Revised global tax pact exempts American firms after G7 talks

Anabelle Colaco

08 Jan 2026, 01:05 GMT+10

- A long-running global effort to curb corporate tax avoidance has taken a new turn, with the world’s biggest economies agreeing to shield U.S. multinationals from paying higher taxes overseas under a revised international deal

- The Organisation for Economic Co-operation and Development said on January 5 that nearly 150 countries had signed off on an amended version of its global tax agreement

- Under the revised framework, large U.S.-based multinational corporations are excluded from the 15 percent global minimum corporate tax, following negotiations between the administration of U.S. President Donald Trump and other members of the Group of Seven wealthy nations

WASHINGTON, D.C.: A long-running global effort to curb corporate tax avoidance has taken a new turn, with the world's biggest economies agreeing to shield U.S. multinationals from paying higher taxes overseas under a revised international deal.

The Organisation for Economic Co-operation and Development said on January 5 that nearly 150 countries had signed off on an amended version of its global tax agreement, first crafted in 2021 to prevent large companies from shifting profits to low-tax jurisdictions regardless of where they operate.

Under the revised framework, large U.S.-based multinational corporations are excluded from the 15 percent global minimum corporate tax, following negotiations between the administration of U.S. President Donald Trump and other members of the Group of Seven wealthy nations.

OECD Secretary-General Mathias Cormann described the outcome as a "landmark decision in international tax co-operation" that "enhances tax certainty, reduces complexity, and protects tax bases," according to a statement.

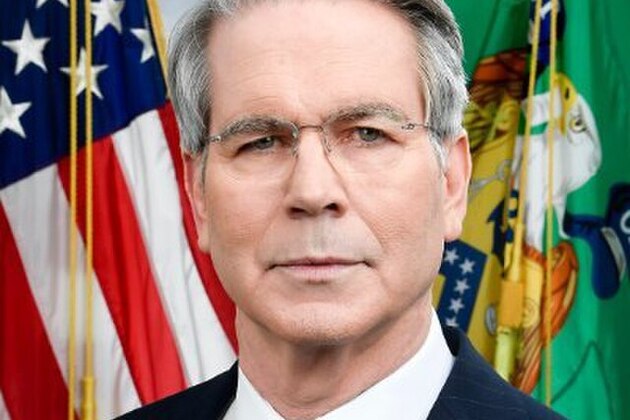

U.S. Treasury Secretary Scott Bessent hailed the agreement as "a historic victory in preserving U.S. sovereignty and protecting American workers and businesses from extraterritorial overreach."

The latest deal significantly softens the original 2021 agreement, which established a minimum global corporate tax rate of 15 percent. That plan was designed to stop multinational companies — including Apple and Nike — from using accounting structures and legal strategies to shift profits to low- or no-tax jurisdictions.

Such jurisdictions often include places like Bermuda and the Cayman Islands, where companies typically conduct little or no actual business but benefit from minimal tax rates.

Former U.S. Treasury Secretary Janet Yellen was a central architect of the 2021 OECD deal and made the global minimum tax one of her top policy priorities. At the time, congressional Republicans strongly opposed the plan, arguing it would weaken U.S. competitiveness in the global economy.

The Trump administration revisited the agreement in June after congressional Republicans rolled back a so-called "revenge tax" provision in Trump's sweeping tax and spending legislation. That provision would have allowed the U.S. government to impose taxes on companies with foreign owners and on investors from countries deemed to levy "unfair foreign taxes" on U.S. firms.

While Republicans applauded the revised deal, tax transparency advocates criticised the changes, arguing they undermine years of progress.

"This deal risks nearly a decade of global progress on corporate taxation only to allow the largest, most profitable American companies to keep parking profits in tax havens," said Zorka Milin, policy director at the FACT Coalition, a tax transparency nonprofit.

Tax watchdog groups say the global minimum tax was intended to halt an international "race to the bottom," in which countries compete to attract multinational profits by offering ever-lower corporate tax rates.

Republican lawmakers, however, welcomed the outcome. Senate Finance Committee Chair Mike Crapo of Idaho and House Ways and Means Committee Chair Jason Smith of Missouri said in a joint statement: "Today marks another significant milestone in putting America First and unwinding the Biden Administration's unilateral global tax surrender."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionAnonymous Polymarket trader nets $400,000 after Venezuela shock

NEW YORK CITY, New York: A little-known trader is drawing attention after a speculative wager tied to the fate of Venezuela's president...

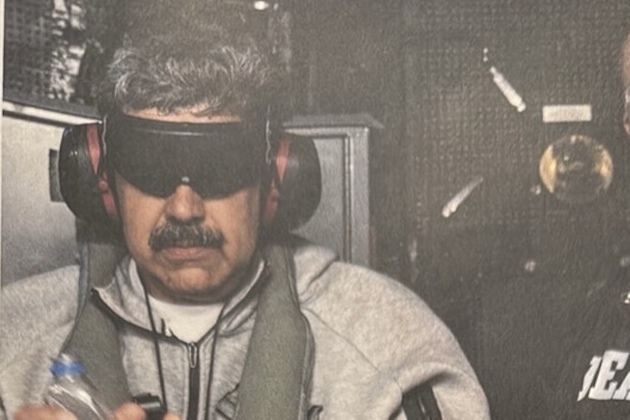

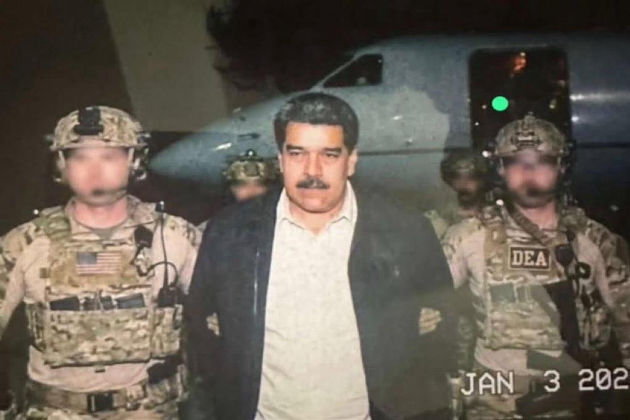

Venezuelans pick up the pieces a day after US forces abduct Maduro

CARACAS, Venezuela: A little over a day after U.S. forces stormed the capital and whisked President Nicolás Maduro and his wife from...

Flights across Greece halted after radio frequencies collapse

ATHENS, Greece: Airport operations across Greece came to a virtual standstill for several hours following the collapse of radio frequencies...

Washington links debt recovery to fresh investment in Venezuelan oil

WASHINGTON, D.C.: Washington has delivered a blunt message to U.S. oil companies weighing a return to Venezuela: any chance of recovering...

Pilot removed from Air India jet after failing breath tests

NEW DELHI, India: Canadian aviation authorities have asked Air India to investigate an incident in which a pilot was removed from a...

Journalists, YouTubers among seven given life terms in Pakistan

ISLAMABAD, Pakistan: Seven people, including three journalists, two YouTubers, and two retired army officers, were sentenced to life...

Wisconsin

SectionSome US Supreme Court justices not enthused by Trump’s tariffs

WASHINGTON, D.C.: U.S. President Donald Trump's ability to unilaterally impose far-reaching tariffs has given rise to skepticism among...

Millions face steep health premium hikes after tax credits expire

NEW YORK CITY, New York: Millions of Americans are beginning 2026 facing sharply higher health insurance bills after enhanced Affordable...

Mavs halt road skid, increase Kings' losing streak to 6

(Photo credit: Cary Edmondson-Imagn Images) Brandon Williams connected on the go-ahead 3-pointer in the final minute and scored 14...

Wisconsin blitzes UCLA early, bounces back for Big 10 triumph

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Nick Boyd scored 20 points and Nolan...

Warriors resume homestand vs. Giannis Antetokounmpo, Bucks

(Photo credit: Jim Dedmon-Imagn Images) Golden State Warriors fans will get a look at the prize atop their trade-deadline wish list...

Kings F Keegan Murray (ankle) out 3-4 weeks

(Photo credit: Joe Camporeale-Imagn Images) Sacramento Kings forward Keegan Murray is expected to be sidelined three-to-four weeks...