From cars to clothing, Latin America resists China import surge

Anabelle Colaco

04 Feb 2026, 20:56 GMT+10

- From factory floors to street markets, governments and businesses across Latin America are scrambling to respond to a surge of low-cost Chinese imports that is reshaping local economies and testing political resolve

- As Chinese exporters adjust to U.S. President Donald Trump’s tariffs and shifting geopolitics, they have increasingly turned to Latin America — a region of more than 600 million consumers — to absorb excess production

- Exports to the area have climbed sharply even as shipments to the United States fell by about 20 percent last year

HONG KONG: From factory floors to street markets, governments and businesses across Latin America are scrambling to respond to a surge of low-cost Chinese imports that is reshaping local economies and testing political resolve.

As Chinese exporters adjust to U.S. President Donald Trump's tariffs and shifting geopolitics, they have increasingly turned to Latin America — a region of more than 600 million consumers — to absorb excess production. Exports to the area have climbed sharply even as shipments to the United States fell by about 20 percent last year.

China, the world's second-largest economy, has become a top trading partner for many Latin American countries, drawn by their abundant natural resources and growing consumer markets. But the influx of inexpensive Chinese goods, from cars and electronics to clothing and furniture, is increasingly provoking backlash from countries trying to build their own globally competitive industries.

"Latin America has a solid middle class, relatively high purchasing power and real demand," said Margaret Myers, director of the Asia and Latin America program at the Inter-American Dialogue think tank in Washington. "Those conditions make it one of the easiest places for China to offload its excess industrial production."

Cheap e-Commerce Goods Gain Ground

For consumers, the flood of affordable imports is often welcome. For local businesses, it is proving punishing.

Chinese e-commerce platforms such as Temu and Shein have accelerated the shift, offering ultra-low prices that many local retailers cannot match.

"I use Temu all the time, whether to buy clothes or household items. The same things I would find in brand-name stores or shopping malls, I find on Temu at a much lower price," said Chilean restaurant manager Lady Mogollon.

Temu averaged 114 million monthly active users in Latin America in the first half of 2025, a 165 percent increase from a year earlier, according to Sensor Tower. Shein's monthly active users in the region rose 18 percent.

The impact extends beyond online shopping. In downtown Mexico City, stalls overflow with Chinese-made T-shirts, jackets, toys, watches, and furniture.

"The Chinese have invaded us in terms of merchandise," said Ángel Ramírez, manager of a downtown lamp shop, sitting behind the counter of his empty store.

The number of shops selling Chinese-made goods in the area has more than tripled in recent years, Ramírez said, forcing some long-established Mexican businesses to close.

Jobs lost as imports rise.

Argentina has been hit particularly hard, with factory closures and layoffs mounting in a manufacturing sector that employs nearly one-fifth of its workforce.

E-commerce imports, mainly from China, jumped 237 percent in October from a year earlier, government data show.

"We're operating at historically low capacity as imports break record highs," said Luciano Galfione, president of the nonprofit Pro Tejer Foundation, which represents textile manufacturers. "We're under indiscriminate attack."

"The number of Chinese products arriving in Argentina, this ultra-fast fashion, is deeply worrying," said Claudio Drescher, head of the chamber of industry and owner of the Jazmín Chebar clothing brand. "It's an international phenomenon, but it's now really beginning to have dramatic importance here."

A Temu spokesperson said the platform gives Latin American businesses "access to a low-cost, scalable online channel that was previously out of reach," including opening its marketplace to domestic sellers in Mexico and Brazil in 2025. Shein said it "respects the importance of local industries and fair competition" but declined to comment on broader trade policy.

Chinese Cars Test Regional Auto Hubs

Pressure is also building in Mexico and Brazil, Latin America's auto manufacturing powerhouses, as low-priced Chinese vehicles gain market share.

More than 80 percent of the 61,615 electric vehicles sold in Brazil in 2024 were Chinese brands, according to the Brazilian Association of Electric Vehicles. Mexico became the largest destination for Chinese auto exports last year, importing 625,187 vehicles, surpassing Russia.

Mexico produced nearly 4 million vehicles last year, while Brazil manufactured about 2.6 million. By contrast, China produced 34.5 million vehicles and exported more than 7 million.

"In an industry where scale is vital, ‘China does have a comparative advantage on EVs,'" said Jorge Guajardo, a partner at consultancy DGA Group and former Mexican ambassador to China.

Chinese automakers such as BYD and GWM are also investing locally, building factories in Brazil that could generate hundreds or thousands of jobs. Brazilian prosecutors sued BYD last year over alleged poor labor conditions — claims the company denied.

Leverage Limited, but Pushback Grows

China relies heavily on Latin America's raw materials, from lithium and copper to soybeans and fishmeal. Yet trade deficits with China are widening in much of the region.

For some countries, "China just sells, they don't buy," Guajardo said.

Mexico's trade deficit with China reached US$120 billion in 2024. Argentina's climbed to nearly $8.2 billion in 2025. Brazil and Chile, by contrast, run surpluses thanks to commodity exports.

China's influence extends well beyond trade. Between 2014 and 2023, Beijing provided about $153 billion in loans and grants to Latin America and the Caribbean, compared with roughly $50.7 billion from the U.S., according to AidData.

"There may be deep concern about competitiveness, but politically, many countries don't feel they have the space to resist China's export surge," Myers said. "The relationship has become too important economically."

Still, resistance is growing. Mexico has imposed tariffs of up to 50 percent on some Chinese imports. Brazil is curbing tax exemptions on low-value parcels and raising EV tariffs. Chile has imposed a 19 percent value-added tax on low-cost imports.

"They can't go too far, or China may retaliate in kind," said Leland Lazarus, founder of Lazarus Consulting. "So, their leverage has a limit.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

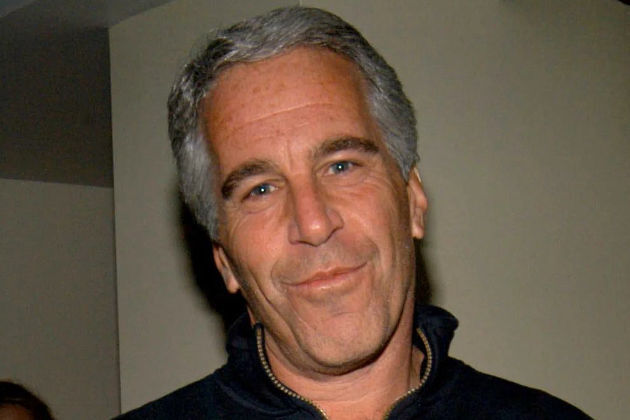

SectionDoJ official says new charges against those in Epstein files unlikely

WASHINGTON, D.C.: A top Justice Department official said there was little possibility of additional criminal charges arising from the...

125 killed in violence that erupts in Balochistan province of Pakistan

QUETTA, Pakistan: Pakistan said its security forces killed 92 militants in the multiple suicide and gun attacks across the restive...

Journalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

Epstein files dig up links to America’s wealthy and powerful

WASHINGTON, D.C.: A massive new tranche of files on millionaire financier and sex offender Jeffrey Epstein, released on January 30,...

After vape ban, cartels tighten control of Mexico’s e-cig market

MEXICO CITY, Mexico: Mexico's sweeping ban on electronic cigarettes is reshaping the country's vape market, driving legal sellers underground...

Israel, Saudi Arabia to receive weapons worth $15.67 billion from US

WASHINGTON, D.C: The Trump administration has approved a massive new series of arms sales to Israel totaling US$6.67 billion and to...

Wisconsin

SectionJournalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

Immigration crackdown could play role in midterms, Republicans feel

WASHINGTON, D.C.: With midterm elections looming, many Republicans fear that immigration enforcement by the Trump administration, which...

Amazon exits Go and Fresh stores to focus on delivery, Whole Foods

NEW YORK CITY, New York: Amazon is reshaping its brick-and-mortar grocery strategy, announcing it will shut down all Amazon Go and...

Giannis Antetokounmpo's future clouds Bucks' game at Pelicans

(Photo credit: Daniel Kucin Jr.-Imagn Images) Giannis Antetokounmpo won't play for the Milwaukee Bucks against the visiting New Orleans...

NBA roundup: Knicks roll over Wizards for 7th straight win

(Photo credit: Rafael Suanes-Imagn Images) Mikal Bridges scored 23 points and Jalen Brunson added 21, fueling the visiting New York...

Celtics ride Jaylen Brown, clamp down on Mavericks

(Photo credit: Kevin Jairaj-Imagn Images) Jaylen Brown posted 33 points and 11 rebounds as the Boston Celtics extended their winning...