Falling global interest rates push gold higher, but prices may correct 10-15% in early 2026: GJC founder member

ANI

25 Dec 2025, 18:02 GMT+10

By Kaushal Verma

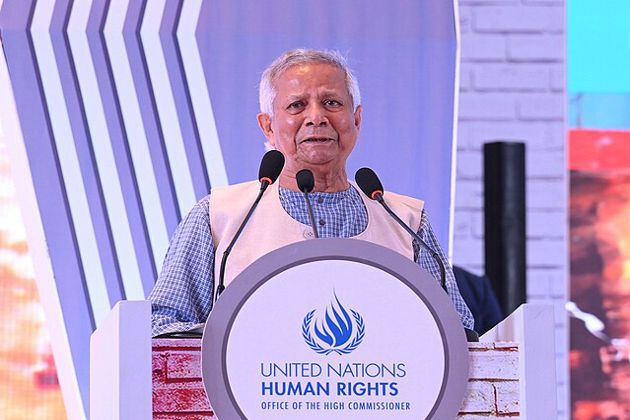

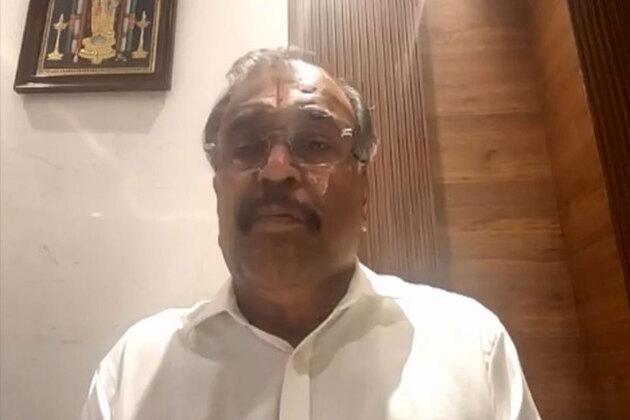

New Delhi, [India] December 25 (ANI): Gold prices have witnessed a sharp surge amid declining global interest rates and heightened geopolitical uncertainties, though a correction of 10-15 per cent is likely in early 2026 as markets normalise after the holiday season and risks begin to ease, said Anantha Padmanaban, founder member and former chairman of the All India Gem & Jewellery Domestic Council (GJC), in an interview with ANI.

'Prices are continuously going up because the interest rates are going down across the world,' Padmanaban told ANI.

He pointed out that major central banks are moving towards monetary easing, adding, 'Yesterday even the Bank of England has lowered interest rates, and next month again it will also come in the US. All this is happening, and a lot of geopolitical situations are driving gold prices higher.'

According to him, domestic gold prices are currently hovering around 1,40,000 per 10 grams. However, low trading volumes during the Christmas period have led to volatile price movements. 'It's Christmas and market participants are very low, so prices are fluctuating erratically,' he said, adding that clarity would emerge only once full participation resumes. 'We have to see from January 3 or 4 onwards, once the full players come in, how the gold price behaves.'

Padmanaban expects a near-term pullback. 'Anything that goes up has to come down a little bit,' he said. 'For the next two months, prices may correct.'

Geopolitical developments could also influence prices in the coming months. 'Russia and Ukraine are serious about settling down. There are peace talks happening,' he said. He also referred to trade discussions, noting, 'Between India and the US, tariff talks are going on. If these two subjects get settled and there are no major issues, prices may correct for some time.'

On the extent of a potential correction in gold prices, Padmanaban said, 'We can see a 10 to 15% correction, that's all, nothing more than that. The window would be in the first three months. Till April, I don't think it goes beyond this.'

He stressed that currency movements will be critical for domestic prices. 'If there is a settlement between the US and India, the rupee will strengthen,' he said. 'Even if gold prices and the dollar don't come down, the rupee can appreciate by 4-5%. That itself will make a big difference.'

India's dependence on imports further amplifies the impact of exchange rates. 'We don't have mining in our country. Every gram is imported,' Padmanaban said. 'Whenever the rupee depreciates, gold prices go up.'

High prices have significantly dampened retail demand. 'Last 15 days, after the price rise and rupee depreciation, sales have come down below 50%,' he said, adding that festive and NRI-led demand has remained muted. 'In spite of Christmas and New Year holidays and NRIs coming in, there is not much reaction.'

He noted that consumers are largely exchanging old jewellery, with fresh buying limited. 'New purchases are happening only if there is a marriage,' he said.

Imports have also declined sharply. 'In November, imports came down by more than 60%,' Padmanaban said. 'This month, it will also be the same. For the full financial year, imports may fall between 25 and 40%.'

A price correction could revive demand, particularly during the wedding season. 'Even a 10-15% fall will attract new buyers,' he said. 'People who postponed buying will come forward.'

Globally, physical demand remains weak. 'Dubai, Singapore, the US - everywhere gold is slow. Prices have gone up 75-80% from last year. People can't afford a double price in 12 months,' he said.

Silver prices have also surged to what he described as 'unimaginable levels,' with a possible correction to 150,000-170,000 rupees per kg from current levels near 240,000 rupees.

On policy measures, Padmanaban urged restraint on import duties and revival of gold-related schemes. 'If they do that, gold lying idle in lockers will come back to the system and imports will reduce,' he said. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionAustralia fails to connect Gaza 'genocide' to Bondi Beach shootings

In the backwash of the Sydney massacre, numerous questions arise, puzzling and otherwise. One, which readers may be able to solve for...

Mobs in Bangladesh attack newspaper offices, editors

DHAKA, Bangladesh: The killing of a prominent Islamic youth leader has triggered attacks on newspaper offices in Bangladesh, and media...

Harassment allegations force HarperCollins to drop children’s author

LONDON, U.K.: After being dropped by publisher HarperCollins, well-known British children's author and comedian David Walliams has...

EU dairy faces up to 42.7% China duties as trade tensions widen

BEIJING/BRUSSELS: China escalated its trade dispute with the European Union by announcing steep provisional tariffs on EU dairy imports,...

Nearly 30 US diplomats recalled by Trump administration

WASHINGTON, D.C.: Nearly 30 U.S. career diplomats from ambassadorial and other senior embassy posts have been recalled by President...

U.S. war on Venezuela contrasted with Houthi-led Red Sea blockade

The United States has now intercepted multiple Venezuelan oil tankers as part of its escalating aggression against Venezuela, while...

Wisconsin

SectionTwo of NFC's best face off when 49ers host Bears

(Photo credit: Mark Hoffman-USA TODAY Network via Imagn Images) Two teams with aspirations of claiming the NFC's top seed battle...

Browns bank on spoiling Steelers' celebration

(Photo credit: Mitch Stringer-Imagn Images) When the football is placed on the tee at 1 p.m. ET on Sunday afternoon for opening kickoff...

Former Packers TE, college Hall of Famer Rich McGeorge dies

(Photo credit: Matt Cashore-Imagn Images) Former Green Bay Packers tight end and college Hall of Famer Rich McGeorge died on Saturday....

QB questions linger but playoff spot in play as Packers, Ravens turn page

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Jordan Love and the Packers can put...

With elimination looming, Ravens' Lamar Jackson misses practice

(Photo credit: Mitch Stringer-Imagn Images) Baltimore Ravens quarterback Lamar Jackson missed practice Wednesday with a back injury,...

CFP ratings plummet 7% as games opposite NFL struggle again

(Photo credit: Petre Thomas-Imagn Images) While college football is big business, the NFL remains king as more evidence arrived from...