Where Crypto Demand Is Growing in Bulgaria in 2026

Novinite.com

05 Jan 2026, 20:52 GMT+10

Bulgaria's crypto scene is finally maturing. The era of loose oversight and messy experimentation is ending, replaced by strict EU alignment and clearer ground rules. With the MiCA deadline looming and euro adoption on the horizon, the market is ditching speculative hype for real-world utility. Today's growth isn't about chasing price spikes; it's anchored in cross-border payment efficiency, regulatory safety, and high-speed value transfer. This pivot offers a stable foundation, allowing local firms to weave digital assets into their long-term plans without the constant threat of legal surprises or sudden volatility.

Online Platforms as Early Demand Signals

Crypto usually hits high-volume digital hubs way before it reaches the mainstream. These sectors live on fast, small transactions that often leave traditional banks struggling to keep up. Marketplaces and subscription services are already ditching cards because crypto wallets are simply faster.

These high-velocity spaces act as a real-world trial for digital payments. You?ll see things like a used with instant payouts to smooth over transaction friction or price swings. Once users try an on-chain wallet and see the speed and control for themselves, they rarely go back to clunky bank apps. It's a shift toward predictability and speed, not just market speculation.

The Euro Effect and Cross-Border Payments

is more about habit than policy. Because the lev has been locked for decades, switching to euro-based stablecoins isn't a shock; it's just the logical next step for a market already thinking in euros. This familiarity is fueling a sudden, practical demand for MiCA-regulated tokens.

Local firms are tired of legacy banking delays. For a Sofia exporter or a creative agency, waiting days for a SEPA transfer feels outdated. Settlement on-chain cuts the wait time to minutes, giving these businesses a handle on their cash flow that traditional banks simply haven't matched yet.

SMEs, Remittances, and Regional Cash Flow

Local SMEs use crypto to shield their margins. Moving funds across Southeast Europe via banks is costly; those fees hit the bottom line hard. Cutting out middleman delays to settle invoices isn't about the tech; it's about keeping cash flowing.

The same pressure drives remittances. Bulgarians working abroad send frequent, relatively small transfers back home, where traditional banking fees and processing times quickly add up. Digital assets and stablecoins reduce intermediary costs and speed up cross-border settlement, making them a practical alternative to international wires. In this context, crypto functions less as an investment product and more as a payment tool designed for repeat use, particularly where efficiency matters more than speculation.

Institutionalization and Tokenized Assets

Institutional demand is now anchoring in real-world asset (RWA) tokenization. Real estate is the standout; fractionalizing property is finally unblocking liquidity traps and opening doors for smaller players. It's a trust play, too; on-chain records offer an immutable trail that messy paper registries simply can't replicate.

Local corporate treasuries are following suit. With Bulgaria's tax rules for crypto finally settled, Sofia's tech scene is treating digital assets as a capital tool rather than a gamble. These startups are now laser-focused on how MiCA-compliant structures can sharpen their balance sheet agility and long-term fiscal grip.

Regulation, Licensing, and Market Trust

Regulatory clarity is central to this transition. The Financial Supervision Commission's role in is consolidating the market around compliant operators. This process reduces counterparty risk and creates clearer expectations for custody, reporting, and consumer protection.

As unregulated platforms fall away, demand is likely to concentrate around services that meet compliance standards. This favors sustained activity over short-lived surges tied to market cycles.

Retail Use Shifts Toward Everyday Utility

Consumers are increasingly using crypto debit cards for everyday purchases. In cities like Sofia, these cards link digital wallets directly to store terminals, making crypto spending as simple as a standard card tap. It's a move that integrates digital assets into normal shopping habits without requiring a total lifestyle change.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionThirty-two Cuban security officials killed in Venezuelan attack

HAVANA, Cuba - Cuba has confirmed that 32 of its military and police officers were killed during an attack on a Venezuelan military...

Journalists faced a rough time in 2025, and future isn’t bright either

NEW YORK CITY, New York: The year 2025 has been a rough one for journalists in the U.S. and many regions of the world. The number...

Some US Supreme Court justices not enthused by Trump’s tariffs

WASHINGTON, D.C.: U.S. President Donald Trump's ability to unilaterally impose far-reaching tariffs has given rise to skepticism among...

Beijing taxes condoms, pills as population decline deepens

HONG KONG: China has begun taxing contraceptive drugs and devices from the start of 2026, ending a tax exemption that had been in place...

Mayor Mamdani swears on the Quran as he takes oath of office

NEW YORK CITY, New York: Zohran Mamdani took his midnight oath of office on a centuries-old Quran, making him the first New York City...

Large US companies to spend billions on oil infrastructure in Venezuela, says Trump

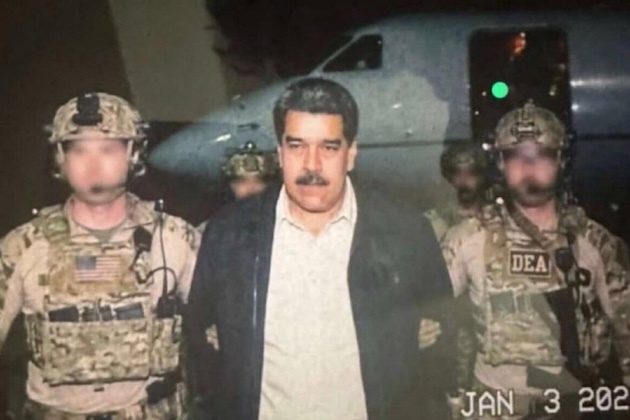

While Venezuelan President Nicolas Maduro and his wife are being shipped to a Federal prison in New York City, after being abducted...

Wisconsin

SectionSome US Supreme Court justices not enthused by Trump’s tariffs

WASHINGTON, D.C.: U.S. President Donald Trump's ability to unilaterally impose far-reaching tariffs has given rise to skepticism among...

Millions face steep health premium hikes after tax credits expire

NEW YORK CITY, New York: Millions of Americans are beginning 2026 facing sharply higher health insurance bills after enhanced Affordable...

Rams WR Davante Adams expected to return for wild-card round

(Photo credit: Scott Kinser-Imagn Images) The Los Angeles Rams will welcome back the second half of their dynamic wide-receiver duo...

(SP)U.S.-SACRAMENTO-BASKETBALL-NBA-MILWAUKEE BUCKS VS SACRAMENTO KINGS

(260105) -- SACRAMENTO, Jan. 5, 2026 (Xinhua) -- Milwaukee Bucks' Kevin Porter Jr. (L) breaks through during the 2025-2026 NBA regular...

NBA roundup: Devin Booker's last-second 3 lifts Suns over Thunder

(Photo credit: Mark J. Rebilas-Imagn Images) Devin Booker hit a 3-pointer with 0.7 seconds left, reserve guard Jordan Goodwin had...

Bears home dogs, Rams biggest wild-card favorite

(Photo credit: Jim Dedmon-Imagn Images) The Los Angeles Rams will travel cross country as the No. 5 seed in the NFC to play at a...