Nasdaq Dubai posts strongest year on record with outstanding Sukuk value surpassing US$100 billion

WAM

16 Feb 2026, 16:58 GMT+10

DUBAI, 16th February, 2026 (WAM) -- Nasdaq Dubai attracted a record number of Sukuk listings in 2025, supported by sustained issuance activity from regional and international issuers and continued global investor demand for Sharia-compliant debt instruments.

By the end of 2025, the total value of outstanding debt securities listed across Dubai Financial Market (DFM) and Nasdaq Dubai reached US$150.9 billion, with Nasdaq Dubai accounting for US$146.1 billion of the total.

The exchange's Sukuk market has expanded significantly over the past decade, with the value of outstanding listings increasing eightfold since 2013, from US$12.6 billion to more than US$100 billion. Since inception, Nasdaq Dubai has hosted more than US$245 billion in cumulative bonds and Sukuk issuances, including US$177 billion in Sukuk.

The growth aligns with the United Arab Emirates' National Strategy for Islamic Finance and Halal Industry, which targets Islamic banking assets of AED2.56 trillion and aims to increase Sukuk listings to more than AED660 billion domestically and AED395 billion internationally by 2031.

In 2025, Nasdaq Dubai recorded US$30.6 billion in new debt listings across 60 issuances, marking record levels of strong and diversified listings activity. Debuts from Ajman Bank, OMNIYAT, Mashreq, China Development Bank and the New Development Bank, alongside repeat issuances under established programmes, further strengthened the exchange's continued appeal to sovereign, supranational, financial and corporate issuers.

Sovereign and government-related issuers continued to represent a significant share of activity during the year. Issuances by the Republic of Indonesia, the UAE Federal Government, and the governments of Ras Al Khaimah and Sharjah reinforced Dubai's standing as a trusted gateway for global capital flows. Corporate and financial institution issuers also listed a diverse range of instruments, spanning conventional bonds, Sukuk, Additional Tier 1 capital securities, and sustainability-linked structures, highlighting the depth and flexibility of Nasdaq Dubai's fixed income market.

Nasdaq Dubai advanced its position as a regional leader in sustainable finance during 2025. By year-end, the total outstanding value of ESG-linked debt instruments listed on the exchange reached US$30.08 billion across 41 issuances. This included:

US$18.38 billion in green bonds across 27 issuances

US$9.05 billion in sustainability bonds across 9 issuances

US$2.55 billion in sustainability-linked bonds across 4 issuances

US$100 million blue bond across 1 issuance

Global Gateway for International Issuers

Global issuer participation has been a defining pillar of Nasdaq Dubai's growth. Over the years, the exchange has attracted landmark debt listings from sovereign, supranational and institutional issuers across Asia and the Middle East, reflecting sustained international confidence in its market infrastructure. Sovereign issuers such as the Governments of Indonesia, Turkey, China, Hong Kong, Philippines, and supranationals including Islamic Development Bank, Islamic Corporation for the Development of the Private Sector and New Development Bank as well as a Policy Bank like China Development Bank, have chosen Nasdaq Dubai as their listing venue, underscoring its role as a trusted international gateway for cross-border debt and sukuk issuance.

Abdul Wahed Al Fahim, Chairman of Nasdaq Dubai, said, "2025 has been a milestone year for Nasdaq Dubai. Surpassing US$100 billion in outstanding Sukuk listings and achieving record levels of debt issuance reflects the strong confidence placed in our market by issuers and investors worldwide. These milestones underscore Dubai's position as a trusted, globally connected hub for Islamic finance, fixed income and sustainable investment."

Hamed Ali, CEO of Nasdaq Dubai and Dubai Financial Market (DFM), said, "Crossing US$100 billion in outstanding Sukuk listings is a landmark achievement for Nasdaq Dubai and reflects the strong and sustained confidence of international and domestic issuers in our market. This momentum was supported in 2025 by US$30.6 billion in new debt listings across 60 issuances, underscoring our role as a leading international listing venue for Sukuk and fixed income instruments. As we look ahead, our focus remains on deepening global connectivity, expanding multi-currency and ESG Sukuk offerings, and attracting new issuers from emerging and frontier markets."

Building on a record-breaking year and historic milestones achieved in 2025, Nasdaq Dubai enters 2026 with continued activity across Sukuk, ESG and multi-currency debt instruments. The exchange remains focused on supporting issuers and investors through a diversified fixed income offering, contributing to Dubai's capital markets ecosystem and reinforcing Dubai's position as a leading global hub for fixed income and Islamic finance.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionFebruary 2027 will be date for Trump’s defamation case against BBC

LONDON, U.K.: Rejecting an attempt by the British Broadcasting Corporation to delay proceedings, a U.S. judge announced on February...

Family of Indian girl runover by Seattle officer paid $29 million

SEATTLE, Washington: The city of Seattle paid US$29 million to the family of a 23-year-old graduate student from India, who was struck...

Teen daughter of North Korean leader emerging as country’s future head

SEOUL, South Korea: The teenage daughter of North Korean leader Kim Jong Un is close to being designated as the country's future leader,...

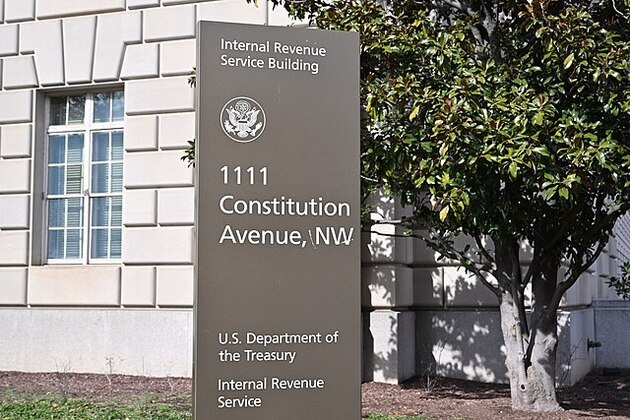

Court filing reveals IRS shared data with DHS in error

WASHINGTON, D.C.: The Internal Revenue Service mistakenly shared the taxpayer information of thousands of people with the Department...

Deportation of Tufts graduate student from Turkey stopped by US court

BOSTON, Massachusetts: A Turkish graduate student from Tufts University, whose immigration officials detained near her Massachusetts...

Governors scrap meeting as Trump excludes Democrats from White House

WASHINGTON, D.C.: After the White House excluded Democratic governors from a meeting with President Donald Trump later this month,...

Wisconsin

SectionGovernors scrap meeting as Trump excludes Democrats from White House

WASHINGTON, D.C.: After the White House excluded Democratic governors from a meeting with President Donald Trump later this month,...

Giannis Antetokounmpo says he is 'committed to the Milwaukee Bucks'

(Photo credit: Jeff Hanisch-Imagn Images) Giannis Antetokounmpo is once again a committed Milwaukee Buck. For now. 'As of today,...

Women's Top 25 roundup: No. 3 South Carolina holds off No. 6 LSU

(Photo credit: Jovanny Hernandez / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Tessa Johnson scored a season-high...

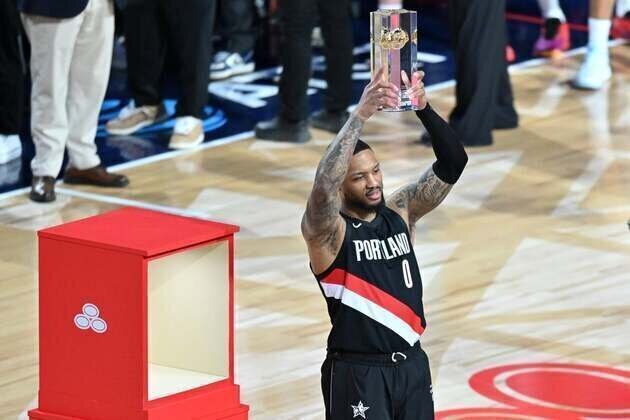

Keshan Johnson wins dunk contest; Damian Lillard wins 3rd 3-point contest

(Photo credit: William Liang-Imagn Images) INGLEWOOD, Calif. - Keshad Johnson of the Miami Heat has not started a game this season,...

Damian Lillard wins 3-point Contest for 3rd time, ties Larry Bird

(Photo credit: William Liang-Imagn Images) INGLEWOOD, Calif. -- Damian Lillard has not played a minute on the court for the Portland...

Women's Top 25 roundup: No. 1 UConn rolls past Marquette

(Photo credit: Jovanny Hernandez / Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Azzi Fudd scored 25 points and...