U.S.stocks fail to find direction despite iCPI falling to 2.4 percent

Lola Evans

14 Feb 2026, 02:37 GMT+10

- The Standard and Poor's 500 eked out a slender gain, rising 3.41 points, or 0.05 percent, to settle at 6,836.17

- The Dow Jones outperformed its large-cap counterpart, adding 48.95 points, or 0.10 percent, to close at 49,500.93.

- The Nasdaq Composite declined 50.48 points, or 0.22 percent, to finish at 22,546.67

NEW YORK, New York - U.S. stock markets edged in and out of positive territory Friday, with little commitment in either direction. A better-than-expected inflation reading failed to stir the pot. CPI for January came in at 0.20 percent, or 2.4 percent on an annual basis.

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in January, the U.S. Bureau of Labor Statistics said in a statement Friday. Over the last 12 months, the all items index increased 2.4 percent before seasonal adjustment. The index for shelter rose 0.2 percent in January and was the largest factor in the all items monthly increase. The food index increased 0.2 percent over the month as did the food at home index, while the food away from home index rose 0.1 percent."

"These increases were partially offset by the index for energy, which fell 1.5 percent in January. The index for all items less food and energy rose 0.3 percent in January. Indexes that increased over the month include airline fares, personal care, recreation, medical care, and communication. The indexes for used cars and trucks, household furnishings and operations, and motor vehicle insurance were among the major indexes that decreased in January," the statistic bureau's statement said. "The all items index rose 2.4 percent for the 12 months ending January, after rising 2.7 percent for the 12 months ending December. The all items less food and energy index rose 2.5 percent over the last 12 months. The energy index decreased 0.1 percent for the 12 months ending January. The food index increased 2.9 percent over the last year."

In New York, the Standard and Poor's 500 eked out a slender gain, rising 3.41 points, or 0.05 percent, to settle at 6,836.17. The broad-market index traded within a range of 6,794.55 and 6,881.96 during the session, with approximately 3.386 billion shares changing hands.

The Dow Jones Industrial Average outperformed its large-cap counterpart, adding 48.95 points, or 0.10 percent, to close at 49,500.93. The blue-chip index fluctuated between 49,084.35 and 49,743.98 on volume of 591.009 million shares.

The technology-heavy Nasdaq Composite bucked the modestly positive trend, slipping into negative territory. The index declined 50.48 points, or 0.22 percent, to finish at 22,546.67 on heavy trading volume of 5.838 billion shares.

U.S. Dollar Mixed as Pound Rises, Aussie Dips in Friday Forex Trading

The U.S. dollar posted a mixed performance against major counterparts on Friday, as traders digested a light economic calendar and positioned for the week ahead. The softer inflation figure however weighed on the greenback.

The euro edged lower against the greenback, with the EURUSD pair slipping 0.01 percent to settle at 1.1869. The single currency struggled to find momentum amid ongoing concerns about European growth prospects.

The British pound was a notable outperformer, gaining 0.19 percent against the dollar. Sterling climbed to 1.3645, extending its recent strength as markets continue to monitor UK economic data and Bank of England policy signals.

In Japan, the dollar strengthened marginally. The USDJPY pair rose 0.02 percent to 152.74, reflecting slight dollar resilience despite broader market uncertainty.

The Swiss franc, traditionally viewed as a safe haven, strengthened modestly against the dollar. The USDCHF pair dipped 0.03 percent to 0.7681.

Commodity-linked currencies presented a mixed picture. The Canadian dollar softened, with the USDCAD pair advancing 0.10 percent to 1.3622. Meanwhile, the Australian dollar was the session's biggest decliner, sliding 0.30 percent to 0.7067 as profit-taking and weaker commodity prices weighed on the resource-linked currency. The New Zealand dollar bucked the trend among its Pacific peers, gaining 0.04 percent to trade at 0.6037.

Currency markets showed no clear directional bias as investors weighed divergent economic outlooks across major economies heading into the weekend.

Bitcoin rallied back towards $69,000 aon Friday fter hitting a low of $65,000 a day earlier.

Global Stock Markets End Mostly Lower on Friday; Taiwan Index Defies Global Downtrend

Global stock markets closed out the trading week with a mixed performance on Friday, as renewed concerns over economic growth weighed heavily on Asian and European bourses, while the Taiwan Weighted index surged higher in a rare day of divergence. Canada's stock markets also surged.

Toronto Leads the Pack

In a striking contrast to the modest moves on U.S. exchanges, Canada's S&P/TSX Composite Index posted a robust advance. The Toronto benchmark surged 608.43 points, or 1.87 percent, to close at 33,073.71 on volume of 263.231 million shares.

The sharp rally in Canadian stocks stood out as the most significant move among major North American indices, suggesting strong investor conviction in the Toronto market heading into the weekend despite the more cautious tone prevailing south of the border.

The UK's FTSE 100 managed to eke out a gain, rising by 43.91 points, or 0.42 percent, to close at 10,446.35. The index traded between a low of 10,380.87 and a high of 10,454.54 during the session.

In Europe, the major indices struggled to find direction. Germany's DAX also finished in positive territory, adding 62.19 points, or 0.25 percent, to settle at 24,914.88. The German benchmark ranged from 24,750.47 to 24,953.15 on the day.

However, France's CAC 40 slipped into the red, losing 28.82 points, or 0.35 percent, to end the session at 8,311.74. The downward trend was echoed by the broader Euro STOXX 50 Index, which fell 26.06 points, or 0.43 percent, to 5,985.23. The Euronext 100 Index dropped 8.07 points, or 0.45 percent, closing at 1,786.66, while Belgium's BEL 20 dipped 11.91 points, or 0.21 percent, to finish at 5,614.13.

Asia-Pacific Markets Hit Hard, New Zealand Leads the Way

Selling pressure was far more pronounced across the Asia-Pacific region, where multiple indices suffered steep losses.

Hong Kong's Hang Seng Index led the declines, plummeting 465.42 points, or 1.72 percent, to close at 26,567.12. Similarly, Singapore's STI Index tumbled 78.98 points, or 1.57 percent, ending the day at 4,937.78.

Australian markets also saw significant red ink. The S&P/ASX 200 dropped 125.90 points, or 1.39 percent, to 8,917.60, while the broader All Ordinaries Index fell 143.00 points, or 1.54 percent, to settle at 9,138.80.

In India, the S&P BSE Sensex lost over a thousand points, sliding 1,048.16, or 1.25 percent, to close at 82,626.76. Japan's Nikkei 225 was not immune to the rout, shedding 697.87 points, or 1.21 percent, to finish at 56,941.97.

Other regional losers included the FTSE Bursa Malaysia KLCI, which fell 11.31 points, or 0.65 percent, to 1,739.54, and Indonesia's IDX Composite, which dropped 53.08 points, or 0.64 percent, to 8,212.27.

The sharpest decline of the day was reserved for New Zealand. The S&P/NZX 50 Index plummeted 333.30 points, or 2.46 percent, closing at 13,198.18.

Mainland China's SSE Composite Index also struggled, falling 51.95 points, or 1.26 percent, to 4,082.07. South Korea's KOSPI dipped 15.26 points, or 0.28 percent, to 5,507.01.

Taiwan Outperforms

In a stark contrast to the regional gloom, the TWSE Capitalization Weighted Stock Index in Taiwan posted a robust gain. The index soared 532.74 points, or 1.61 percent, to close at 33,605.71, reaching a high of 33,707.83 during the session.

Meanwhile, the Top 40 USD Net TRI Index in Johannesburg fell sharply, losing 177.53 points, or 2.29 percent, to end at 7,566.79.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Thursday 12 February 2026 | Dow Jones dives 669 points Thursday, Nasdaq sheds over 2% | Big News Network

Wednesday 11 February 2026 | Wall Street dips despite upbeat employment data | Big News Network.com

Tuesday 10 February 2026 | Wall Street in doldrums Tuesday but Dow ekes out new high | Big News Network

Monday 9 February 2026 | Tech stocks surge again Monday, Dow hits new high | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionOn the brink of financial collapse, UN waits for US to pay dues

UNITED NATIONS: The United Nations said on February 9 that it was waiting to see how much and when U.S. President Donald Trump would...

Mexico identifies five of ten bodies found in Sinaloa as Canadian

MEXICO CITY, Mexico: Mexican authorities said on February 9 that bodies of five of the 10 workers kidnapped from a mine operated by...

Ghislaine Maxwell invokes the Fifth Amendment, demands clemency

WASHINGTON, D.C.: Ghislaine Maxwell, the former girlfriend of Jeffrey Epstein, invoked her Fifth Amendment rights when House lawmakers...

King Charles responds to mass shooting in Canada

VANCOUVER, British Columbia, Canada - The death toll in Tuesday afternoon's deadly high school shooting in Canada has been revised...

Chatbots fall short in guiding patients on medical decisions

LONDON, U.K.: People who turn to artificial intelligence for medical advice may not be making better health decisions than those who...

UBS banked Maxwell in 2014, just months after Epstein’s arrest

LONDON/TORONTO/FRANKFURT: Jeffrey Epstein's partner Ghislaine Maxwell opened accounts with Swiss wealth giant UBS that helped her manage...

Wisconsin

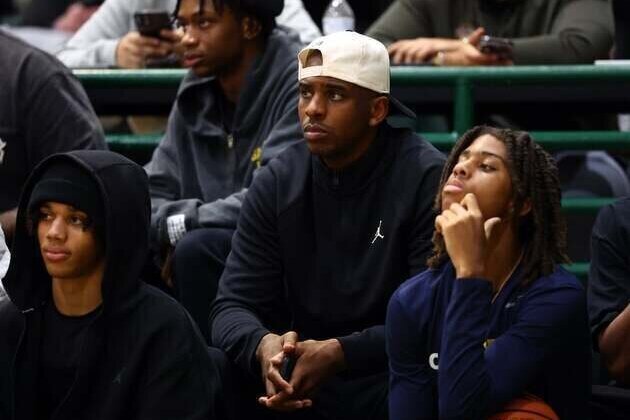

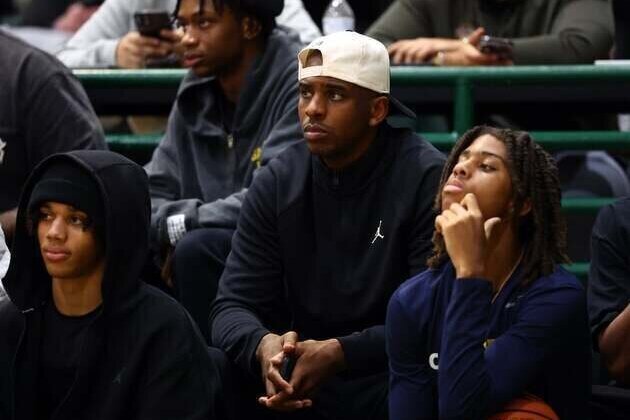

SectionG Chris Paul announces retirement after 21 seasons

(Photo credit: Mark J. Rebilas-Imagn Images) Twelve-time All-Star guard Chris Paul on Friday announced his retirement from the NBA...

Raptors waive veteran G Chris Paul

(Photo credit: Mark J. Rebilas-Imagn Images) The Toronto Raptors waived 12-time All-Star guard Chris Paul on Friday. The move was...

NBA roundup: LeBron James becomes oldest player to log triple-double

(Photo credit: Jayne Kamin-Oncea-Imagn Images) LeBron James became the oldest player in NBA history to record a triple-double and...

Ousmane Dieng's first double-double carries Bucks past Thunder

(Photo credit: Alonzo Adams-Imagn Images) Ousmane Dieng scored a season-high 19 points while leading the Milwaukee Bucks to a 110-93...

Bucks coach Doc Rivers (funeral) to miss game at Thunder

(Photo credit: Gary A. Vasquez-Imagn Images) Assistant Darvin Ham will coach the Milwaukee Bucks on Thursday night against the host...

Browns president: We're 'easy to pick on right now'

(Photo credit: Jeff Lange / USA TODAY NETWORK via Imagn Images) Dave Jenkins knows the reputation surrounding the Cleveland Browns....