News Analysis: Europe seeks "safer distance" from dollar assets

Xinhua

13 Feb 2026, 20:15 GMT+10

BELGRADE, Feb. 13 (Xinhua) -- European investors have been gradually adjusting their holdings of U.S. dollar assets as growing uncertainty over Washington's fiscal and monetary policy prompts them to reconsider portfolio strategies and long-term risk management.

While Europe remains deeply integrated with U.S. financial markets, recent portfolio adjustments suggest that institutions are increasingly seeking to hedge against potential volatility. Discussions in financial circles about maintaining a "safer distance" from dollar assets reflect a broader shift toward diversification.

A survey conducted by British universal bank Barclays illustrates this trend. According to Reuters reports, the bank, which covered 342 investors managing a combined 7.8 trillion U.S. dollars in assets, found that intentions to allocate to U.S.-based hedge funds in 2026 declined by around 5 percent compared to 2025. By contrast, interest in hedge funds based in Asia and Europe rose by approximately 10 percent and 8 percent, respectively. The bank noted that this is the first time since 2023 that investor appetite for U.S. hedge funds has weakened.

Similar signals have emerged among asset managers. According to a report by the Financial Times, Valerie Baudson, chief executive officer of France-based asset management company Amundi, said the firm has been promoting portfolio diversification for more than a year and advising clients to spread risk geographically. She added that if current U.S. economic policies remain unchanged, the U.S. dollar could face sustained downward pressure.

Pension funds have also adjusted their holdings. Data released by Dutch pension fund ABP showed that the market value of its U.S. Treasury holdings fell from nearly 29 billion euros (34.4 billion U.S. dollars) at the end of 2024 to about 19 billion euros by September 2025. Dutch public broadcaster NOS suggested that the scale of the decline could not be explained solely by price movements, implying active reductions in holdings.

In January, Sweden's largest private pension fund Alecta announced that it had gradually sold off most of its U.S. Treasury holdings over the past year. Denmark's AkademikerPension also divested approximately 100 million U.S. dollars' worth of American government bonds.

Analysts attribute these moves to a reassessment of multiple layers of risk. Elevated U.S. fiscal deficits, ongoing policy adjustments, and geopolitical frictions have created a more complex investment environment. Rather than focusing solely on short-term returns, investors are increasingly weighing structural uncertainties.

Katarina Zakic, senior research fellow at the Institute of International Politics and Economics in Serbia, said that external volatility has become an important consideration in portfolio decisions. Meanwhile, Belgrade-based senior financial adviser James Thornley noted that concerns over fiscal sustainability, monetary policy direction, and potential equity market overvaluation are reshaping investment logic, leading some investors to trim holdings of U.S. technology stocks and Treasuries.

Recently, the United States has exerted pressure on European countries over Greenland, prompting several European institutions to explore the potential strategic use of U.S. assets in Europe. A trend of adopting safer and more resilient investment strategies is becoming increasingly evident, with investors actively seeking to maintain a prudent distance from dollar assets.

Marcus Berret, global managing director of Germany-based international management consulting firm Roland Berger, told Xinhua that European institutions are prioritizing resilience in an uncertain global environment. The actions taken by various central banks, such as increasing their gold holdings, also reflect the market's choices in diversified asset allocation.

Jesper Rangvid, professor of finance at Copenhagen Business School, added that even the discussion of reducing dollar exposure can influence expectations and asset pricing dynamics.

Current developments suggest that European capital is undergoing a measured rebalancing process. In the short term, investors are hedging against policy-driven volatility; over the longer term, they are reassessing the sustainability of transatlantic financial dependence and broadening allocations to Europe and the Asia-Pacific region. (1 euro = 1.19 U.S. dollar)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionDeportation of Tufts graduate student from Turkey stopped by US court

BOSTON, Massachusetts: A Turkish graduate student from Tufts University, whose immigration officials detained near her Massachusetts...

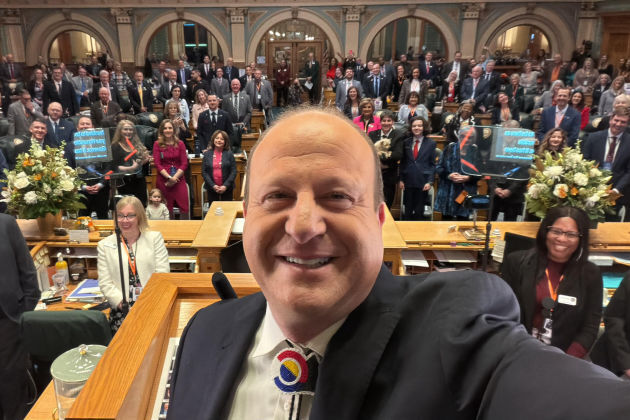

Governors scrap meeting as Trump excludes Democrats from White House

WASHINGTON, D.C.: After the White House excluded Democratic governors from a meeting with President Donald Trump later this month,...

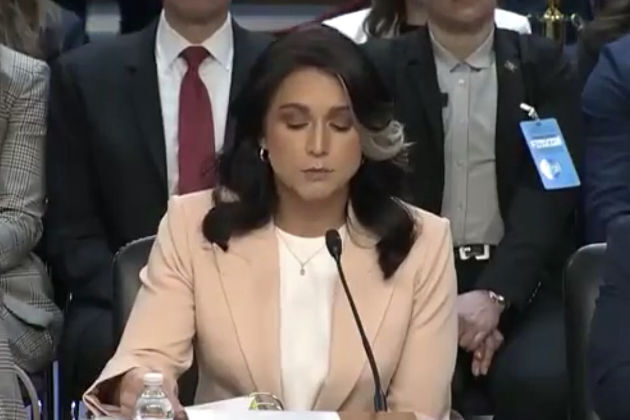

Gabbard shuts down task force meant to end intelligence politicization

WASHINGTON, D.C.: The Director's Initiatives Group, a task force launched last year by U.S. spy chief Tulsi Gabbard to root out politicization...

On the brink of financial collapse, UN waits for US to pay dues

UNITED NATIONS: The United Nations said on February 9 that it was waiting to see how much and when U.S. President Donald Trump would...

Mexico identifies five of ten bodies found in Sinaloa as Canadian

MEXICO CITY, Mexico: Mexican authorities said on February 9 that bodies of five of the 10 workers kidnapped from a mine operated by...

Ghislaine Maxwell invokes the Fifth Amendment, demands clemency

WASHINGTON, D.C.: Ghislaine Maxwell, the former girlfriend of Jeffrey Epstein, invoked her Fifth Amendment rights when House lawmakers...

Wisconsin

SectionGovernors scrap meeting as Trump excludes Democrats from White House

WASHINGTON, D.C.: After the White House excluded Democratic governors from a meeting with President Donald Trump later this month,...

Women's Top 25 roundup: No. 3 South Carolina holds off No. 6 LSU

(Photo credit: Jovanny Hernandez / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Tessa Johnson scored a season-high...

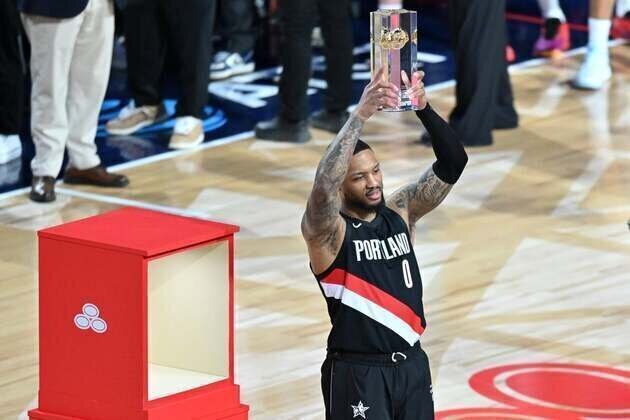

Keshan Johnson wins dunk contest; Damian Lillard wins 3rd 3-point contest

(Photo credit: William Liang-Imagn Images) INGLEWOOD, Calif. - Keshad Johnson of the Miami Heat has not started a game this season,...

Damian Lillard wins 3-point Contest for 3rd time, ties Larry Bird

(Photo credit: William Liang-Imagn Images) INGLEWOOD, Calif. -- Damian Lillard has not played a minute on the court for the Portland...

Women's Top 25 roundup: No. 1 UConn rolls past Marquette

(Photo credit: Jovanny Hernandez / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Azzi Fudd scored 25 points and...

Jovan Milicevic, Xavier fend off Marquette's comeback attempt

(Photo credit: Albert Cesare/The Enquirer / USA TODAY NETWORK via Imagn Images) Jovan Milicevic had 23 points and Filip Borovicanin...