pause after its recent rate cut, with any further monetary easing contingent on inflation consistently undershooting its current trajectory, ICICI Bank's Economic Research Group has asserted, after analysing the minutes of the December monetary policy.

'We expect MPC to be on an extended pause. Any additional easing is possible only if inflation prints are consistently below current trajectory. In February, MPC would like to assess the impact of the new GDP and CPI series on the headline numbers,' the ICICI Bank report read.

The minutes of the December MPC meeting, released on Friday, indicated that inflation has turned increasingly benign.

'Further rate cuts from here are possible only if inflation continues to remain well below estimates going forward. In terms of the timing, the MPC is expected to keep status quo in February, as it would like to assess the impact of the new series of GDP and CPI on the headline numbers. In the meantime, the RBI would continue to provide adequate liquidity (OMO purchase/FX swaps) to ensure transmission onto lending rates,' the ICICI Bank report read.

MPC members noted that further easing would be considered only if inflation prints remain persistently below projections.

With headline inflation expected to hover around 4 per cent going into FY27, the current real interest rate is already close to the lower end of the RBI's estimated comfort range, limiting room for aggressive action

In the near term, the MPC is likely to maintain status quo at its February policy meeting, as it seeks to assess the impact of the upcoming new GDP and CPI series on headline macroeconomic indicators.

MPC members emphasised the importance of recalibrating policy assessments once the revised statistical series are incorporated into growth and inflation readings.

The minutes also reflect growing concerns over a moderation in growth momentum, particularly in the second half of FY26.

High-frequency indicators such as PMI, industrial output and export data point to some slack in economic activity, even as global and domestic growth outcomes have so far exceeded expectations.

While benign inflation, supported by favourable food production prospects and subdued global oil prices, was the primary driver behind the recent rate cut, some external members cautioned that prolonged low inflation could hurt profit margins and investment decisions, especially for smaller enterprises.

The MPC members, as per the minutes, stressed that future policy actions would be carefully balanced between supporting growth and preserving macroeconomic stability.

Overall, the MPC's stance suggests a shift towards data-dependent policymaking, with liquidity measures expected to continue supporting transmission, even as interest rates are likely to remain unchanged in the coming months unless inflation dynamics change materially.

In line with expectations, the Monetary Policy Committee (MPC) cut policy rates by 25 basis points (bps) in its December meeting. It maintained its neutral policy stance. The RBI Governor Sanjay Malhotra characterised India's current macroeconomic moment as a 'rare goldilocks period', that currently marks high economic growth and exceptionally low inflation.

GDP growth rose to a six-quarter high of 8.2 per cent year-on-year in the second quarter of fiscal 2026, from 7.8 per cent in the previous quarter, fuelled by robust consumption and aided by the GST rate rationalisation exercise of September 2025. Nominal GDP growth slowed to 8.7 per cent from 8.8 per cent.

Taking all factors into account, the RBI raised its GDP growth projection at 7.3 per cent for the full year, up by half a percentage point.

The RBI revised its CPI inflation forecast for 2025-26 to just 2.0 per cent, down from previous estimates of 2.6 per cent. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionDoctor gets home confinement in Matthew Perry death case

LOS ANGELES, California: A doctor who pleaded guilty to supplying ketamine to actor Matthew Perry before his death due to overdose...

MIT professor killed, days after gunman killed two at Brown University

BROOKLINE, Massachusetts: Authorities launched a homicide investigation into the fatal shooting of a professor from the Massachusetts...

Trump’s chief of staff goes candid in Vanity Fair interview

WASHINGTON, D.C.: In a candid interview with Vanity Fair on December 16, Susie Wiles, U.S. President Donald Trump's influential chief...

Five-day doctors’ strike hits England amid worsening flu wave

LONDON, U.K.: As hospitals brace for a sharp rise in flu admissions, doctors in England have launched a five-day walkout, escalating...

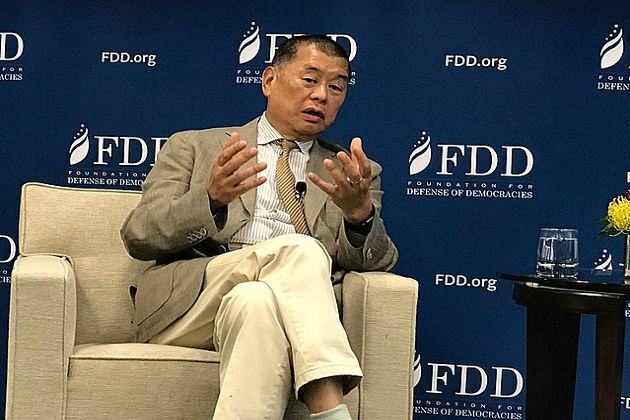

Hong Kong court finds media tycoon Jimmy Lai guilty of conspiracy

HONG KONG: Jimmy Lai, the media tycoon and pro-democracy campaigner, was found guilty on December 15 of conspiracy to collude with...

Australia’s already strict gun laws under lens after Sydney killings

SYDNEY, Australia: After a father-and-son duo slaughtered at least 15 people celebrating Hanukkah at Sydney's Bondi Beach on December...

Wisconsin

SectionTrump administration argues ASL services limit presidential control

WASHINGTON, D.C.: The Trump administration is defending its decision not to provide real-time American Sign Language interpretation...

Bears rally, beat Packers in OT; Jordan Love suffers concussion

(Photo credit: Mike Dinovo-Imagn Images) Caleb Williams hit DJ Moore with a 46-yard touchdown pass in overtime as the Chicago Bears...

No. 15 Nebraska vows not to look past North Dakota

(Photo credit: Ron Johnson-Imagn Images) Nebraska coach Fred Hoiberg knows all too well about the dangers of the getaway game. ...

Riding high, Timberwolves wary of letdown vs. Bucks

(Photo credit: Bruce Kluckhohn-Imagn Images) The Minnesota Timberwolves are coming off their biggest win of the season. Now, the...

Raptors, Celtics tangle again in Toronto

(Photo credit: John E. Sokolowski-Imagn Images) The host Toronto Raptors will aim to win their third consecutive game on Saturday...

Bryce Lindsay powers Villanova to overtime win against Wisconsin

(Photo credit: Benny Sieu-Imagn Images) Bryce Lindsay scored 10 of his 12 points in overtime to pace Villanova to a 76-66 victory...