U.S. stocks edge lower, unfazed by positive economic date

Lola Evans

12 Feb 2026, 02:39 GMT+10

- The NASDAQ Composite declined 36.01 points, or 0.16 percent, to finish at 23,066.47.

- The Dow Jones Industrial Average slipped 66.74 points, or 0.13 percent, to settle at 50,121.40.

- The Standard and Poor's 500 dipped 0.36 points, or 0.01 percent, closing at 6,941.45.

NEW YORK, New York - U.S. stocks closed marginally lower Wednesday, despite positive economic data which saw the U.S. economy add 130,000 jobs last month, and unemployment remaining mired at 4.3 percent, against 4.4 percent expected.

"Total nonfarm payroll employment rose by 130,000 in January, and the unemployment rate changed little at 4.3 percent, the U.S. Bureau of Labor Statistics said in a statement Wednesday. "Job gains occurred in health care, social assistance, and construction, while federal government and financial activities lost jobs," the statistics department statement said.

"This is generally a good sign, as you'd expect, but we are certainly not out of the woods yet with respect to the labor market. ‘Moving in the right direction' would be a better description. The unemployment rate is gradually improving, but there are still plenty of signs that the labor market remains exceedingly weak," Rick Wedell, CIO at RFG Advisory, told CNBC Wednesday.

"In this environment, it is clear that we still have a long way to go before the labor market can be considered ‘solid,'" Wedell added.

Dow Jones, S&P 500 Ease from Records

The Dow Jones Industrial Average slipped 66.74 points, or 0.13 percent, to settle Wednesday at 50,121.40. The blue-chip index traded within a range of 49,901.61 to 50,512.79 on volume of 560.277 million shares.

The Standard and Poor's 500 dipped 0.36 points, or 0.01 percent, closing at 6,941.45 after touching a session high of 7,002.28. Trading volume on the broad index reached 3.699 billion shares. The benchmark remains within striking distance of its all-time highs.

NASDAQ Edges Lower

The NASDAQ Composite declined 36.01 points, or 0.16 percent, to finish at 23,066.47 on heavy volume of 7.838 billion shares. Technology stocks showed modest weakness, weighing on the index.

Market participants characterized the session as consolidation following recent gains, with many investors awaiting further catalysts on the economic and policy fronts. Trading ranges were narrow across all major benchmarks.

U.S. Dollar Mixed as Yen Surgess, Aussie Shines in Wednesday's FX Trading

The U.S. dollar delivered a fractured performance in global foreign exchange markets on Wednesday, sliding sharply against the Japanese yen and commodity-linked currencies while firming against the euro and the Swiss franc.

Euro Softens, Franc weakens

The euro retreated against the greenback, with EURUSD last trading at 1.1874, down 0.17 percent on the session. The single currency struggled for traction as markets digested softer-than-expected eurozone services data.

The dollar strengthened against the Swiss franc, USDCHF rising 0.50 percent to 0.7710, extending its rebound from recent lows as haven demand for the franc ebbed.

Yen Rebound Extends

The U.S. dollar fell sharply against the Japanese yen, USDJPY declining 0.76 percent to 153.19. T

Loonie Edges Higher, Pound Subdued

The Canadian dollar strengthened modestly, with USDCAD slipping 0.16 percent to 1.3572 as oil prices stabilized near three-month highs. The pound traded marginally lower, GBPUSD easing 0.10 percent to 1.3627, as markets looked past stronger-than-expected UK services data and focused on looming Bank of England policy signals.

Antipodean Currencies Outperform

The Australian dollar led G10 gainers, AUDUSD jumping 0.73 percent to 0.7126, supported by stronger iron ore prices and rising expectations the Reserve Bank of Australia may need to maintain tighter policy for longer.

The New Zealand dollar followed suit, NZDUSD advancing 0.12 percent to 0.6049, though gains were capped ahead of domestic trade data due later in the week.

Trading volumes remained broadly in line with recent averages as participants awaited key US inflation data and Federal Reserve Chair testimony for further directional cues.

Global Markets Mixed as Tech Surge Lifts Nikkei, European Bourses Slip

Global stock markets delivered a divided performance in Wednesday trading, with Asian benchmarks surging to record highs while European indices retreated from recent peaks amid lingering inflation concerns.

Toronto Flat

In Canada, the S&P/TSX Composite index slipped 2.64 points, or 0.01 percent, to close at 33,254.19 on volume of 305.034 million shares.

London Outperforms Europe

The FTSE 100 was a rare bright spot\, closing up 118.27 points, or 1.14 percent, to settle at 10,472.11. The blue-chip index touched a session high of 10,493.83 as mining and energy stocks rallied.

Continental bourses painted a bleaker picture. The DAX P slipped 131.70 points, or 0.53 percent, to 24,856.15, pulling back from its high of 25,507.79. France's CAC 40 edged down 14.64 points, or 0.18 percent, to 8,313.24, while the broader EURO STOXX 50 I declined 11.42 points, or 0.19 percent, to 6,035.64.

The Euronext 100 Index dipped a marginal 1.04 points, or 0.06 percent, to 1,801.39. Belgium's BEL 20 bucked the trend, adding 12.24 points, or 0.22 percent, to close at 5,594.88.

Tokyo Soars on Tech Frenzy

Asia saw explosive gains led by Tokyo. The Nikkei 225 skyrocketed 1,286.64 points, or 2.28 percent, to close at 57,650.54—its highest level on record—fueled by a semiconductor rally and a weaker yen.

Australia also celebrated milestones. The S&P/ASX 200 surged 147.40 points, or 1.66 percent, to finish at 9,014.80, crossing the 9,000 threshold for the first time. The broader All Ordinaries jumped 141.90 points, or 1.55 percent, to 9,281.80.

Elsewhere in the region, Taiwan's TWSE Capitalization Weighted Stock Index advanced 532.74 points, or 1.61 percent, to 33,605.71. South Korea's KOSPI Composite Index rose 52.80 points, or 1.00 percent, to 5,354.49, though data showed no recorded opening or range figures. Hong Kong's Hang Seng Index added 83.23 points, or 0.31 percent, to 27,266.38, while Singapore's STI Index gained 20.33 points, or 0.41 percent, to 4,984.58Indonesia was the region's standout performer, with the IDX Composite leaping 159.23 points, or 1.96 percent, to 8,290.97. Malaysia's FTSE Bursa KLCI rose 8.85 points, or 0.51 percent, to 1,756.39.

Mixed Signals in India, China, New Zealand

India's S&P BSE Sensex slipped 40.28 points, or 0.05 percent, to 84,233.64, retreating from its high of 86,159.02. New Zealand's S&P/NZX 50 edged down 6.40 points, or 0.05 percent, to 13,507.28.

Mainland China's SSE Composite Index managed a modest gain of 3.61 points, or 0.09 percent, to 4,131.98 on turnover of 2.824 billion shares.

Middle East and Africa Under Pressure

Israel's TA-125 index fell 25.86 points, or 0.62 percent, to 4,136.01. Egypt saw steeper declines, with the EGX 30 Price Return Index dropping 676.00 points, or 1.34 percent, to 49,700.20 on volume of 401.069 million.

South Africa's Top 40 USD Net TRI Index posted a gain of 66.22 points, or 0.87 percent, closing at 7,677.27.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related story:

Tuesday 10 February 2026 | Wall Street in doldrums Tuesday but Dow ekes out new high | Big News Network

Monday 9 February 2026 | Tech stocks surge again Monday, Dow hits new high | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionKing Charles responds to mass shooting in Canada

VANCOUVER, British Columbia, Canada - The death toll in Tuesday afternoon's deadly high school shooting in Canada has been revised...

Chatbots fall short in guiding patients on medical decisions

LONDON, U.K.: People who turn to artificial intelligence for medical advice may not be making better health decisions than those who...

UBS banked Maxwell in 2014, just months after Epstein’s arrest

LONDON/TORONTO/FRANKFURT: Jeffrey Epstein's partner Ghislaine Maxwell opened accounts with Swiss wealth giant UBS that helped her manage...

20-year prison sentence for Hong Kong ex-media tycoon Jimmy Lai

HONG KONG: Jimmy Lai, the 78-year-old pro-democracy former Hong Kong media tycoon and a fierce critic of Beijing, received a 20-year...

Japanese PM Takaichi’s party sweeps the parliamentary elections

TOKYO, Japan: Japanese Prime Minister Sanae Takaichi's governing party won a landslide victory, surpassing the two-thirds supermajority...

From parties to retreats, women celebrate love through their closest pals

TRINITY, Florida: For Christie O'Sullivan of Trinity, Florida, Valentine's Day has mostly been a couples' affair. She has spent 21...

Wisconsin

SectionYum targets weak Pizza Hut stores, eyes strategic options

LOUISVILLE, Kentucky: As Yum Brands reassesses the future of one of its most recognisable chains, Pizza Hut is preparing to close 250...

Bucks punish missed dunk, top Magic in final minutes

(Photo credit: Mike Watters-Imagn Images) Cam Thomas scored 34 points off the bench as the visiting Milwaukee Bucks snapped the Orlando...

Reports: Brewers bring back C Gary Sanchez on 1-year deal

(Photo credit: Jerome Miron-Imagn Images) After one season away, free agent catcher Gary Sanchez is returning to the Milwaukee Brewers...

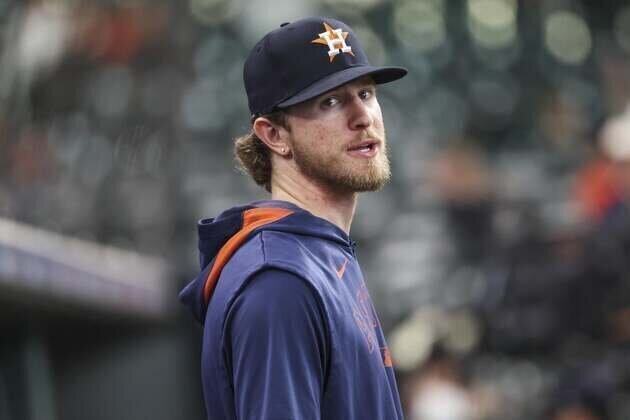

Astros closer Josh Hader (biceps) uncertain for Opening Day

(Photo credit: Troy Taormina-Imagn Images) Houston Astros closer Josh Hader's availability for Opening Day is in doubt because the...

Reports: Rockies reach 1-year deal with LHP Jose Quintana

(Photo credit: Kirby Lee-Imagn Images) The Colorado Rockies are signing free agent left-hander Jose Quintana to a one-year contract,...

Pacers, facing Nets, chase N.Y. sweep after wild win over Knicks

(Photo credit: Brad Penner-Imagn Images) The Indiana Pacers are experiencing a trying season while Tyrese Haliburton recovers from...