Tech hit the skids again, but Dow Jones gains 260 points

Lola Evans

05 Feb 2026, 02:39 GMT+10

- The tech-heavy NASDAQ Composite experienced a significant sell-off, plunging 350.61 points, or 1.51 percent, to end the day at 22,904.58.

- The Dow Jones Industrial Average bucked the negative trend, climbing 260.31 points, or 0.53 percent, to close at 49,501.30.

- The Standard and Poor's 500 index finished in negative territory, pulled down by the drag from its technology constituents.

NEW YORK, New York - AI stocks continued to be pounded on Wednesday dragging the tech sector sharply lower, however the Dow Jones surged

"Toward the end of last year, you began to see the market differentiate between what the market perceived to be the winners and losers in the artificial intelligence space," Scott Welch, chief investment officer at Certuity told CNBC Wednesday. "I think you're seeing a continuation of that now."

"It's just a natural rotation," Welch said. "It's been such a large cap growth-dominated space for so long — value was just punished, small cap was punished and non-U.S. markets were just kind of ignored when, in fact, they basically doubled the results of the domestic market last year."

"All of this has been sort of coming for a while, and I think you're just beginning to see that play out," the Certuity CIO added.

The Dow Jones Industrial Average bucked the negative trend, climbing 260.31 points, or 0.53 percent, to close at 49,501.30. The rally was fueled by gains in several industrial and financial components, highlighting a rotation into more cyclical sectors.

In contrast, the tech-heavy NASDAQ Composite experienced a significant sell-off, plunging 350.61 points, or 1.51 percent, to end the day at 22,904.58.

The broader Standard and Poor's 500 index also finished in negative territory, pulled down by the drag from its technology constituents. The benchmark fell 35.06 points, or 0.51 percent, to settle at 6,882.75.

The day's action underscored a notable market divergence, with money flowing out of high-growth technology shares and into more value-oriented and cyclical segments of the market. This rotation reflects ongoing investor caution and repositioning ahead of key economic data and corporate earnings reports.

U.S. Dollar Gains Ground as Yen Weakens in Wednesday's Forex Trading

The U.S. dollar demonstrated broad strength in foreign exchange markets on Wednesday, rallying against most major currencies while the Japanese yen fell sharply. The dollar's advance was fueled by ongoing market reassessments of the interest rate path between the Federal Reserve and other global central banks.

The yen was a notable outlier, suffering significant losses. The USD/JPY pair surged 0.77 percent to breach the 156.91 level, reflecting continued pressure on the Japanese currency amid a wide yield differential with the United States. The dollar also climbed against the Swiss franc, with USD/CHF rising 0.36 percent to 0.7771, and made a more modest gain against the Canadian dollar, as USD/CAD increased 0.24 percent to 1.3668.

In contrast, the euro and pound sterling retreated against the greenback. The EUR/USD pair dipped 0.10 percent to 1.1805, while the GBP/USD pair fell 0.31 percent to 1.3652.

The commodity-linked Australian and New Zealand dollars faced stronger headwinds. The AUD/USD declined 0.32 percent to 0.6997, and the NZD/USD experienced the session's steepest drop, tumbling 0.70 percent to 0.6002.

Overall, the market movement underscored a firmer U.S. dollar environment, with traders focusing on economic resilience and relative interest rate expectations that continue to favor the American currency against many of its peers.

Global Stock Markets Show Mixed Performance in Wednesday Trading

Major global stock indices delivered a mixed performance in Wednesday's trading session, with European and Asian markets painting a varied picture of investor sentiment.

Canada's S&P/TSX Composite index mirrored the Dow's positive performance, rising 175.53 points, or 0.54 percent, to close at 32,564.13. The gain was supported by strength in the energy and materials sectors, which benefitted from steady commodity prices.

The UK's FTSE 100 also posted solid gains, rising 87.75 points, or 0.85 percent, to finish at 10,402.34.

In Europe, the region's benchmarks were divided. France's CAC 40 was a standout performer, climbing 82.66 points, or 1.01 percent, to close at 8,262.16. In Belgium the BEL 20 advanced 45.92 points, or 0.83 percent, to 5,545.43.

However, Germany's DAX bucked the positive trend, falling 177.75 points, or 0.72 percent, to 24,603.04. The broader EURO STOXX 50 followed suit, dipping 24.88 points, or 0.41 percent, to settle at 5,970.47. The Euronext 100 eked out a minimal gain of 2.21 points, or 0.12 percent, closing at 1,782.80.

Asian markets also lacked a uniform direction. South Korea's KOSPI was a notable gainer, surging 83.02 points, or 1.57 percent, to 5,371.10. In Australia the S&P/ASX 200 rose 70.70 points, or 0.80 percent, to 8,927.80, while the broader All Ordinaries index gained 55.30 points, or 0.60 percent, to 9,204.60.

The Shanghai Composite (SSE) in China posted a strong gain, rising 34.46 points, or 0.85 percent, to close at 4,102.20.

Japan's Nikkei 225 experienced a decline, dropping 427.30 points, or 0.78 percent, to 54,293.36. In Hong Kong' Wednesday, the Hang Seng Index was nearly flat, adding a modest 12.55 points, or 0.05 percent, to end at 26,847.32.

India's S&P BSE Sensex saw a minor increase of 78.55 points, or 0.09 percent, closing at 83,817.69.

In other regional markets, Taiwan's TWSE Index was up 94.45 points, or 0.29 percent, at 32,289.81. In Singapore Wednesday, the STI Index gained 21.41 points, or 0.43 percent, to 4,965.50. New Zealand's S&P/NZX 50 rose 45.77 points, or 0.34 percent, to 13,467.29.

Indonesia's IDX Composite advanced 24.12 points, or 0.30 percent, to 8,146.72. Conversely, in Malaysia, the FTSE Bursa Malaysia KLCI slipped 5.44 points, or 0.31 percent, to 1,742.82.

In the Middle East, Egypt's EGX 30 was a strong performer, jumping 653.10 points, or 1.33 percent, to close at 49,631.60. Israel's TA-125 edged lower by 6.01 points, or 0.15 percent, to 4,100.96.

In Africa, South Africa's Top 40 USD Net TRI Index fell 16.41 points, or 0.22 percent, to 7,557.39

Overall, the trading session reflected cautious and fragmented sentiment across global financial centers, with investors weighing regional economic data and corporate earnings reports.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Tuesday 3 February 2026 | U.S. stock markets tumble despite end to shutdown | Big News Network

Monday 2 February 2026 | Wall Street rallies despite meltdown in gold, silver, bitcoin | Big News Network.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

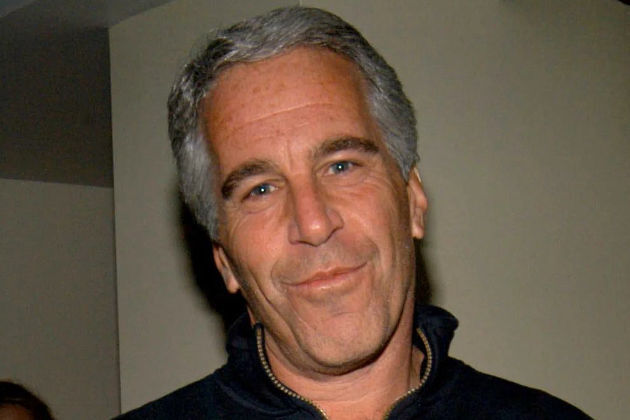

SectionDoJ official says new charges against those in Epstein files unlikely

WASHINGTON, D.C.: A top Justice Department official said there was little possibility of additional criminal charges arising from the...

125 killed in violence that erupts in Balochistan province of Pakistan

QUETTA, Pakistan: Pakistan said its security forces killed 92 militants in the multiple suicide and gun attacks across the restive...

Journalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

Epstein files dig up links to America’s wealthy and powerful

WASHINGTON, D.C.: A massive new tranche of files on millionaire financier and sex offender Jeffrey Epstein, released on January 30,...

After vape ban, cartels tighten control of Mexico’s e-cig market

MEXICO CITY, Mexico: Mexico's sweeping ban on electronic cigarettes is reshaping the country's vape market, driving legal sellers underground...

Israel, Saudi Arabia to receive weapons worth $15.67 billion from US

WASHINGTON, D.C: The Trump administration has approved a massive new series of arms sales to Israel totaling US$6.67 billion and to...

Wisconsin

SectionJournalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

Immigration crackdown could play role in midterms, Republicans feel

WASHINGTON, D.C.: With midterm elections looming, many Republicans fear that immigration enforcement by the Trump administration, which...

Report: Cardinals hire Nathaniel Hackett as OC

(Photo credit: Ron Chenoy-Imagn Images) Nathaniel Hackett, who spent three seasons on Green Bay Packers head coach Matt LaFleur's...

Report: Mavericks trade Anthony Davis to Wizards

(Photo credit: Cary Edmondson-Imagn Images) The Dallas Mavericks are sending 10-time All-Star forward Anthony Davis to the Washington...

Giannis Antetokounmpo's future clouds Bucks' game at Pelicans

(Photo credit: Daniel Kucin Jr.-Imagn Images) Giannis Antetokounmpo won't play for the Milwaukee Bucks against the visiting New Orleans...

NBA roundup: Knicks roll over Wizards for 7th straight win

(Photo credit: Rafael Suanes-Imagn Images) Mikal Bridges scored 23 points and Jalen Brunson added 21, fueling the visiting New York...