Wall Street rallies on U.S. overthrow of Maduro

Lola Evans

06 Jan 2026, 02:38 GMT+10

- Dow Jones Industrial Average: 48,977.49, +1.23 percent

- NASDAQ Composite: 23,395.82, +0.69 percent

- Standard and Poor's 500 Index: 6,902.09, +0.64 percent

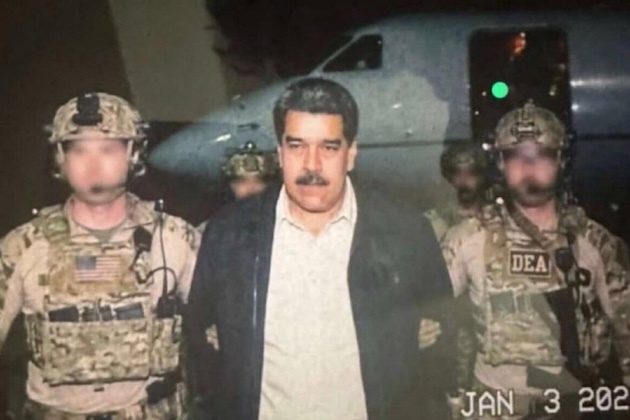

NEW YORK, New York - U.S. stock jumped sharply Monday following the weekend's U.S. military actions in Venezuela which resulted in a number of airstrikes in the capital Caracas, and a number of regional areas, and the overthrow and abduction of President Nicolas Maduro and his wife, both of whom appeared in a Manhattan court room on Monday, charged with drug trafficking and possession of machine guns..

The broad-based rally was boosted by a surge in energy stocks following President Trump's announcement on Sunday that the U.S. would run Venezuela, and would seize its oil wells, which house the largest oil reserves in the world.

"Maybe in the short term, it'll boost the price of oil because the question is surrounding the supply and delivery of oil," Sam Stovall, chief investment strategist at CFRA Research,told CNBC Monday. "Longer term, it could end up being an improvement because Venezuela represents only 1 percent of the world's oil supply, and they've been getting worse and worse over the years. Their infrastructure needs to be improved, and possibly that is something that the U.S. can help with."

Wall Street kicked off the week with robust gains on Monday, as major indices closed firmly in positive territory, led by a powerful rally in blue-chip stocks, particularly in the energy sector.

The Dow Jones Industrial Average (^DJI) posted the strongest performance among the major U.S. benchmarks, soaring 595.10 points, or 1.23 percent, to close at 48,977.49. The significant advance brought the 30-stock index within striking distance of the 49,000 mark, reflecting broad-based investor optimism.

The broader S&P 500 (^GSPC) also enjoyed solid gains, rising 43.62 points, or 0.64 percent, to finish the session at 6,902.09. The benchmark index continued its steady climb closer to the 7,000 level, supported by strength across multiple sectors.

The tech-heavy NASDAQ Composite (^IXIC) kept pace with the rally, adding 160.19 points, or 0.69 percent, to end at 23,395.82. The gain underscored continued confidence in the technology sector despite recent volatility.

Analysts attributed Monday's buoyant sentiment to a combination of factors, including eased concerns over geopolitical tensions following the weekend coup in Venezuela, and positive momentum from the previous week's earnings reports. The universal gains suggested a risk-on mood among investors to start the trading period.

Monday's Closing U.S. Markets Snapshot:

-

Dow Jones Industrial Average: 48,977.49, +1.23 percent

-

S&P 500 Index: 6,902.09, +0.64 percent

-

NASDAQ Composite: 23,395.82, +0.69 percent

British Pound Leads Gains as Dollar Shows Mixed Signals in Monday Trading

The foreign exchange market saw a split performance on Monday, with the U.S. dollar weakening against UK and European and commodity-linked currencies but firming against some traditional safe havens. The British pound was the standout performer of the session.

Sterling rallied strongly against the greenback, with GBPUSD climbing 0.65 percent to last trade Monday at 1.3545. The move was attributed to a relative calm in UK politics and market positioning ahead of key economic data releases later in the week.

The euro also posted modest gains, with EURUSD rising 0.06 percent to 1.1726. The common currency held its ground despite lingering concerns over the economic outlook within the Eurozone.

The commodity-sensitive Australian and New Zealand dollars advanced, buoyed by stable risk sentiment. The AUDUSD pair rose 0.36 percent to 0.6715, while the NZDUSD pair gained 0.43 percent to 0.5789.

In contrast, the U.S. dollar found strength against the Japanese yen and the Canadian dollar. The USDJPY pair increased by 0.34 percent to 156.27, continuing its recent upward trajectory. The USDCAD pair also moved higher, up 0.27 percent to 1.3764, supported by stable oil prices.

The Swiss franc, another traditional safe-haven currency, edged lower against the dollar. The USDCHF pair ticked up by 0.04 percent to 0.7915.

Analysts suggested the currency movements reflected a cautiously optimistic market mood, with investors favoring currencies tied to growth while the dollar index remained in a holding pattern ahead of crucial inflation reports and central bank commentary.

Key Monday FX Rates:

-

EUR/USD: 1.1726, +0.06 percent

-

GBP/USD: 1.3545, +0.65 percent

-

USD/JPY: 156.27, +0.34 percent

-

USD/CAD: 1.3764, +0.27 percent

-

AUD/USD: 0.6715, +0.36 percent

-

NZD/USD: 0.5789, +0.43 percent

-

USD/CHF: 0.7915, +0.04 percent

Global Markets Rally as Asia and Canada Lead Gains; European Indices Post Steady Advances

Equity markets across the globe closed mostly higher on Monday, with Canadian and Asian benchmarks surging and European indices posting solid, broad-based gains, setting a positive tone for the trading week.

The session's standout performance came from the Asia-Pacific region.

Japan's Nikkei 225 (^N225) soared, closing at 51,832.80, a powerful gain of 1,493.32 points or 2.97 percent.

In South Korea the KOSPI Composite (^KS11) also recorded a stellar advance, jumping 147.89 points to finish at 4,457.52, up 3.43 percent. Taiwan's TWSE Index (^TWII) rose sharply by 2.57 percent to start the week, adding 755.23 points to close at 30,105.04.

In mainland China on Monday, the SSE Composite (000001.SS) climbed 1.38 percent to 4,023.42. Other notable gainers in Asia included Indonesia's IDX Composite (^JKSE), up 1.27 percent, and Australia's S&P/ASX 200 (^AXJO), which eked out a 0.01 percent gain. In Hong Kong the Hang Seng Index (^HSI) was nearly flat, rising a marginal 0.03 percent.

Canada's primary benchmark joined the upward trend. The S&P/TSX Composite Index (^GSPTSE) jumped 336.58 points, or 1.06 percent, closing at 32,219.95. The move highlighted synchronized strength in commodities and financials within the Canadian market.

UK and European markets sustained the positive momentum. Germany's DAX (^GDAXI) led the major continental indices, climbing 329.35 points or 1.34 percent to 24,868.69. The broader Euro Stoxx 50 (^STOXX50E) followed closely, gaining 1.25 percent to reach 5,923.69.

In the UK the FTSE 100 (^FTSE) advanced 0.54 percent Monday to close at 10,004.57, while France's CAC 40 (^FCHI) added a more modest 0.20 percent.

The pan-European Euronext 100 (^N100) index rose 1.04 percent. In Belgium the BEL 20 (^BFX) was a rare decliner in the region, dipping 0.25 percent.

Other global indices showed mixed results. India's S&P BSE SENSEX (^BSESN) fell 0.38 percent, and Egypt's EGX 30 (^CASE30) declined 0.54 percent.

New Zealand's S&P/NZX 50 (^NZ50) gained 0.29 percent, Malaysia's FTSE Bursa Malaysia KLCI (^KLSE) rose 0.63 percent, and Israel's TA-125 (^TA125.TA) increased by 1.64 percent.

In South Africa the Top 40 USD Index (^JN0U.JO) closed 0.98 percent higher.

Key Monday Closing Figures:

-

FTSE 100 (UK): 10,004.57, +0.54 percent

-

DAX (Germany): 24,868.69, +1.34 percent

-

CAC 40 (France): 8,211.50, +0.20 percent

-

Euro Stoxx 50: 5,923.69, +1.25 percent

-

Nikkei 225 (Japan): 51,832.80, +2.97 percent

-

Hang Seng (Hong Kong): 26,347.24, +0.03 percent

-

KOSPI (South Korea): 4,457.52, +3.43 percent

-

S&P/ASX 200 (Australia): 8,728.60, +0.01 percent

-

S&P BSE SENSEX (India): 85,439.62, -0.38 percent

-

SSE Composite (China): 4,023.42, +1.38 percent

The strong performance, particularly in Asian technology and export-heavy markets, was attributed to renewed investor optimism surrounding global economic resilience and sector-specific tailwinds.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Friday 2 January 2026 | U.S. stocks kick off 2026 in style, Dow jumps 319 points | Big News Network.com

Wednesday 31 December 2025 | Wall Street marks New Year's Eve with major losses | Big News Network.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionThirty-two Cuban security officials killed in Venezuelan attack

HAVANA, Cuba - Cuba has confirmed that 32 of its military and police officers were killed during an attack on a Venezuelan military...

Journalists faced a rough time in 2025, and future isn’t bright either

NEW YORK CITY, New York: The year 2025 has been a rough one for journalists in the U.S. and many regions of the world. The number...

Some US Supreme Court justices not enthused by Trump’s tariffs

WASHINGTON, D.C.: U.S. President Donald Trump's ability to unilaterally impose far-reaching tariffs has given rise to skepticism among...

Beijing taxes condoms, pills as population decline deepens

HONG KONG: China has begun taxing contraceptive drugs and devices from the start of 2026, ending a tax exemption that had been in place...

Mayor Mamdani swears on the Quran as he takes oath of office

NEW YORK CITY, New York: Zohran Mamdani took his midnight oath of office on a centuries-old Quran, making him the first New York City...

Large US companies to spend billions on oil infrastructure in Venezuela, says Trump

While Venezuelan President Nicolas Maduro and his wife are being shipped to a Federal prison in New York City, after being abducted...

Wisconsin

SectionSome US Supreme Court justices not enthused by Trump’s tariffs

WASHINGTON, D.C.: U.S. President Donald Trump's ability to unilaterally impose far-reaching tariffs has given rise to skepticism among...

Millions face steep health premium hikes after tax credits expire

NEW YORK CITY, New York: Millions of Americans are beginning 2026 facing sharply higher health insurance bills after enhanced Affordable...

Rams WR Davante Adams expected to return for wild-card round

(Photo credit: Scott Kinser-Imagn Images) The Los Angeles Rams will welcome back the second half of their dynamic wide-receiver duo...

(SP)U.S.-SACRAMENTO-BASKETBALL-NBA-MILWAUKEE BUCKS VS SACRAMENTO KINGS

(260105) -- SACRAMENTO, Jan. 5, 2026 (Xinhua) -- Milwaukee Bucks' Kevin Porter Jr. (L) breaks through during the 2025-2026 NBA regular...

NBA roundup: Devin Booker's last-second 3 lifts Suns over Thunder

(Photo credit: Mark J. Rebilas-Imagn Images) Devin Booker hit a 3-pointer with 0.7 seconds left, reserve guard Jordan Goodwin had...

Bears home dogs, Rams biggest wild-card favorite

(Photo credit: Jim Dedmon-Imagn Images) The Los Angeles Rams will travel cross country as the No. 5 seed in the NFC to play at a...