Trading volume will hold steady despite higher STT imposed in Budget 2026: ICRA

ANI

02 Feb 2026, 15:31 GMT+10

New Delhi [India], February 2 (ANI): With the announcement of hike in the Securities Transaction Tax (STT) on futures and options (F&O) trades in the Union Budget 2026, credit rating agency ICRA projected a 16% spike in the STT collections for the Financial Year 2027, above the revised FY2026 estimate.

In ICRA's view, these budgeted numbers assume that trading volumes will hold steady despite the higher transaction costs.

'Nonetheless, some moderation in derivatives activity remains a risk, which could translate into lower trading turnover and consequently softer brokerage volumes and revenues from the derivatives segment for the securities broking industry,' ICRA said.

The proposed increase in STT on F&O trades, following the earlier hike implemented in October 2024, reflects the continued policy intent to temper excessive speculative activity, the report said.

Prior to this proposed change, robust growth in derivatives market participation and the 60% STT hike in H2 FY2025 had led to expectations that STT collections would rise to Rs 780 billion in FY2026 from Rs 522 billion in FY2025, ICRA highlighted.

However, measures aimed at curbing hyperactive trading dampened market volumes, resulting in an 18% downward revision in FY2026 STT collections from the budgeted estimate of Rs 780 billion.

As announced by the Union Finance Minister Nirmala Sitharaman in Budget 2026, the rate of STT on the sale of an option in securities has been increased from 0.1 per cent to 0.15 per cent, the sale of an option in securities where the option is exercised has been increased from 0.125 per cent to 0.15 per cent while the rate of STT on the sale of a future in securities has been increased from 0.02 per cent to 0.05 per cent.

The revised rates shall take effect from the 1st day of April, 2026 and shall apply to derivatives transactions in securities entered into on or after that date.

Issuing FAQs on the rate hike, the Income Tax Department on Sunday said the total volume of transaction in options and futures is more than 500 times of Indian Gross Domestic Product (GDP) and there was a justification to curb speculation.

In Rupee terms, our GDP is 300 lakh crore rupees, while the volume for options and futures is more than 1.5 lakh lakh crore rupees. Therefore, there is justification for increase in rates to curb purely speculative activity in options and futures, it said. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionWHO downplays cross-border risk after India Nipah cases

HYDERABAD, India: The World Health Organization (WHO) said on January 30 it sees a low risk of the Nipah virus spreading beyond India,...

Economic conditions the main concern of Iranian protesters

In early January, several currency trackers briefly displayed the Iranian rial's value as $0.00, unable to process the speed and scale...

Alcaraz in historic win over Dkokovic in Melbourne

MELBOURNE, Australia (Xinhua) -- Top seed Carlos Alcaraz won his first Australian Open title on Sunday to complete his set of major...

Canada could now face 50% tariff on aircraft sold in US

WASHINGTON, D.C.: The threat to impose a 50 percent tariff on any Canadian aircraft sold in the United States is the latest salvo in...

New Zealand teenager blitzes field to win mile in 3:48.88 minutes

BOSTON, Massachusetts - A New Zealand kid has shocked the athletics world with a stunning sub-4 minute mile run, and he says he has...

Air crash claims life of prominent Indian politician Ajit Pawar

MUMBAI, India: Ajit Pawar, the deputy chief minister of Maharashtra, India's wealthiest state, who was killed in a charter aircraft...

Wisconsin

SectionImmigration crackdown could play role in midterms, Republicans feel

WASHINGTON, D.C.: With midterm elections looming, many Republicans fear that immigration enforcement by the Trump administration, which...

Amazon exits Go and Fresh stores to focus on delivery, Whole Foods

NEW YORK CITY, New York: Amazon is reshaping its brick-and-mortar grocery strategy, announcing it will shut down all Amazon Go and...

Family says Minneapolis nurse killed by Border Patrol was ‘nonviolent’

MINNEAPOLIS, Minnesota: Conflicting accounts have emerged over the deadly shooting of intensive care nurse Alex Pretti by Border Patrol...

AI use surges at US workplaces, Gallup poll finds

WASHINGTON, D.C.: American workers are incorporating artificial intelligence into their jobs at a rapidly accelerating pace, with a...

Torrid Clippers take on suddenly surging Sixers

(Photo credit: Mark J. Rebilas-Imagn Images) After another top defensive performance, the Los Angeles Clippers return home Monday...

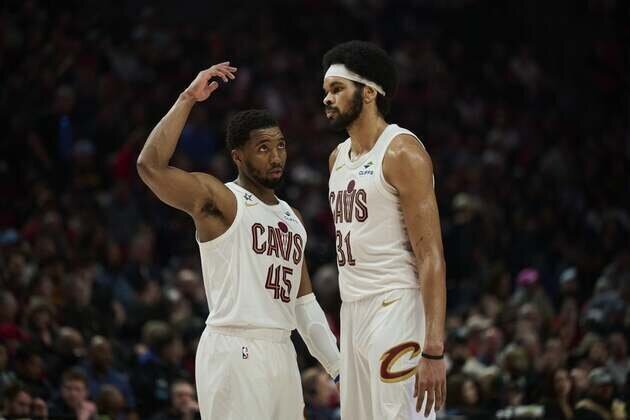

NBA roundup: Jarrett Allen's career night carries Cavs past Blazers

(Photo credit: Troy Wayrynen-Imagn Images) Jarrett Allen scored a career-best 40 points, collected a season-high 17 rebounds and...