India-US trade agreement along with other FTAs positive for Indian economy: SBI Chairman

ANI

07 Feb 2026, 18:31 GMT+10

Mumbai (Maharashtra) [India], February 7 (ANI): State Bank of India (SBI) Chairman CS Setty on Saturday said the India-US trade agreement, along with the other recently concluded Free Trade Agreements (FTAs) are extremely positive for the Indian economy.

While responding to a question by ANI on the India-US trade deal at a press conference, Setty said, 'It's not only the India-US deal, but also other trade deals, whether it is with the EU or the FTA with the UK in the past, all these are extremely positive for the Indian economy.'

'One big positive development is that there's no overhang of tariffs,' he said, adding that the agreement opens up significant opportunities for both corporates and micro, small and medium enterprises (MSMEs) to integrate with global supply chains.

Further, on the Reserve Bank of India's (RBI) decision to keep the repo rate unchanged, Setty said, it was largely on expected lines, adding that the central bank's stance on liquidity management has boosted confidence in the banking system.

'On the repo rate, I think it was broadly on the expected lines. Obviously, the pause was widely anticipated, and we are happy with that,' Setty said.

Commenting on liquidity conditions, he noted that system liquidity is currently adequate and in surplus. He added that the RBI Governor's assurance of a pre-emptive approach to liquidity management would ensure smooth credit flow. 'That gives us great confidence that liquidity will not be constrained for any credit growth going forward,' he said.

State Bank of India reported strong performance across key financial and operational parameters, with total business exceeding Rs 103 trillion in the third quarter of Financial Year 2026.

The country's largest lender said deposits and advances stood at over Rs 257 trillion and Rs 46 trillion, respectively, while its SME portfolio crossed Rs 6 trillion, reflecting robust credit growth across segments.

SBI posted its highest-ever quarterly net profit of Rs 21,028 crore in Q3FY26, registering a year-on-year growth of 24.49 per cent. Operating profit for the quarter surged 39.54 per cent YoY to Rs 32,862 crore.

For the nine months ended FY26, the bank's return on assets (ROA) and return on equity (ROE) stood at 1.16 per cent and 20.68 per cent, respectively. Net Interest Income (NII) for Q3FY26 rose 9.04 per cent YoY.

Whole Bank and domestic net interest margins (NIM) for 9MFY26 were at 2.95 per cent and 3.08 per cent, respectively, while Q3FY26 NIM stood at 2.99 per cent for the whole bank and 3.12 per cent domestically.

Whole Bank advances grew 15.14 per cent YoY, led by domestic advances growth of 15.44 per cent. Advances from foreign offices rose 13.41 per cent YoY.

Retail advances increased 16.51 per cent YoY, with double-digit growth across all segments. SME advances grew by a sharp 21.02 per cent YoY, followed by agriculture advances at 16.56 per cent and retail personal advances at 14.95 per cent. Corporate advances recorded a YoY growth of 13.37 per cent.

On the liabilities side, Whole Bank deposits grew 9.02 per cent YoY. CASA deposits rose 8.88 per cent YoY, with the CASA ratio standing at 39.13 per cent as of December 31, 2025. Retail term deposits grew 14.54 per cent YoY.

Asset quality continued to improve, with the gross NPA ratio declining by 50 basis points YoY to 1.57 per cent. Net NPA ratio improved by 14 basis points to 0.39 per cent.

The provision coverage ratio (PCR) increased by 88 basis points YoY to 75.54 per cent, while PCR including AUCA stood at 92.37 per cent, up 63 basis points YoY.

Slippage ratio for 9MFY26 improved by 5 basis points YoY to 0.54 per cent, while Q3FY26 slippages stood at 0.40 per cent. Credit cost for the quarter was contained at 0.29 per cent.

The bank's capital adequacy ratio (CAR) stood at 14.04 per cent at the end of Q3FY26.

SBI also highlighted continued traction in digital adoption. More than 68 per cent of savings bank accounts were opened digitally through YONO during Q3FY26. The share of alternate channels in total transactions increased to 98.6 per cent in 9MFY26 from 98.1 per cent in the corresponding period last year. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionUK seeks answers after Air India Dreamliner fuel switch concern

NEW DELHI, India: British aviation regulators are seeking answers from Air India after a Boeing 787 Dreamliner departed London despite...

Mexicans get jitters as Trump flexes muscles across Americas

FBI Director Kash Patel's announcement on January 23 regarding the arrest of Canadian drug trafficker Ryan Wedding in Mexico led to...

10 years jail to Bangladesh’s ex-PM Hasina, UK lawmaker niece

DHAKA, Bangladesh: Bangladesh's former Prime Minister Sheikh Hasina and her niece, Tulip Siddiq, a British lawmaker, were sentenced...

Clintons agree to testify in House Epstein probe

WASHINGTON, D.C.: Bowing to the threat of a contempt of Congress vote against them, former President Bill Clinton and former Secretary...

From sold-out handbags to ballots: Takaichi’s youth surge

TOKYO, Japan: Japan's general election has taken an unexpected turn, with social media buzz, sold-out fashion accessories, and snack...

Israel Economic Forum convenes in secret in Riyadh

RIYADH, Saudi Arabia – Approximately 200 prominent Jewish business leaders and influential figures are gathering in Riyadh this week...

Wisconsin

SectionJournalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

Ohio State eager to derail No. 2 Michigan's historic run

(Photo credit: Rick Osentoski-Imagn Images) No. 2 Michigan will look to continue its historic winning ways by completing a season...

NBA roundup: Stunning comeback lifts Celtics over Heat

(Photo credit: Bob DeChiara-Imagn Images) Jaylen Brown scored 29 points and Payton Pritchard finished with 24 as the Boston Celtics...

Bucks build big lead, then hang on to top Pacers

(Photo credit: Benny Sieu-Imagn Images) Kevin Porter Jr. scored 23 points and dished eight assists to lead the Milwaukee Bucks to...

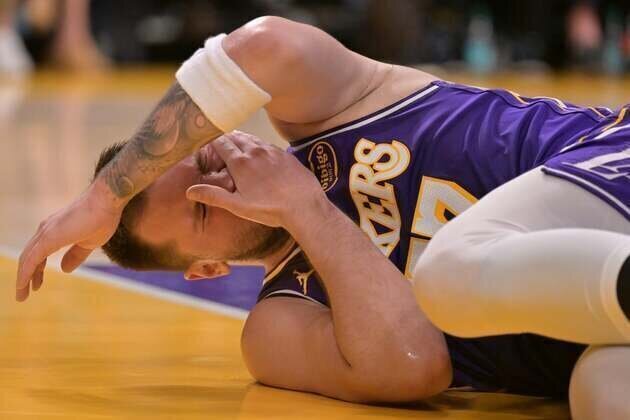

Without Luka Donic, Lakers welcome Steph Curry-less Warriors

(Photo credit: Jayne Kamin-Oncea-Imagn Images) While struggling to get their top players all on the court at the same time, the Los...

Magic set sights on another convincing win vs. Jazz

(Photo credit: Mike Watters-Imagn Images) The Orlando Magic took a step forward in their first of four consecutive home games against...