UPI preferred mode of transaction at 57%, surpassing cash at 38%: Survey

ANI

16 Feb 2026, 16:34 GMT+10

New Delhi [India], February 16 (ANI): Unified Payments Interface (UPI) has emerged as the most preferred mode of transaction, accounting for 57 per cent, surpassing cash transactions at 38 per cent, primarily due to ease of use and instant fund transfer capability, according to a survey.

The Department of Financial Services (DFS), Ministry of Finance, released a report titled 'Socio-Economic Impact Analysis of the Incentive Scheme for Promotion of RuPay Debit Card and low-value BHIM-UPI (Person-to-Merchant) transactions' during the Chintan Shivir held last week.

The study has been carried out by an independent third-party research agency in consultation with the National Payments Corporation of India (NPCI).

The analysis evaluates the effectiveness of the Government's incentive framework in promoting digital payments, strengthening payment infrastructure, and advancing financial inclusion across the country.

The Incentive Scheme was conceptualised as part of the Government of India's broader policy objective of accelerating universal adoption of digital payments, reducing dependence on cash, and formalising routine economic activity, a release said. Introduced in FY 2021-22 and continued through FY 2024-25, the scheme provided structured budgetary support to acquiring banks and ecosystem participants to ensure that digital payments remained affordable, accessible, and sustainable for citizens and merchants alike.

The socio-economic impact analysis is based on an extensive primary survey covering 10,378 respondents across 15 states, including 6,167 users, 2,199 merchants, and 2,012 service providers, representing the key stakeholders of India's digital payments ecosystem along with in-depth secondary research.

The study adopted a comprehensive sampling framework spanning five geographical zones- North, South, East, West, and North-East- covering urban and semi-urban locations. Fieldwork was conducted between July 22 and August 25, 2025 using face-to-face Computer Assisted Personal Interviews (CAPI) to ensure accuracy, reliability, and high-quality data collection.

Among other findings in the survey, digital payments now dominate everyday transaction behaviour with 65 per cent of UPI users reporting multiple digital transactions per day. Preference for UPI is particularly pronounced among younger users in the 18-25 age group, where adoption stands at 66 per cent%, indicating strong behavioural shift toward digital-first financial habits.

The study also finds that 90 per cent of users reported increased confidence in digital payments after using UPI and RuPay cards, accompanied by a marked decline in cash usage and ATM withdrawals.

Cashback incentives were identified as a key motivation for adoption by 52 per cent of users, while 74 per cent cited speed of payment as the primary advantage.

Among merchants, digital acceptance has reached near universality, with 94 per cent small merchants reporting adoption of UPI. About 72 per cent expressed satisfaction with digital payments, citing faster transactions, improved record-keeping, and operational convenience, while 57 per cent reported an increase in sales following digital adoption.

The report highlights that incentives have played a critical role in reducing cost barriers for merchants and acquiring banks, accelerating merchant onboarding, and building trust in digital payment systems across income groups and geographies. Coordinated efforts of the Government, NPCI, banks, fintech players, and payment service providers have collectively strengthened India's digital payments ecosystem and advanced the vision of a less-cash, digitally empowered economy.

Significant expansion in digital payments and infrastructure has been observed during the implementation period of the scheme. Digital transactions increased nearly 11 times, with UPI's share in total digital transactions surging to 80 per cent.

UPI QR deployment also expanded dramatically from 9.3 crore to 65.8 crore, enabling widespread merchant acceptance.

The Government's budgetary support of Rs 8,276 crore for the scheme has been significant, with incentive disbursements of Rs 1,389 crore in FY 2021-22, Rs 2,210 crore in FY 2022-23, Rs 3,631 crore in FY 2023-24, and Rs 1,046 crore in FY 2024-25. These disbursements supported banks, payment system operators, and app providers in scaling low-value digital transactions across the country.

The findings of the Socio-Economic Impact Analysis are expected to add value in future policy design and ensure continuity of support for India's digital payments ecosystem. The report reinforces the Government's commitment to building resilient, inclusive, and secure digital public infrastructure that supports economic growth and financial inclusion. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionFebruary 2027 will be date for Trump’s defamation case against BBC

LONDON, U.K.: Rejecting an attempt by the British Broadcasting Corporation to delay proceedings, a U.S. judge announced on February...

Family of Indian girl runover by Seattle officer paid $29 million

SEATTLE, Washington: The city of Seattle paid US$29 million to the family of a 23-year-old graduate student from India, who was struck...

Teen daughter of North Korean leader emerging as country’s future head

SEOUL, South Korea: The teenage daughter of North Korean leader Kim Jong Un is close to being designated as the country's future leader,...

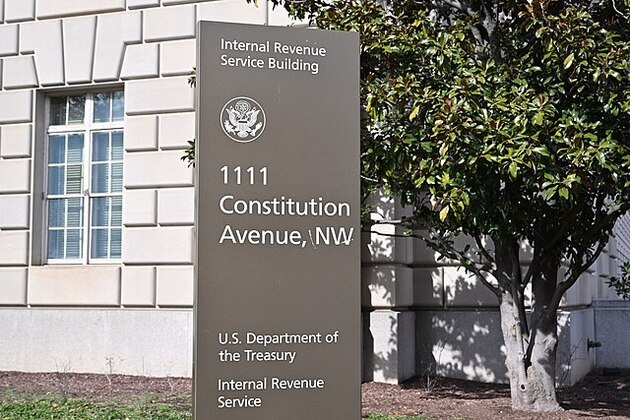

Court filing reveals IRS shared data with DHS in error

WASHINGTON, D.C.: The Internal Revenue Service mistakenly shared the taxpayer information of thousands of people with the Department...

Deportation of Tufts graduate student from Turkey stopped by US court

BOSTON, Massachusetts: A Turkish graduate student from Tufts University, whose immigration officials detained near her Massachusetts...

Governors scrap meeting as Trump excludes Democrats from White House

WASHINGTON, D.C.: After the White House excluded Democratic governors from a meeting with President Donald Trump later this month,...

Wisconsin

SectionGovernors scrap meeting as Trump excludes Democrats from White House

WASHINGTON, D.C.: After the White House excluded Democratic governors from a meeting with President Donald Trump later this month,...

Giannis Antetokounmpo says he is 'committed to the Milwaukee Bucks'

(Photo credit: Jeff Hanisch-Imagn Images) Giannis Antetokounmpo is once again a committed Milwaukee Buck. For now. 'As of today,...

Women's Top 25 roundup: No. 3 South Carolina holds off No. 6 LSU

(Photo credit: Jovanny Hernandez / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Tessa Johnson scored a season-high...

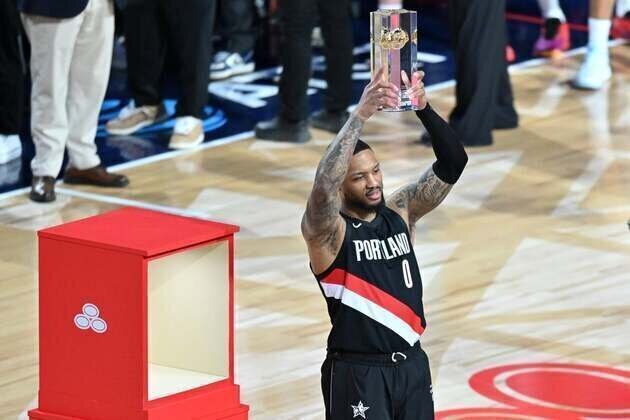

Keshan Johnson wins dunk contest; Damian Lillard wins 3rd 3-point contest

(Photo credit: William Liang-Imagn Images) INGLEWOOD, Calif. - Keshad Johnson of the Miami Heat has not started a game this season,...

Damian Lillard wins 3-point Contest for 3rd time, ties Larry Bird

(Photo credit: William Liang-Imagn Images) INGLEWOOD, Calif. -- Damian Lillard has not played a minute on the court for the Portland...

Women's Top 25 roundup: No. 1 UConn rolls past Marquette

(Photo credit: Jovanny Hernandez / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Azzi Fudd scored 25 points and...