Crude Oil to remain under pressure in 2026 as oversupply outweighs geopolitical risks: Analysts

ANI

29 Dec 2025, 22:02 GMT+10

By Kaushal Verma

New Delhi [India], December 29 (ANI): Crude oil markets are likely to remain under sustained pressure in 2026 as chronic oversupply, swelling inventories and modest demand growth outweigh geopolitical risks, giving prices range bound to bearish tone despite efforts by OPEC+ to defend price floors, analysts said.

'The 2026 outlook for crude oil is defined by a transition into a period of chronic oversupply,' said Vandana Bharti, AVP, Commodities Research at SMC Global Securities. 'Global production growth will continue to outpace modest demand gains, potentially leading to a surplus of 2 to 4 million barrels per day.'

Bharti said relentless output growth from non-OPEC+ producers, particularly the U.S., Brazil and Guyana, is driving the imbalance, while global demand remains subdued due to transportation electrification, shifting trade policies and a cooling manufacturing sector.

Rising inventories are expected to intensify price pressure as Bharti said, 'Global stockpiles reached four-year highs in late 2025 and are forecast to build by another 2.2 million bpd through 2026. This inventory overhang will continue to weigh on prices.'

Although OPEC+ has paused further output hikes to defend price floors, she said that the group's influence is diminishing. 'The geopolitical premium has eroded, and the risk of a market share battle cannot be ruled out,' Bharti said.

Benchmark Brent crude and U.S. West Texas Intermediate (WTI) have already weakened sharply in 2025, with Brent briefly trading near the low $60s per barrel, reflecting a structural imbalance that analysts expect to persist into next year.

Supply-side pressures intensified in 2025 as production from the U.S., Canada, Brazil and OPEC+ exceeded expectations.

Prathamesh Mallya, Deputy Vice President, Research Commodities and Currencies at Angel One said, 'Brent and WTI have experienced significant declines compared with prior years. OPEC+ decisions to reverse voluntary production cuts early in the year added further to the surplus.'

On the demand side, Mallya pointed to structural headwinds and said, 'Accelerating electric vehicle adoption is eating into fuel demand, especially in key markets like China. While Asia and parts of the developing world continue to provide some demand support, it is not enough to absorb the supply surge.'

Forecasts from major agencies underscore the bearish outlook, he said.

'The U.S. Energy Information Administration (EIA) expects global liquid fuel production to rise by about 1.4 million barrels per day (bpd) in 2026, outpacing demand growth of around 1.1 million bpd. Non-OPEC producers are expected to account for nearly two-thirds of new supply, while OPEC+ output is projected to remain broadly steady at 37-38 million bpd,' he highlighted.

Ravinder Kumar, Senior Research Analyst at SMC Global Securities said, 'The global crude oil market is clearly shifting toward oversupply,' said Ravinder Kumar, Senior Research Analyst at SMC Global Securities. 'The International Energy Agency sees supply potentially exceeding demand by nearly 4 million bpd, marking the biggest surplus since the early 2010s.'

Kaynat Chainwala, Research Analyst at Kotak Securities mentioned that the geopolitical risks may still trigger short-lived rallies. 'Tensions around Russia and Venezuela could lead to episodic price spikes,' she said.

U.S. President Donald Trump's enforcement of a 'total and complete' blockade on sanctioned Venezuelan oil tankers and the possibility of fresh U.S. sanctions on Russia's energy sector as upside risks, she added.

'However, any meaningful progress towards a Russia-Ukraine peace agreement would likely intensify selling pressure,' Chainwala added, noting that prices are increasingly driven by structural imbalances rather than geopolitical headlines.

Analysts broadly expect Brent crude to average in the mid-USD 50s to low-USD 60s per barrel in 2026, with several financial institutions, including JPMorgan, forecasting prices below 2025 levels. WTI is expected to trade in the USD 50-65 per barrel range.

Amit Gupta, Senior Research Analyst at Kedia Advisory has advised to sell the crude oil futures at Rs 4750 per barrel as he expected a negative tone for the fossil fuel in the coming year following excess global supply and also because of inadequate demand which may fail to absorb huge inventories.

Vandana Bharti of SMC Global Securities highlighted that in India's domestic market, crude oil futures on the MCX are projected to remain volatile within a Rs 3,500-Rs 6,500 per barrel band in the coming year. 'Short-term rallies driven by Middle East tensions or Chinese stimulus are likely to be met with aggressive selling,' Bharti said.

Further, Ravinder Kumar said currently, crude oil prices are hovering around Rs 5216 per barrel on MCX and on WTI, the fossil fuel is trading at around USD 57.50 per barrel.

According to government data, during 2024-25 (April-March) India imported around 300 million metric tonnes of crude and petroleum products, meeting about 88% of the requirements through imports. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

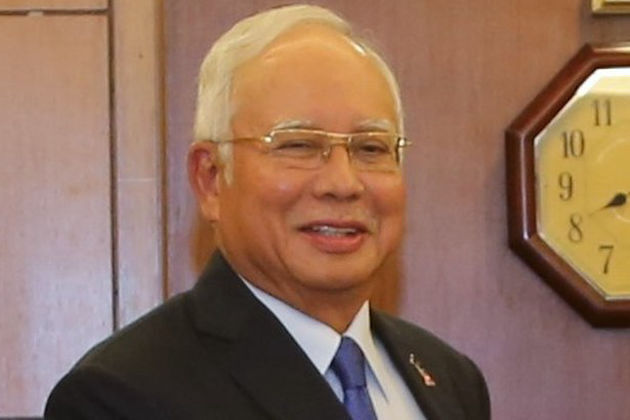

SectionRole in 1MDB scandal gets Malaysian ex-PM Razak 15 more years in jail

KUALA LUMPUR, Malaysia: In the most significant trial of the multibillion-dollar 1MDB scandal, Malaysia's influential former prime...

Hochul targets infinite scroll, autoplay with new warning-label law

NEW YORK CITY, New York: New York will soon require prominent mental health warnings on social media platforms that use features designed...

Snow, ice prompt emergency declarations across the U.S. Northeast

NEW YORK CITY, New York: A powerful winter system swept toward the U.S. Northeast at the start of the post-holiday weekend, triggering...

Kennedy Center Christmas Eve jazz concert canceled after name change

NEW YORK CITY, New York: Jazz musician Chuck Redd canceled a planned Christmas Eve concert at the Kennedy Center after the White House...

From child labor to trafficking, U.S. children under fire

There's an invisible emergency in America: children toil in slaughterhouses, factories, and fields—night and day, unseen, unprotected,...

US strikes ISIS forces in Nigeria after killing of Christians

WEST PALM BEACH, Florida: After spending weeks accusing Nigeria's government of failing to rein in the persecution of Christians, President...

Wisconsin

SectionFrom child labor to trafficking, U.S. children under fire

There's an invisible emergency in America: children toil in slaughterhouses, factories, and fields—night and day, unseen, unprotected,...

White House Tech Force draws strong interest amid AI push

WASHINGTON, D.C.: The Trump administration's effort to bring artificial intelligence expertise into the federal workforce has attracted...

Report: Bears rookie WR Luther Burden injures quad

(Photo credit: David Banks-Imagn Images) Chicago Bears rookie receiver Luther Burden III sustained a quad injury Sunday night in...

Steelers-Ravens to decide playoff berth on Sunday night stage

(Photo credit: Peter Casey-Imagn Images) The Pittsburgh Steelers will host the Baltimore Ravens in a battle for the AFC North title...

Packers dispel QB1 doubt, plan to stay with Jordan Love

(Photo credit: Kayla Wolf-Imagn Images) Malik Willis might start again for the Packers in a Week 18 that won't change the playoff...

Steelers TE Darnell Washington breaks arm vs. Browns

(Photo credit: Charles LeClaire-Imagn Images) Pittsburgh Steelers coach Mike Tomlin confirmed after his team's 13-6 loss to the Cleveland...