Dow Jones loses 42 points as Nasdaq Composite takes big hit

Lola Evans

15 Jan 2026, 02:45 GMT+10

- The NASDAQ Composite tumbled 238.12 points, a significant 1.00 percent drop, to end the session at 23,471.75.

- The Dow Jones Industrial Average demonstrated relative resilience, dipping only 42.24 points, or 0.09 percent, to settle at 49,149.75.

- The Standard and Poor's 500 closed at 6,926.99, retreating 36.75 points, or 0.53 percent

NEW YORK, New York - U.S. stocks slumped on Wednesday, with technology stocks dragging down key benchmarks. While traditional industrials showed some resistance, all the major indices ended lower.

The broad Standard and Poor's 500 (^GSPC) closed at 6,926.99, retreating 36.75 points, or 0.53 percent, on the day. The index traded within a range of 6,885.74 to 6,941.30, continuing its consolidation below the recent high of 6,986.33.

The Dow Jones Industrial Average (^DJI) demonstrated relative resilience, dipping only 42.24 points, or 0.09 percent, to settle at 49,149.75. The blue-chip index's narrower decline suggests a rotation out of high-growth sectors and into more established industrial names.

Selling pressure was most acute in the tech-heavy NASDAQ Composite (^IXIC), which tumbled 238.12 points, a significant 1.00 percent drop, to end the session at 23,471.75. The decline points to investor caution ahead of key earnings reports and ongoing sensitivity to interest rate expectations.

Analysts attributed the divergent performance to sector-specific concerns, with mega-cap technology stocks facing headwinds while energy and materials found support. Market participants now turn their focus to upcoming economic data and corporate earnings for clearer directional signals.

U.S. dollar trades flat to lower Wednesday as strength fades on Trump's attacks on Powell

Global currency markets were little changed on Wednesday with the U.S. dollar's upward trend being undermined by the Donald Trump-led launch of a criminal investigation into Fed Chair Jerome Powell.

The euro edged higher against the U.S. dollar, with EUR/USD rising 0.01 percent to trade at 1.1643, reflecting modest support for the single currency during the session.

The U.S. dollar weakened against the Japanese yen, with USD/JPY slipping 0.30 percent to 158.57, as the yen clawed back some ground after recent pressure tied to policy divergence and market volatility.

Against the Canadian dollar, the greenback was little changed. USD/CAD edged down 0.01 percent to 1.3884, with trading largely rangebound amid steady oil prices and subdued domestic data from Canada.

Sterling advanced on the day, with GBP/USD gaining 0.09 percent to 1.3432, as the pound benefited from cautious optimism around the UK economic outlook and relative policy stability.

The U.S. dollar also softened against the Swiss franc, with USD/CHF down 0.07 percent at 0.8002, highlighting a modest bid for traditional safe-haven currencies.

In the Asia-Pacific region, the Australian dollar strengthened slightly, with AUD/USD up 0.04 percent to 0.6683, while the New Zealand dollar outperformed its regional peers. NZD/USD rose 0.17 percent to 0.5746, supported by improved risk sentiment and demand for higher-yielding currencies.

European shares slide while broader global indices show strength Wednesday

Global equity markets ended Wednesday on a mixed note, with gains across the UK, Canada, parts of Asia and Australia offset by declines in several major European benchmarks and emerging markets.

Canada's main benchmark outperformed its U.S. counterparts. TheS&P/TSX Composite index (^GSPTSE)gained 46.11 points, or 0.14percent, closing at 32,916.47. The positive finish was likely bolstered by strength in the resource and financial sectors, which dominate the Canadian index.

In London, the FTSE 100 closed higher, advancing 47.00 points, or 0.46 percent, to finish at 10,184.35. The index traded between an intraday low of 10,135.35 and a session high that matched its closing level, reflecting steady investor confidence across blue-chip stocks.

Germany's DAX retreated, slipping 134.42 points, or 0.53 percent, to close at 25,286.24. The benchmark touched a high of 25,461.36 earlier in the session before selling pressure pushed it lower by the close. France's CAC 40 also ended in negative territory, falling 16.23 points, or 0.19 percent, to 8,330.97, while the broader EURO STOXX 50 declined 24.78 points, or 0.41 percent, to finish at 6,005.05.

Elsewhere in Europe, the Euronext 100 Index edged down 0.90 points, or 0.05 percent, to 1,780.71. Belgium's BEL 20 was a standout performer, surging 52.28 points, or 1.00 percent, to close at 5,302.37, supported by strength in heavyweight components.

Asian markets were largely higher. Hong Kong's Hang Seng Index gained 151.34 points, or 0.56 percent, ending the session at 26,999.81 after swinging between 26,780.27 and 27,097.72. Singapore's STI Index added 5.38 points, or 0.11 percent, to close at 4,812.51.

In Japan, the Nikkei 225 posted a strong advance, climbing 792.07 points, or 1.48 percent, to finish at 54,341.23, while South Korea's KOSPI Composite Index rose 30.46 points, or 0.65 percent, to 4,723.10. Taiwan's TWSE Capitalization Weighted Stock Index also ended firmly higher, gaining 234.56 points, or 0.76 percent, to close at 30,941.78.

Markets in Southeast Asia were mixed. Indonesia's IDX Composite jumped 84.28 points, or 0.94 percent, to 9,032.58, while Malaysia's FTSE Bursa Malaysia KLCI edged up 2.71 points, or 0.16 percent, to 1,710.91. New Zealand's S&P/NZX 50 Index Gross recorded a strong session, rising 101.66 points, or 0.74 percent, to end at 13,757.71.

Australian equities finished modestly higher, with the S&P/ASX 200 gaining 12.10 points, or 0.14 percent, to close at 8,820.60, while the broader All Ordinaries added 13.30 points, or 0.15 percent, to 9,151.80.

In other markets, India's S&P BSE Sensex slipped 244.98 points, or 0.29 percent, to finish at 83,382.71. Egypt's EGX 30 Price Return Index saw a sharper decline, dropping 625.90 points, or 1.43 percent, to 43,058.30. South Africa's Top 40 USD Net TRI Index edged down 1.79 points, or 0.02 percent, to 7,414.54.

Mainland China's SSE Composite Index ended lower, falling 12.67 points, or 0.31 percent, to close at 4,126.09, while Israel's TA-125 was among the day's strongest performers, rallying 50.60 points, or 1.29 percent, to 3,963.99.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Tuesday 13 January 2026 | Dow Jones dives 398 points as Trump continues attacks on Powell | Big News Network

Monday 12 January 2026 | Wall Street edges higher despite Trump howler on Powell | Big News Network .com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionPowell calls indictment threat a pretext to control interest rates

WASHINGTON, D.C.: President Donald Trump has sharply intensified his standoff with the Federal Reserve, with the Justice Department...

Northern Finland freezes, all flights cancelled, tourists stranded

HELSINKI, Finland: The severe cold forced cancelations of flights at Kittilä airport, leaving thousands of tourists in northern Finland...

Can’t give Peace Prize to Trump, Nobel Institute tells Machado

WASHINGTON, D.C.: The Norwegian Nobel Institute has dashed any hope that Venezuelan opposition leader María Corina Machado would give...

Outings to Italy’s Mount Etna restricted as volcanic eruptions begin

MOUNT ETNA, Italy: Guides in Sicily's Mount Etna are upset with the local authorities over tougher restrictions imposed by them after...

Four-runway Bishoftu project aims to become Africa’s largest hub

BISHOFTU, Ethiopia: Ethiopia has kicked off construction of a vast new airport near its capital, a project officials say will transform...

Breather for Trump as US top court delays tariffs ruling to January 14

WASHINGTON, D.C.: President Donald Trump's decision on global tariffs received an unexpected breather when the U.S. Supreme Court postponed...

Wisconsin

SectionGM joins Ford in pulling back from EVs after tax credit exit

DETROIT, Michigan: General Motors is rolling back part of its electric-vehicle push, booking a US$6 billion writedown as weaker demand...

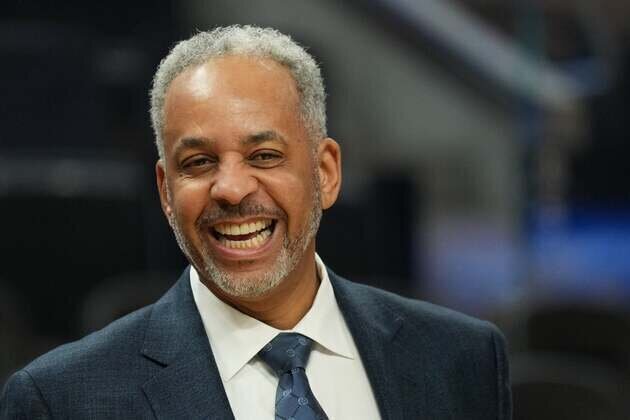

Report: Hornets retiring Dell Curry's No. 30 jersey

(Photo credit: Darren Yamashita-Imagn Images) The Charlotte Hornets will retire former NBA Sixth Man of the Year Dell Curry's No....

John Blackwell's buzzer-beater lifts Wisconsin over Minnesota

(Photo credit: Matt Krohn-Imagn Images) John Blackwell pulled up and drilled a 25-footer as time ran out, lifting Wisconsin to a...

NBA roundup: Thunder finally get past Spurs on 4th try

(Photo credit: Alonzo Adams-Imagn Images) Shai Gilgeous-Alexander scored 15 of his 34 points in the third quarter to help Oklahoma...

Warriors overcome Stephen Curry's poor shooting, blast Blazers

(Photo credit: David Gonzales-Imagn Images) De'Anthony Melton led a balanced attack with a season-high 23 points, Stephen Curry had...

No. 4 Michigan hopes for bounce-back effort at Washington

(Photo credit: Brian Bradshaw Sevald-Imagn Images) Michigan's dominating season includes 10 wins by 25 or more points, but now there...