U.S. stocks stage welcome rebound, doilar also gains ground

Lola Evans

16 Jan 2026, 02:37 GMT+10

- The Dow Jones Industrial Average outperformed Thursday, surging 292.63 points, or 0.60 percent, to 49,442.26.

- The NASDAQ Composite advanced 58.27 points, or 0.25 percent, closing at 23,530.02.

- The Standard and Poor's 500 advanced 17.89 points, or 0.26 percent, to finish at 6,944.49.

NEW YORK, New York - U.S. stocks bounced back Thursday with all the major indices finishing in positive territory. The rally followed a two-day losing streak that saw substantial losses across the major indices. Not everyone however saw Thursday's gains as a turning point.

"For all the prevailing optimism, not all is healthy beneath the surface, suggesting caution before chasing a further market melt-up," UBS strategist Michel Lerner said in a note to clients Thursday.

He set out 4 reasons why investors and traders should be cautious:

- "There is a wide gap between Wall Street exuberance and Main Street caution;"

- "U.S. Valuations look rich and the marginal buyer is becoming less obvious;"

- "The U.S. market is becoming a geared bet on AI, with uncertain payoffs;"

- "Financial leverage to fund AI projects increases company-specific ands ystemic risks."

The Dow Jones Industrial Average outperformed Thursday, surging 292.63 points, or 0.60 percent, to 49,442.26.

-

The benchmark S&P 500 advanced 17.89 points, or 0.26 percent, to finish at 6,944.49.

-

The NASDAQ Composite advanced 58.27 points, or 0.25 percent, closing at 23,530.02.

U.S. Dollar Strengthens Against Major Peers in Thursday Trading

The U.S. dollar posted broad gains in foreign exchange markets on Thursday, firming against several European and commodity-linked currencies amid shifting risk sentiment and interest rate expectations.

The greenback saw strength against most majors. The euro fell, with EUR/USD declining 0.34 percent to last trade at 1.1603. The British pound experienced a steeper drop, as GBP/USD slid 0.48 percent to 1.3374.

The dollar also advanced against the Japanese yen, with USD/JPY rising 0.11 percent to 158.60. The greenback gained ground against the Canadian dollar, as USD/CAD moved up 0.14 percent to 1.3897. The most pronounced gain was against the Swiss franc, where USD/CHF jumped 0.50 percent to 0.8036.

Performance was mixed among the commodity-focused Antipodean currencies. The Australian dollar managed a modest gain against the weakening greenback, with AUD/USD rising 0.24 percent to 0.6697. Conversely, the New Zealand dollar softened, as NZD/USD dipped 0.12 percent to 0.5737.

Analysts noted the dollar's strength was driven by its continued role as a safe-haven asset, coupled with market reassessments of the comparative monetary policy trajectories between the Federal Reserve and other major central banks. The euro's decline was particularly watched, reflecting ongoing economic concerns within the Eurozone.

Global Stock Markets Post Mixed Finish Thursday; European Indices Lead Gains

Stock markets around the world delivered a mixed performance on Thursday, with Canadian, UK and European bourses largely advancing while several major Asian indices closed in negative territory.

Canada's main benchmarkwas among the gainers. The S&P/TSX Composite index rose 112.45 points, or 0.34 percent, to end the session at 33,028.92.

In the United Kingdom, the benchmark FTSE 100 in London led the gains, closing at 10,238.94, a rise of 54.59 points or 0.54 percent.

In Germany the DAX added 66.15 points to finish at 25,352.39, up 0.26 percent.

The pan-European EURO STOXX 50 performed strongly, gaining 36.09 points, or 0.60 percent, to settle at 6,041.14.

France's CAC 40 was a notable decliner in the region, slipping 17.84 points, or 0.21 percent, to 8,313.12. Conversely, Belgium's BEL 20 outperformed, jumping 47.69 points, or 0.90 percent, to 5,350.06.

The broader Euronext 100 Index closed at 1,789.92, up 0.52 percent.

Asian markets presented a more subdued picture. Hong Kong's Hang Seng Index fell 76.19 points, or 0.28 percent, to 26,923.62. In India the S&P BSE Sensex retreated 0.29 percent to 83,382.71, and Taiwan's TWSE Index declined 0.42 percent.

In Japan the Nikkei 225 dropped 230.73 points, or 0.42 percent, closing at 54,110.50.

However, gains were seen elsewhere in the Asia-Pacific. Australia's S&P/ASX 200 rose 0.47 percent to 8,861.70, and South Korea's KOSPI surged 74.45 points, or 1.58 percent, to 4,797.55.

In Singapore the STI gained 0.43 percent, and Indonesia's IDX Composite added 0.47 percent.

In the Middle Easts, Israel's TA-125 climbed 0.63 percent, and Egypt's EGX 30 rose 0.67 percent.

In Africa, South Africa's Top 40 USD Index edged up 0.28 percent.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Wednesday 14 January 2026 | Tech stocks tumble Wednesday, Nasdaq drops 238 points | Big News Network.com

Tuesday 13 January 2026 | Dow Jones dives 398 points as Trump continues attacks on Powell | Big News Network

Monday 12 January 2026 | Wall Street edges higher despite Trump howler on Powell | Big News Network .com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionGrok under lens in UK for explicit deepfake images of women, children

LONDON, U.K.: Elon Musk's X is now under scrutiny in the United Kingdom, with the media regulator, the Office of Communications (Ofcom),...

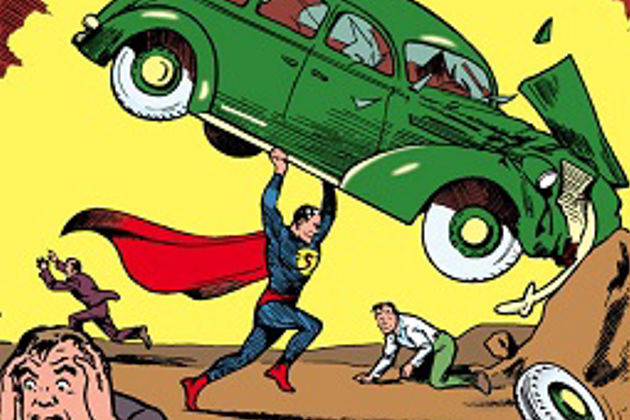

Rare copy of Superman comic book fetches $15 million at auction

NEW YORK CITY, New York: A rare copy of the first Superman comic book, which was also once stolen from the home of actor Nicolas Cage,...

Powell calls indictment threat a pretext to control interest rates

WASHINGTON, D.C.: President Donald Trump has sharply intensified his standoff with the Federal Reserve, with the Justice Department...

Northern Finland freezes, all flights cancelled, tourists stranded

HELSINKI, Finland: The severe cold forced cancelations of flights at Kittilä airport, leaving thousands of tourists in northern Finland...

Can’t give Peace Prize to Trump, Nobel Institute tells Machado

WASHINGTON, D.C.: The Norwegian Nobel Institute has dashed any hope that Venezuelan opposition leader María Corina Machado would give...

Outings to Italy’s Mount Etna restricted as volcanic eruptions begin

MOUNT ETNA, Italy: Guides in Sicily's Mount Etna are upset with the local authorities over tougher restrictions imposed by them after...

Wisconsin

SectionGM joins Ford in pulling back from EVs after tax credit exit

DETROIT, Michigan: General Motors is rolling back part of its electric-vehicle push, booking a US$6 billion writedown as weaker demand...

Rockies sign veteran RHP Michael Lorenzen

(Photo credit: Jay Biggerstaff-Imagn Images) The Colorado Rockies signed well-traveled right-hander Michael Lorenzen to a one-year...

Report: Mike McCarthy to meet with Titans on Saturday

(Photo credit: Kevin Jairaj-Imagn Images) Mike McCarthy will interview for the Titans' head coaching job on Saturday in Tennessee,...

Packers DC Jeff Hafley interviews for Falcons' HC position

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Jeff Hafley interviewed for the vacant...

Top 25 roundup: Texas ends No. 10 Vanderbilt's perfect start

(Photo credit: Dustin Safranek-Imagn Images) Matas Vokietaitis scored 22 points on 7-of-9 shooting from the floor and Texas' defense...

No. 4 Michigan rebounds from 1st loss, tops Washington

(Photo credit: Steven Bisig-Imagn Images) Aday Mara scored 20 points on 10-of-11 shooting to lead No. 4 Michigan to an 82-72 victory...