U.S. stock markets retreat ahead of weekend

Big News Network.com

17 Jan 2026, 02:47 GMT+10

- The Dow Jones finished in negative territory, slipping 83.11 points, or 0.17 percent, to close at 49,359.33.

- The NASDAQ Composite edged lower by 14.63 points, or 0.06 percent, closing at 23,515.39.

- The Standard and Poor's 500 ended the session at 6,940.01, down 4.46 points, or 0.06 percent.

NEW YORK, New York - U.S. stocks were unwanted Friday as President Donald Trump poured cold water on the potential appointment of National Economic Council Director Kevin Hassett to the Federal Reserve chair role. "I actually want to keep you where you are, if you want to know the truth," Trump said Friday.

Markets have been unnerved by Trump's objective of controlling the Fed and driving interest rates down. "Whether it's Hassett or someone else, I think the assumption that we, at least most of us, have is that whoever it's going to be, this person is going to certainly have a political motive and not the more traditional, trying-to-be-fully-objective mindset in regards to leading the Fed," David Krakauer, vice president of portfolio management at Mercer Advisors told CBC Friday. "That threat to the independence of the Fed is certainly, you know, a concern for us and everyone," he said.

On Wall Street Friday, U.S. equities closed slightly lower. The Standard and Poor's 500 ended the session at 6,940.01, down 4.46 points, or 0.06 percent. The benchmark index traded between an intraday low of 6,925.09 and a high of 6,967.30, with trading volume reaching nearly 3.97 billion shares.

The Dow Jones Industrial Average also finished in negative territory, slipping 83.11 points, or 0.17 percent, to close at 49,359.33. The index touched a session low of 49,246.24 and a high of 49,616.70, with turnover of just under one billion shares.

The NASDAQ Composite edged lower by 14.63 points, or 0.06 percent, closing at 23,515.39, as technology stocks posted a mixed performance.

In North America outside the U.S., Canada's S&P/TSX Composite Index edged up 11.63 points, or 0.04 percent, to finish at 33,040.55.

London's FTSE 100 closed at 10,235.29, down 3.65 points, or 0.04 percent.

In Europe, markets broadly declined. Germany's DAX fell 55.26 points, or 0.22 percent, to end the day at 25,297.13, while France's CAC 40 recorded steeper losses, dropping 54.18 points, or 0.65 percent, to 8,258.94.

The broader EURO STOXX 50 index slipped 11.69 points, or 0.19 percent, to close at 6,029.45, while the Euronext 100 Index declined 2.67 points, or 0.15 percent, to 1,787.25. Belgium's BEL 20 was a notable European outperformer, rising 7.08 points, or 0.13 percent, to finish at 5,357.14.

Asian markets delivered a more positive close. In Hong Kong, the Hang Seng Index fell 78.66 points, or 0.29 percent, to 26,844.96. Singapore's STI Index moved higher, gaining 15.76 points, or 0.33 percent, to close at 4,849.10.

Australian equities posted solid gains, with the S&P/ASX 200 rising 42.20 points, or 0.48 percent, to 8,903.90, while the broader All Ordinaries index advanced 42.50 points, or 0.46 percent, to 9,226.70.

In South Asia, India's S&P BSE Sensex climbed 187.64 points, or 0.23 percent, ending the session at 83,570.35. Indonesia's IDX Composite also finished higher, gaining 42.82 points, or 0.47 percent, to 9,075.41, while Malaysia's FTSE Bursa Malaysia KLCI slipped 2.42 points, or 0.14 percent, to close at 1,712.74.

New Zealand shares moved higher, with the S&P/NZX 50 Index Gross rising 58.31 points, or 0.43 percent, to 13,718.10. South Korea's KOSPI Composite Index recorded one of the strongest performances in the region, surging 43.19 points, or 0.90 percent, to 4,840.74.

Taiwan's TWSE Capitalization Weighted Stock Index led regional gains, jumping 598.12 points, or 1.94 percent, to close at 31,408.70.

Other notable markets ended lower. Japan's Nikkei 225 declined 174.33 points, or 0.32 percent, to close at 53,936.17. China's SSE Composite Index slipped 10.69 points, or 0.26 percent, to 4,101.91. In Africa, South Africa's Top 40 USD Net TRI Index dropped sharply, falling 88.42 points, or 1.19 percent, to end the day at 7,347.20.

Overall, global markets wrapped up Friday's session with cautious sentiment, as investors balanced regional economic developments with expectations for upcoming data releases and central bank policy signals in the week ahead.

World Currencies Mixed as U.S. Dollar Strength Persists into Friday

Major currencies traded mixed against the U.S. dollar on Friday as investors weighed global economic signals and remained cautious ahead of upcoming data releases and central bank guidance.

The euro weakened slightly, with the single currency trading at 1.1600 against the US dollar, down 0.07 percent on the day. The modest decline reflected continued uncertainty around the eurozone economic outlook and the relative resilience of the greenback.

In Asian trading, the U.S. dollar strengthened against the Japanese yen, rising to 158.075, a decrease of 0.35 percent for the yen. Currency markets continued to monitor Japan's monetary policy stance, with the yen remaining under pressure amid a wide interest rate differential with the United States.

The Canadian dollar softened, pushing the U.S. dollar up to 1.3914 against its Canadian counterpart, a gain of 0.21 percent. Moves in the loonie tracked broader trends in the U.S. dollar, alongside ongoing volatility in global commodity markets.

Sterling edged higher, with the British pound trading at 1.3380 against the dollar, up 0.04 percent. The modest gain came as traders balanced domestic economic indicators with expectations for future policy decisions by the Bank of England.

The greenback also posted a slight advance against the Swiss franc, trading at 0.8030, up 0.02 percent. The move reflected steady demand for the US currency despite ongoing geopolitical and economic uncertainties.

In the Asia-Pacific region, the Australian dollar fell to 0.6684 against the U.S. dollar, down 0.21 percent, while the New Zealand dollar bucked the regional trend, rising 0.21 percent to trade at 0.5754.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Thursday 15 January 2025 | Dow Jones jumps 293 points as U.S. stock markets rebound | Big News Network.com

Wednesday 14 January 2026 | Tech stocks tumble Wednesday, Nasdaq drops 238 points | Big News Network.com

Tuesday 13 January 2026 | Dow Jones dives 398 points as Trump continues attacks on Powell | Big News Network

Monday 12 January 2026 | Wall Street edges higher despite Trump howler on Powell | Big News Network .com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionBBC will move to dismiss Trump’s $10 billion lawsuit dismissed

LONDON, U.K. The BBC plans to seek dismissal of U.S. President Donald Trump's US$10 billion lawsuit, which has accused the broadcaster...

Epstein probe: Clintons won’t comply with congressional subpoena

WASHINGTON, D.C.: Even as Republican lawmakers prepare contempt of Congress proceedings against them, Bill and Hillary Clinton said...

Saks Global seeks Chapter 11 protection with $1.75 billion financing

NEW YORK CITY, New York: After years of expansion fueled by debt and rising pressure from cautious luxury shoppers, Saks Global has...

US State Department revoked over 100,000 visas since Trump’s return

WASHINGTON, D.C.: The U.S. State Department has revoked more than 100,000 visas since President Donald Trump took office last year,...

Grok under lens in UK for explicit deepfake images of women, children

LONDON, U.K.: Elon Musk's X is now under scrutiny in the United Kingdom, with the media regulator, the Office of Communications (Ofcom),...

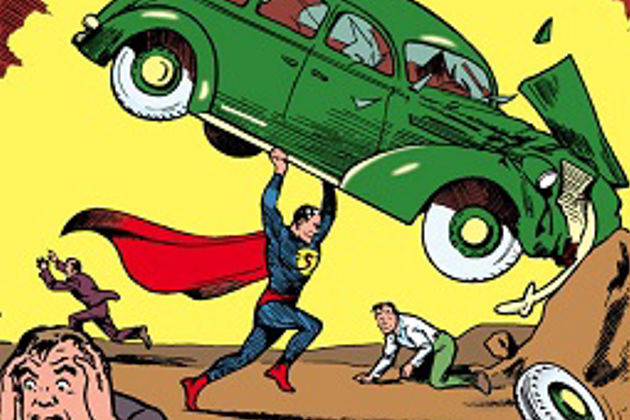

Rare copy of Superman comic book fetches $15 million at auction

NEW YORK CITY, New York: A rare copy of the first Superman comic book, which was also once stolen from the home of actor Nicolas Cage,...

Wisconsin

SectionSaks Global seeks Chapter 11 protection with $1.75 billion financing

NEW YORK CITY, New York: After years of expansion fueled by debt and rising pressure from cautious luxury shoppers, Saks Global has...

US State Department revoked over 100,000 visas since Trump’s return

WASHINGTON, D.C.: The U.S. State Department has revoked more than 100,000 visas since President Donald Trump took office last year,...

GM joins Ford in pulling back from EVs after tax credit exit

DETROIT, Michigan: General Motors is rolling back part of its electric-vehicle push, booking a US$6 billion writedown as weaker demand...

Reports: Twins sign C Victor Caratini to 2-year, $14M deal

(Photo credit: Brett Davis-Imagn Images) Victor Caratini agreed to a two-year, $14 million contract with the Twins on Friday, according...

Wisconsin showing toughness on Big Ten win streak; Rutgers up next

(Photo credit: Matt Krohn-Imagn Images) While his play and his team's form lately might imply otherwise, Wisconsin guard John Blackwell...

Falcons interview Antonio Pierce for coaching vacancy

(Photo credit: Stephen R. Sylvanie-Imagn Images) Former Las Vegas Raiders coach Antonio Pierce on Friday became the ninth candidate...