IPO surge tests Chinese banks under new SFC limits

Anabelle Colaco

14 Feb 2026, 09:17 GMT+10

- A surge in initial public offerings in Hong Kong is exposing staffing strains at Chinese investment banks, as regulators tighten oversight and cap the number of deals senior bankers can handle at once

- Last month, Hong Kong’s Securities and Futures Commission (SFC) warned 13 banks over what it described as "serious deficiencies" in IPO applications

- The regulator asked them to conduct comprehensive reviews and limited the number of mandates a signing principal can oversee at any one time to six

HONG KONG: A surge in initial public offerings in Hong Kong is exposing staffing strains at Chinese investment banks, as regulators tighten oversight and cap the number of deals senior bankers can handle at once.

Last month, Hong Kong's Securities and Futures Commission (SFC) warned 13 banks over what it described as "serious deficiencies" in IPO applications. The regulator asked them to conduct comprehensive reviews and limited the number of mandates a signing principal can oversee at any one time to six.

The SFC did not name the banks, but said the listing applications filed by the 13 firms accounted for around 70 percent of market share in the Asian financial hub.

The move highlights intense competition in Hong Kong's lucrative IPO market. Chinese banks have expanded their presence in recent years, leveraging local credentials to gain ground against global rivals such as Goldman Sachs, Morgan Stanley, and UBS.

Pressure on margins in equity capital markets has increased the need for banks to secure more listing mandates, recruiters say.

"Firms must execute more deals to justify their cost bases and generate sufficient revenue. As a result, we're seeing several bulge-bracket and Asian banks actively hiring sponsor principals, sparking a short-term talent war in this niche," said Sid Sibal, managing director of Aster Recruiting.

The SFC's action followed a December letter issued jointly with the Hong Kong exchange to listing sponsors — banks that lead IPO applications — warning that submissions were not meeting required standards. A person familiar with the matter said the SFC's warnings targeted banks that had taken sponsor roles in most listing applications, but declined to be named as discussions were private.

IPO activity has accelerated sharply. The number of applications more than doubled from 160 in June last year to 414 as of this week, including 96 new filings in January alone, according to exchange data.

Chinese investment banks, backed by strong mainland client networks, are handling a growing pipeline of deals, said Kenny How, a councillor of the Hong Kong Securities & Futures Professional Association (HKSFPA).

Banks, including CICC, CITIC Securities, and Huatai International, have increased market share and dominated Hong Kong listings in recent years. They are followed by China Securities International and Guotai Junan International, according to Reuters calculations based on filings.

LSEG data showed that Chinese banks accounted for nearly 70 percent of Hong Kong's US$579 million listing-fee pool last year, up from 48 percent in 2019.

An SFC spokesperson declined further comment, referring to a circular issued on January 30. The banks named did not respond to requests for comment.

The rebound in IPOs is testing not only senior bankers but overall staffing levels, as larger deals demand more input from bankers and lawyers, How said.

Since 2023, CITIC, CICC, and many foreign banks have cut investment banking staff in Asia amid a slowdown in China-related deals. Bankers and headhunters say recent hiring has not kept pace with the rebound since late 2024.

Industry sources said banks are scrambling to win mandates but lack sufficient resources and supervision to ensure application quality.

Public records show the five largest Chinese banks have between five and 21 signing principals registered with the SFC.

With deal volumes surging, some firms are drawing on mainland staff or relocating them to Hong Kong, two sources said. The SFC warned last month that all individuals engaged in sponsor work would face stricter examinations after some banks allowed ineligible staff to perform such duties.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionOn the brink of financial collapse, UN waits for US to pay dues

UNITED NATIONS: The United Nations said on February 9 that it was waiting to see how much and when U.S. President Donald Trump would...

Mexico identifies five of ten bodies found in Sinaloa as Canadian

MEXICO CITY, Mexico: Mexican authorities said on February 9 that bodies of five of the 10 workers kidnapped from a mine operated by...

Ghislaine Maxwell invokes the Fifth Amendment, demands clemency

WASHINGTON, D.C.: Ghislaine Maxwell, the former girlfriend of Jeffrey Epstein, invoked her Fifth Amendment rights when House lawmakers...

King Charles responds to mass shooting in Canada

VANCOUVER, British Columbia, Canada - The death toll in Tuesday afternoon's deadly high school shooting in Canada has been revised...

Chatbots fall short in guiding patients on medical decisions

LONDON, U.K.: People who turn to artificial intelligence for medical advice may not be making better health decisions than those who...

UBS banked Maxwell in 2014, just months after Epstein’s arrest

LONDON/TORONTO/FRANKFURT: Jeffrey Epstein's partner Ghislaine Maxwell opened accounts with Swiss wealth giant UBS that helped her manage...

Wisconsin

SectionWisconsin blitzes No. 10 Michigan State, fells another top-10 foe

(Photo credit: Robert Goddin-Imagn Images) Nick Boyd had 29 points and John Blackwell added 24 to pace Wisconsin to a dominant 92-71...

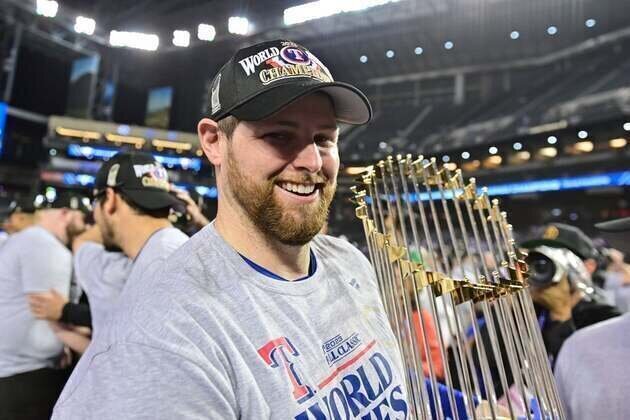

Rangers bring back 2023 postseason hero Jordan Montgomery

(Photo credit: Matt Kartozian-Imagn Images) The Texas Rangers signed 2023 postseason hero Jordan Montgomery to a one-year contract...

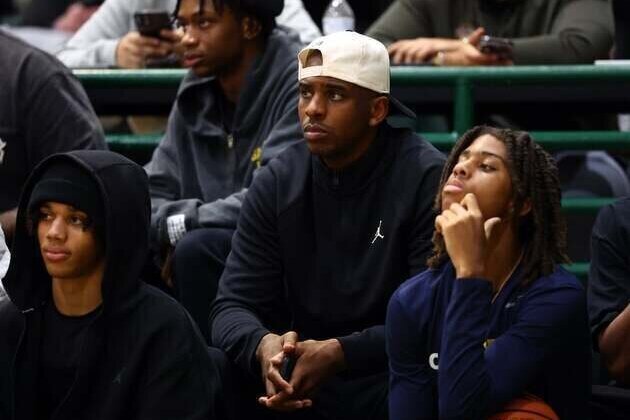

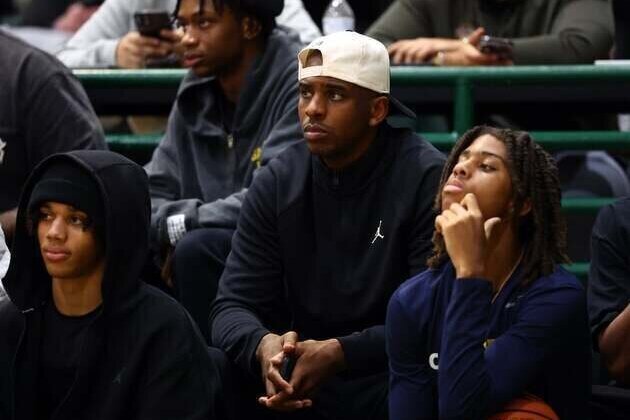

G Chris Paul announces retirement after 21 seasons

(Photo credit: Mark J. Rebilas-Imagn Images) Twelve-time All-Star guard Chris Paul on Friday announced his retirement from the NBA...

Raptors waive veteran G Chris Paul

(Photo credit: Mark J. Rebilas-Imagn Images) The Toronto Raptors waived 12-time All-Star guard Chris Paul on Friday. The move was...

NBA roundup: LeBron James becomes oldest player to log triple-double

(Photo credit: Jayne Kamin-Oncea-Imagn Images) LeBron James became the oldest player in NBA history to record a triple-double and...

Ousmane Dieng's first double-double carries Bucks past Thunder

(Photo credit: Alonzo Adams-Imagn Images) Ousmane Dieng scored a season-high 19 points while leading the Milwaukee Bucks to a 110-93...