Inflation needs monitoring in FY27 as new CPI series kicks in: SBI Research

ANI

07 Feb 2026, 08:28 GMT+10

New Delhi [India], February 7 (ANI): The trajectory of inflation needs to be monitored before taking a monetary policy call by the Reserve Bank in 2026-27, with the Consumer Price Index (CPI) series set to come into effect soon, said SBI Research in a report.

The new CPI series with base year 2024 will be released on February 12, 2026, as per the government.

The Ministry of Statistics and Programme Implementation is revising the base year of key macroeconomic indicators. Indicators such as CPI, GDP, and IIP play a vital role in policymaking in RBI.

On Friday, the Monetary Policy Committee of the RBI unanimously decided to keep repo rate unchanged at 5.25 per cent. The MPC also maintained its neutral stance.

Taking into account factors like GST rationalisation, healthy rabi prospects, benign inflation environment, the GDP growth outlook has been revised to 6.9 per cent in Q1 2026-27 and 7 per cent in Q2 2026-27.

Retail or CPI-based inflation for 2025-26 is projected at 2.1 per cent with Q4 CPI at 3.2 per cent. The slight upward revision in the 2025-26 projection is due to an increase in prices of precious metals.

The rupee also rose significantly following yesterday's policy announcements.

'This was again unexpected. It may be again a better option for RBI to recoup dollars when the rupee has appreciated below 90,' SBI Research suggested.

The RBI often intervenes by managing liquidity, including selling dollars, to prevent a steep depreciation of the rupee. The RBI strategically buys dollars when the rupee is strong and ideally sells when it weakens.

On the regulatory front, the RBI yesterday focused on reforming current practices on cross-selling, loan recovery methods using agents, and a framework for compensation in cases of small-value fraudulent transactions.

A Discussion Paper to curb fraud in digital payments will explore the implementation of calibrated safeguards, such as lagged credits.

According to SBI Research, the number of banking frauds has increased from 13,494 in 2022-23 to 23,879 in 2024-25.

RBI has permitted lending to REITs in line with InvITs. Banks can now lend to the projects in the operational phase through REITs or can take equity.

'This provision is positive development and furthers Budget announcement for monetizing CPSE assets through REIT structure and flow of fund to the sector,' SBI Research report asserted.

In another major announcement, the RBI has decided to enhance the limit of collateral-free loans to MSEs from Rs 10 lakh to Rs 20 lakh. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

Section10 years jail to Bangladesh’s ex-PM Hasina, UK lawmaker niece

DHAKA, Bangladesh: Bangladesh's former Prime Minister Sheikh Hasina and her niece, Tulip Siddiq, a British lawmaker, were sentenced...

Clintons agree to testify in House Epstein probe

WASHINGTON, D.C.: Bowing to the threat of a contempt of Congress vote against them, former President Bill Clinton and former Secretary...

From sold-out handbags to ballots: Takaichi’s youth surge

TOKYO, Japan: Japan's general election has taken an unexpected turn, with social media buzz, sold-out fashion accessories, and snack...

Israel Economic Forum convenes in secret in Riyadh

RIYADH, Saudi Arabia – Approximately 200 prominent Jewish business leaders and influential figures are gathering in Riyadh this week...

China plays discordant note over Grammy award to Dalai Lama

BEIJING/NEW DELHI: Beijing has expressed its dissatisfaction with the Grammy Award to the Dalai Lama for the audiobook Meditations:...

Norway’s royal family faces fresh scandal as princess’s son arrested

OSLO, Norway: In a week of embarrassments to the royal family, the eldest son of Norway's crown princess was arrested over new allegations...

Wisconsin

SectionJournalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

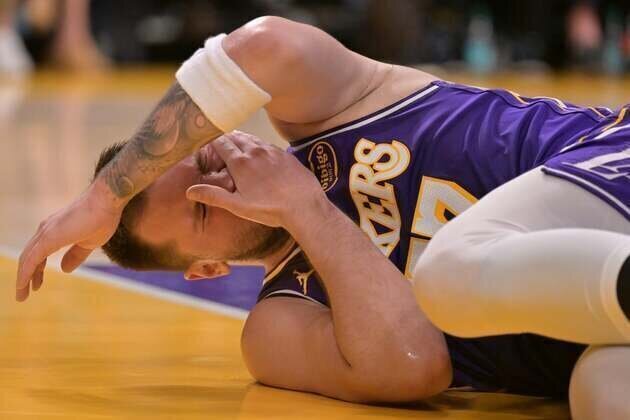

Without Luka Donic, Lakers welcome Steph Curry-less Warriors

(Photo credit: Jayne Kamin-Oncea-Imagn Images) While struggling to get their top players all on the court at the same time, the Los...

Magic set sights on another convincing win vs. Jazz

(Photo credit: Mike Watters-Imagn Images) The Orlando Magic took a step forward in their first of four consecutive home games against...

Top scorers collide when Wisconsin pays visit to Indiana

(Photo credit: Matthew O'Haren-Imagn Images) Nick Boyd's production is helping Wisconsin position itself nicely in the Big Ten standings...

Matthew Stafford's MVP, return announcement highlights NFL Honors

(Photo credit: Steven Bisig-Imagn Images) Matthew Stafford played it coy minutes before the NFL Honors event kicked off Thursday...

Christoph Tilly's bounce-back effort powers Ohio State past Maryland

(Photo credit: Tommy Gilligan-Imagn Images) Christoph Tilly, rebounding from going scoreless in his previous game, put up 19 points...