India stocks sign off 2025 on strong note; Sensex rises 545 points; Silver corrects sharply

ANI

31 Dec 2025, 17:02 GMT+10

New Delhi [India], December 31 (ANI): Indian stock indices jumped substantially on Wednesday, the last day of 2025, supported largely by value buying after the year-end thin trade.

Sensex jumped 0.64 per cent or 545 points to 85,220 points, while Nifty rose 191 points or 0.74 per cent to 26,130 points.

The domestic stock market opened with marginal gains on Wednesday, reflecting a balanced but soft mood among investors amid thin year-end volumes and limited global cues.

According to analysts, going ahead, market participants will keep a close watch on news flow on the India-US trade deal front, auto sales data, Budget announcements, Q3 earnings, among other key global indicators.

'The market has the potential for a directional move upwards but is being weighed down by sustained FII selling and absence of fresh triggers like positive news on the US-India trade front,' said VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited .

The coming days are going to be eventful, starting with the auto sales data for December, Q3 corporate results, expectations from the budget and other news relating to global economy like the possible US Fed action in 2026, Vijayakumar said.

'The Q3 results have to be watched carefully for indications of uptick in earnings. This is significant since there is lot of hope that there will be a rebound in earnings, going forward. Earnings growth will be the single most important factor determining the market trend in 2026. The FII flows in 2026, too, will depend on the earnings performance and expectations surrounding that,' Vijayakumar further asserted.

Sensex and Nifty cumulatively rose 8-10 per cent in 2025, lower than the recent year trends.

Market participants remained cautious, with experts pointing to low foreign investor participation. Foreign portfolio investors remained net sellers in India in 2025, data showed. Overall, Indian equity markets had largely been choppy over the past months, barring some bullish days, as investors remained uncertain over the trade deal with the United States, which imposed a 50 per cent tariff on Indian goods.

In 2024, Sensex and Nifty accumulated a growth of about 9-10 per cent each. In 2023, Sensex and Nifty gained 16-17 per cent, on a cumulative basis. In 2022, they gained a mere 3 per cent each.

'The (today's) session reflected a gradual improvement in risk appetite into year-end, driven primarily by short covering and selective buying, rather than aggressive fresh positioning. Sentiment across the metal space turned positive after the government announced a three-year safeguard duty of around 11-12% on select steel imports, aimed at shielding domestic producers from cheaper overseas supply. The impressive, broad-based rally witnessed today has set the stage for the next directional move in the early part of the new year, with improving sentiment encouraging investors to reassess positioning amid renewed risk appetite,' said Ponmudi R, CEO of Enrich Money, a SEBI-registered online trading and wealth tech firm.

Vinod Nair, Head of Research, Geojit Investments Limited, said markets ended the 2025 on a strong note, posting a broad-based recovery.

'Looking ahead, expectations are rising for a constructive rebound in 2026, supported by improving demand conditions. Investor sentiment is likely to hinge on corporate earnings and a potential uptick in nominal GDP growth. Metal stocks led gains today after the government announced import tariffs on steel products. Meanwhile, the oil and gas sector outperformed on the back of anticipated stable demand and stronger refining margins,' Nair noted.

In another news today, international silver traded sharply lower, declining over 8 per cent at the time of filing this report. Taking cues from global markets, silver on MCX too declined sharply - down over 5 per cent at the time of filing this report -- at Rs 2.37 lakh per kg.

'Despite the near-term pressure, the longer-term bullish framework remains intact,' Ponmudi R said. 'The broader trend continues to favour accumulation on dips.'

As per reports, international silver prices rose by approximately 140-158 per cent in 2025. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionTrump says, getting ‘lot closer’ to peace deal after meeting Zelenskyy

PALM BEACH, Florida: While acknowledging that the disputed Donbas region remains a key unresolved issue, U.S. President Donald Trump...

Federal panel to hear January briefing on controversial White House project

PALM BEACH, Florida: After weeks of legal challenges and political pushback, the White House is preparing to formally outline its plans...

Times Square’s crystal ball to go up on New Year’s Eve and July 3

NEW YORK CITY, New York: The customary crystal ball that rises over Times Square in New York City on every New Year's Eve and disperses...

Arms sales to Taiwan invite sanctions against US firms from China

BEIJING, China: The Chinese foreign ministry has imposed sanctions against 10 individuals and 20 U.S. defence firms, including Boeing's...

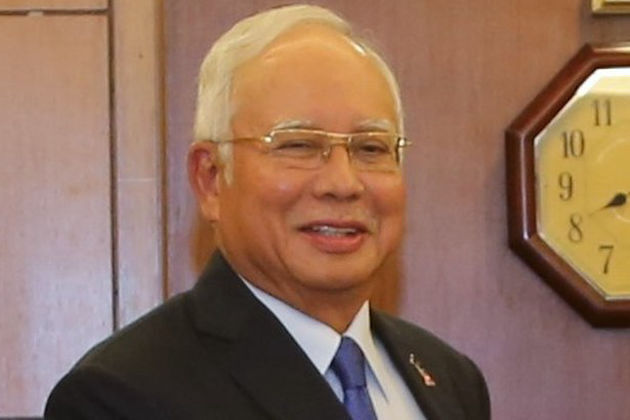

Role in 1MDB scandal gets Malaysian ex-PM Razak 15 more years in jail

KUALA LUMPUR, Malaysia: In the most significant trial of the multibillion-dollar 1MDB scandal, Malaysia's influential former prime...

Hochul targets infinite scroll, autoplay with new warning-label law

NEW YORK CITY, New York: New York will soon require prominent mental health warnings on social media platforms that use features designed...

Wisconsin

SectionFrom child labor to trafficking, U.S. children under fire

There's an invisible emergency in America: children toil in slaughterhouses, factories, and fields—night and day, unseen, unprotected,...

White House Tech Force draws strong interest amid AI push

WASHINGTON, D.C.: The Trump administration's effort to bring artificial intelligence expertise into the federal workforce has attracted...

Wisconsin strolls to comfortable win over Milwaukee

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Nick Boyd scored 16 points while leading...

Rolling with Giannis back, Bucks welcome Wizards

(Photo credit: Sam Sharpe-Imagn Images) With former Most Valuable Player Giannis Antetokounmpo back in the lineup, the Milwaukee...

Stephen Curry returns home as Warriors face Hornets

(Photo credit: Brad Penner-Imagn Images) Stephen Curry hopes for a lucky 13th homecoming when the Golden State Warriors make their...

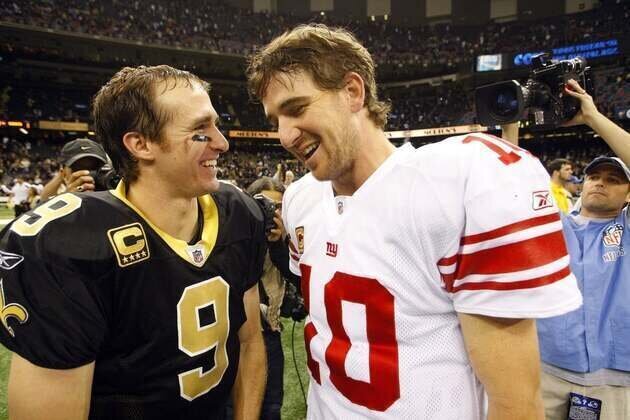

Final 15 revealed for Hall of Fame Class of '26

(Photo credit: John David Mercer-Imagn Images) Super Bowl-winning quarterbacks Drew Brees and Eli Manning and one of the most clutch...