Big day again for Nasdaq Composite, gains 207 points

Lola Evans

10 Feb 2026, 02:40 GMT+10

- The Standard and Poor's 500 finished 32.51 points, or 0.47 percent higher, to end the session at 6,964.81.

- The Dow Jones Industrial Average underperformed its peers, inching up a modest 20.20 points, a rise of just 0.04 percent.

- The technology-heavy NASDAQ Composite was the clear leader among U.S. benchmarks, surging 207.46 points.

NEW YORK, New York - Technology stocks extended Friday's gains on Monday, pushed higher by shares in AI companies such as Nvidia and Broadcom. The Dow Jones hit a fresh record high, albeit with a minor advance.

"Investors are saying, ‘Okay, we had a tremendous bounce back. Does that have staying power? Is this something that I could get sucked into and only end up getting trounced, or is this really another buying opportunity?'" asked Sam Stovall of CFRA Research on CNBC.

"We went from a 17 percent premium to an 8 percent discount," the chief investment strategist said about tech's forward price-to-earnings ratio compared with its average for the past five years. "You could say, ‘Well, gee, that's pretty good, and so maybe it's time not to bail out on technology just yet,'" Stovall added.

NASDAQ Leads U.S. Advance

The technology-heavy NASDAQ Composite was the clear leader among U.S. benchmarks Monday, surging 207.46 points, or 0.90 percent, to close at 23,238.67.

The broader Standard and Poor's 500 also finished solidly in positive territory, gaining 32.51 points, an increase of 0.47 percent, to end the session at 6,964.81.

The Dow Jones Industrial Average underperformed its peers, inching up a modest 20.20 points, a rise of just 0.04 percent, to settle at 50,135.87, still another closing high. The narrow gain suggests a rotation away from some of the blue-chip industrial and financial names that dominate the 30-stock index.

Market Context

Monday's action reflects a continuing divergence between mega-cap technology stocks and other segments of the market. Investor sentiment appeared to favor growth-oriented sectors, providing a significant tailwind for the NASDAQ. The robust showing in Toronto highlights the ongoing sensitivity of the Canadian market to global resource demand.

Traders are now looking ahead to a busy week of corporate earnings and key economic data, including inflation reports, which may set the tone for the remainder of the month.

U.S. Dollar Weakens Sharply on Monday as Rate Cut Expectations Build

The U.S. dollar faced sustained selling pressure across the board on Monday, falling against most major peers as shifting interest rate expectations continued to drive foreign exchange markets.

Euro and Pound Climb

The European common currency was a notable gainer. The Euro (EUR/USD) strengthened by 0.87 percent to break above the 1.19 handle, trading at 1.1916. Similarly, the British Pound (GBP/USD) advanced 0.63 percent to 1.3695, capitalizing on the dollar's broad retreat.

Commodity Currencies Rally

The Australian and New Zealand dollars, often sensitive to global risk sentiment, posted strong gains. The Australian Dollar (AUD/USD) led the charge with a significant jump of 1.20 percent to 0.7094. The New Zealand Dollar (NZD/USD) followed suit, rising 0.74 percent to 0.6055.

Safe Havens Outperform

Traditional safe-haven currencies also found strength against the greenback. The U.S. Dollar (USD/CHF) fell 1.16 percent against the Swiss Franc to 0.7663. Meanwhile, the Japanese Yen (USD/JPY) appreciated, with the greenback dropping 0.87 percent to 155.81. The Canadian Dollar (USD/CAD) also strengthened, pushing the pair down 0.81 percent to 1.3559.

Global Markets Rally to Start the Week; Asia-Pacific Leads Gains

Major global equity indices closed firmly in positive territory on Monday, with Asia-Pacific markets posting particularly strong gains to lead a broad-based rally.

Canadian Market Jumps

Canada's main benchmark outperformed too. The S&P/TSX Composite Index rallied sharply, climbing 552.34 points, or 1.70 percent, to close at 33,023.32. The strong performance was fueled by robust gains in the index's heavyweight energy and materials sectors, which benefited from rising commodity prices during the trading session.

European Markets Edge Higher

In Europe, the region's benchmarks finished the day with steady advances. Germany's DAX was a standout performer, closing at 25,014.87, a gain of 293.41 points or 1.19 percent. The pan-European EURO STOXX 50 rose 60.61 points, or 1.01 percent, to finish at 6,059.01.

France's CAC 40 added 49.44 points (0.60 percent) Monday, to close at 8,323.28. Belgium's BEL 20 rose 1.07 percent to 5,576.62, and the broader Euronext 100 Index gained 0.88 percent to close at 1,803.63.

UK in Modest Advance

The UK's FTSE 100 saw a more modest increase, climbing 16.43 points, or 0.16 percent, to settle at 10,386.23.

Strong Advances Across Asia-Pacific

Asian markets were a primary driver of the day's optimism. Japan's Nikkei 225 surged by 2,110.26 points Monday, a jump of 3.89 percent, closing at 56,363.94. The surge followed Sunday's historic victory by Prime Minister Sanae Takaichi'sLiberal Democratic Party (LDP) in the national elections.

South Korea's KOSPI Composite Index recorded an even larger percentage gain, soaring 4.10 percent or 208.90 points to 5,298.04; technical reporting issues prevented the display of its daily range data.

In Australia the S&P/ASX 200 rallied 1.85 percent to 8,870.10, while the nation's broader All Ordinaries index gained 1.97 percent to finish at 9,131.10. New Zealand's S&P/NZX 50 was a notable exception, eking out a marginal gain of just 0.02 percent to close at 13,446.37.

Singapore's STI Index advanced 0.54 percent Monday to 4,960.83.

Taiwan's TWSE Index advanced 1.96 percent to 32,404.62, and in Hong Kong Monday, the Hang Seng Index rose 1.76 percent to 27,027.16.

Other notable gains in the region included Indonesia's IDX Composite, up 1.22 percent to 8,031.87, and Malaysia's FTSE Bursa Malaysia KLCI, which closed 1.07 percent higher at 1,751.30.

In India theS&P BSE Sensex added 0.58 percent to close at 84,065.75.

Middle East Markets

In the Middle East, Israel's TA-125 index climbed 1.59 percent to 4,092.75. Egypt's EGX 30 posted a gain of 0.52 percent, closing at 50,293.50.

Africa

In South Africa Monday, the JNOU JO Top 40 USD TRI Index rose 93.9 points or 1.25 percent to 7,518.24.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related story:

Friday 6 February 2026 | Dow Jones surges 1,207 points, closes at new all time high | Big News Network

(File photo).

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

Section31 killed, 169 injured in suicide bombing in Pakistan’s capital city

ISLAMABAD, Pakistan: Thirty-one people were killed and 169 others wounded in a suicide bombing attack on a Shiite mosque on the outskirts...

As Winter Olympics begin, Italian police get new arrest powers

ROME, Italy: A new law-and-order decree adopted this week by Prime Minister Giorgia Meloni's rightist government empowers the Italian...

Andrew leaves Royal Lodge after new Epstein emails released

LONDON, U.K.: After the release of the latest tranche of emails in the Jeffrey Epstein investigation by the U.S., the former Prince...

Chairman of US law firm Paul Weiss quits after Epstein emails

NEW YORK CITY, New York: The chairman of one of the country's most prestigious law firms has resigned after the release of emails revealing...

Trump’s history still way off mark, but he wants to build an arch

WASHINGTON, D.C.: Claiming that history is on his side, President Donald Trump says he wants to build a towering arch near the Lincoln...

Teen braves cold waters off West Australian coast to get help, save family

PERTH, Western Australia: A 13-year-old boy swam for four hours to get help off the coast of Western Australia in cold and choppy waters...

Wisconsin

SectionYum targets weak Pizza Hut stores, eyes strategic options

LOUISVILLE, Kentucky: As Yum Brands reassesses the future of one of its most recognisable chains, Pizza Hut is preparing to close 250...

Acaden Lewis, Villanova thriving ahead of Marquette matchup

(Photo credit: Brad Mills-Imagn Images) In his first season at Villanova, head coach Kevin Willard has been lucky to have another...

Irksome road losses inspire No. 8 Illinois, Wisconsin

(Photo credit: Ron Johnson-Imagn Images) No. 8 Illinois and Wisconsin both were reminded this past weekend how much it stings to...

Irksome road losses inspire No. 5 Illinois, Wisconsin

(Photo credit: Ron Johnson-Imagn Images) No. 5 Illinois and Wisconsin both were reminded this past weekend how much it stings to...

Reports: RHP Erick Fedde reuniting with White Sox

(Photo credit: Michael McLoone-Imagn Images) Right-hander Erick Fedde is rejoining the Chicago White Sox after agreeing to a one-year...

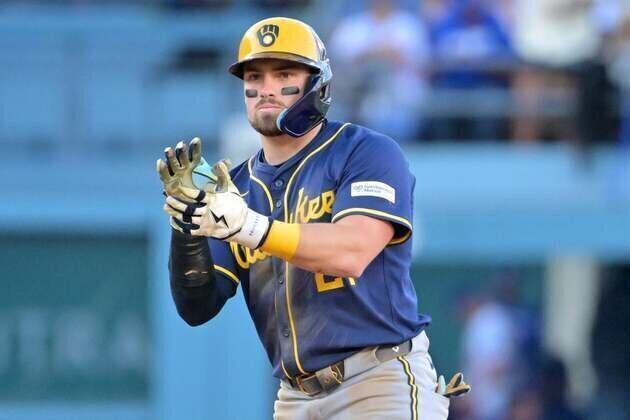

Red Sox acquire 3B Caleb Durbin from Brewers

(Photo credit: Jayne Kamin-Oncea-Imagn Images) The Boston Red Sox acquired third baseman Caleb Durbin and two other infielders from...