Dow drops 95 points amid division among Federal Reserve

Lola Evans

31 Dec 2025, 02:37 GMT+10

- The Federal Reserve minutes revealed division among members over their decision to cut interest rates by 25 basis points earlier this month..

- "A few participants judged that lowering the federal funds rate target range at this meeting was not justified because data received over the intermeeting period did not suggest any significant further weakening in the labor market."

- Of further concern to traders was the indication that inflation will need to decline to ensure futuure interest rate cuts.

NEW YORK, New York - U.S. stocks were weaker Tuesday as investors and traders pondered the latest Federal Reserve FOMC meeting minutes. The minutes revealed division among members over their decision to cut interest rates by 25 basis points earlier this month..

"A few participants judged that lowering the federal funds rate target range at this meeting was not justified because data received over the intermeeting period did not suggest any significant further weakening in the labor market," said the minutes released on Tuesday afternoon.

The decision to cut rates had three dissenters; two members to hold rates unchanged, while Governor Stephen Miran wanted a bigger 50 basis points cut.

Of further concern to traders was the indication that inflation will need to decline to ensure futuure interest rate cuts.

"Most participants judged that further downward adjustments to the target range for the federal funds rate would likely be appropriate if inflation declined over time as expected," the minutes said.

Nonetheless, the major stock indices closed with only modest losses on Tuesday, as a quiet trading session saw investors pull back slightly from recent record levels.

The benchmark Standard and Poor's 500 dipped 9.50 points, or 0.14 percent, to close at 6,896.24.

The Dow Jones Industrial Average declined 94.87 points, a loss of 0.20 percent, finishing the session at 48,367.06.

The tech-heavy NASDAQ Composite saw a similar retreat, falling 55.27 points or 0.24 percent to 23,419.08.

The session was marked by a lack of major catalysts, leading to subdued trading activity. The slight pullback reflects a degree of profit-taking and consolidation following recent gains, with investors appearing to await fresh economic data or corporate news for direction.

Market analysts suggest the minor declines represent a pause rather than a shift in sentiment, as underlying economic fundamentals remain a primary focus for traders.

U.S. Dollar Strengthens Against Major Rivals in Tuesday Trading

The U.S. dollar posted broad gains in foreign exchange trading on Tuesday, firming against the UK and European, and some commodity-linked currencies while also climbing versus the Japanese yen.

The greenback's strength was most evident against the UK and European currencies. The euro fell, with EUR/USD declining 0.19 percent to 1.1749. The British pound saw a steeper drop, as GBP/USD slid 0.32 percent to 1.3467.

The dollar also advanced against the traditional safe-haven Swiss franc, with USD/CHF rising 0.38 percent to 0.7918. It registered a more modest gain against the Canadian dollar, as USD/CAD edged up 0.03 percent to 1.3693.

In Asia, the dollar continued its upward momentum against the Japanese yen, with USD/JPY climbing 0.27 percent to 156.45.

The picture was more mixed for the commodity-sensitive Antipodean currencies. The Australian dollar managed a slight gain, with AUD/USD inching up 0.06 percent to 0.6696. Conversely, the New Zealand dollar softened, with NZD/USD diving 0.17 percent to 0.5793.

Tuesday's moves reflect a market favoring the U.S. dollar, potentially driven by shifting expectations over interest rates following the release of the Fed minutes on Tuesday afternoon, which revealed division amongst members over the pathway ahead.

Global Markets Close Mixed on Tuesday Amid Cautious Optimism

Major global stock indices delivered a mixed performance on Tuesday, with European and several Asian bourses posting solid gains while markets in Canada, Australia and parts of Asia retreated.

In Europe, the rally was broad-based. The UK's FTSE 100 led the charge, closing at 9,940.71, a gain of 74.18 points or 0.75 percent. Germany's DAX advanced 139.29 points to 24,490.41, rising 0.57 percent. France's CAC 40 climbed 56.13 points, or 0.69 percent, to 8,168.15. The pan-European EURO STOXX 50 index rose 0.77 percent to 5,796.22. Belgium's BEL 20 also finished higher, adding 0.46 percent to 5,077.71.

In Canada, the S&P/TSX Composite Index ended the day in negative territory, slipping 30.33 points, or 0.10 percent, to settle at 31,866.26.

The Asia-Pacific region presented a more varied picture. Hong Kong's Hang Seng Index was a standout performer, jumping 219.37 points or 0.86 percent to 25,854.60. Singapore's STI Index gained 0.47 percent. However, Australia's S&P/ASX 200 dipped 0.10 percent to 8,717.10, and the broader All Ordinaries index fell 0.11 percent. South Korea's KOSPI retreated 0.15 percent, and Taiwan's TWSE Index declined 0.36 percent.

Other global indices showed modest movements. India's S&P BSE Sensex was nearly flat, down a marginal 0.02 percent. Indonesia's IDX Composite edged up 0.03 percent, while Malaysia's FTSE Bursa Malaysia KLCI rose 0.21 percent. New Zealand's S&P/NZX 50 gained 0.16 percent. Israel's TA-125 was a notable gainer, up 1.02 percent, while Egypt's EGX 30 slipped 0.10 percent.

The day's trading reflected a market balancing optimism over corporate earnings and economic resilience against persistent concerns over interest rates and geopolitical tensions. The positive momentum in Europe contrasted with the cautious sentiment seen in several Asian markets, setting the stage for a key central bank policy decision from the European Central Bank later in the week.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Monday 29 December 2025 | Dow Jones drops 249 points Monday, as year-end looms | Big News Network.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionFederal panel to hear January briefing on controversial White House project

PALM BEACH, Florida: After weeks of legal challenges and political pushback, the White House is preparing to formally outline its plans...

Times Square’s crystal ball to go up on New Year’s Eve and July 3

NEW YORK CITY, New York: The customary crystal ball that rises over Times Square in New York City on every New Year's Eve and disperses...

Arms sales to Taiwan invite sanctions against US firms from China

BEIJING, China: The Chinese foreign ministry has imposed sanctions against 10 individuals and 20 U.S. defence firms, including Boeing's...

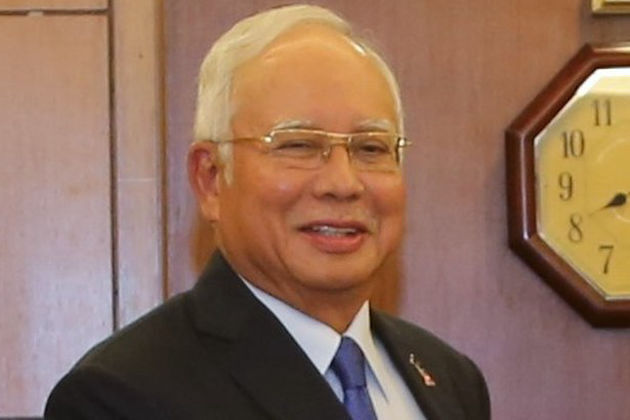

Role in 1MDB scandal gets Malaysian ex-PM Razak 15 more years in jail

KUALA LUMPUR, Malaysia: In the most significant trial of the multibillion-dollar 1MDB scandal, Malaysia's influential former prime...

Hochul targets infinite scroll, autoplay with new warning-label law

NEW YORK CITY, New York: New York will soon require prominent mental health warnings on social media platforms that use features designed...

Snow, ice prompt emergency declarations across the U.S. Northeast

NEW YORK CITY, New York: A powerful winter system swept toward the U.S. Northeast at the start of the post-holiday weekend, triggering...

Wisconsin

SectionFrom child labor to trafficking, U.S. children under fire

There's an invisible emergency in America: children toil in slaughterhouses, factories, and fields—night and day, unseen, unprotected,...

White House Tech Force draws strong interest amid AI push

WASHINGTON, D.C.: The Trump administration's effort to bring artificial intelligence expertise into the federal workforce has attracted...

Stephen Curry returns home as Warriors face Hornets

(Photo credit: Brad Penner-Imagn Images) Stephen Curry hopes for a lucky 13th homecoming when the Golden State Warriors make their...

Final 15 revealed for Hall of Fame Class of '26

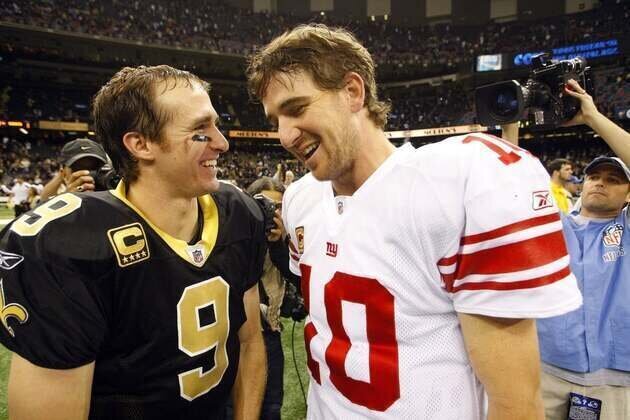

(Photo credit: John David Mercer-Imagn Images) Super Bowl-winning quarterbacks Drew Brees and Eli Manning and one of the most clutch...

Wisconsin draws Milwaukee in final non-conference game of season

(Photo credit: Benny Sieu-Imagn Images) Wisconsin coach Greg Gard wants more movement from the Badgers when they host Milwaukee in...

NBA roundup: Nuggets lose Nikola Jokic, fall to Heat

(Photo credit: Sam Navarro-Imagn Images) Denver's three-time NBA MVP Nikola Jokic sustained a left knee injury as the Miami Heat...