U.S. stock markets end mixed, Dow Jones drops 466 points

Lola Evans

08 Jan 2026, 02:37 GMT+10

- “What’s happened in South America hasn’t changed the prospect for growth in the U.S. from an equity market standpoint."

- The markets appear to have taken in their stride talk of the U.S. 'acquiring' Greenland, and its airstrikes on Caracas on the weekend, and its abduction of Venezuelan President Maduro.

- "There's some complacency from appreciating the overall geopolitical risks that are growing, in our opinion, but we don't feel like what's happening in Venezuela has moved the needle in that regard up or down."

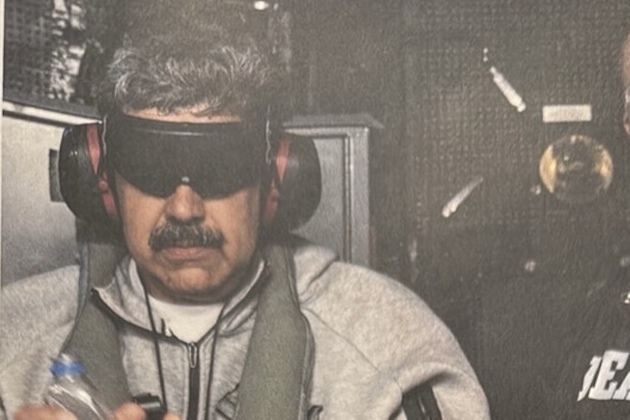

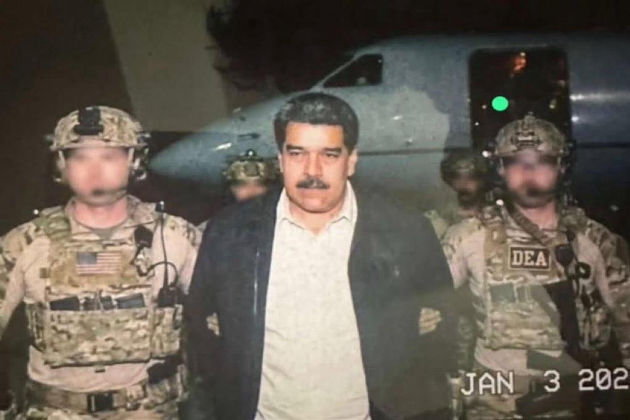

NEW YORK, New York - U.S. stock markets pulled back after the Dow Jones and S&P 500 notched up new all-time highs a day earlier. On Wednesday investors and traders preferred to sell stocks, booking profits, while looking ahead. The markets appear to have taken in their stride talk of the U.S. 'acquiring' Greenland, and its airstrikes on Caracas and other Venezuelan states on the weekend, and its abduction of Venezuelan President Nicolas Maduro and his wife.

"What's happened in South America hasn't changed the prospect for growth in the U.S. from an equity market standpoint," Keith Buchanan, senior portfolio manager at Globalt Investments told CNBC Wednesday.

"I think there's some complacency from appreciating the overall geopolitical risks that are growing, in our opinion, but we don't feel like what's happening in Venezuela has moved the needle in that regard up or down," Buchanan said. "We just feel like we're still in a tinderbox."

In the end, U.S. equity markets delivered a split performance on Wednesday, with technology strength propping up the Nasdaq Composite while the Dow Jones Industrial Average and S&P 500 ended the session in negative territory.

The benchmark S&P 500 (^GSPC) declined 23.87 points, or 0.34 percent, to close at 6,920.95.

The sell-off was broader in the blue-chip Dow Jones Industrial Average (^DJI), which fell 466.00 points, a loss of 0.94 percent, finishing the day at 48,996.08.

In contrast, the tech-heavy NASDAQ Composite (^IXIC) managed a modest advance, adding 37.10 points, or 0.16 percent, to end at 23,584.28. The gain suggested resilient investor appetite for major technology names, which helped offset weakness in other sectors.

Market analysts attributed the divergent performance to shifting sector rotations and investor caution ahead of key economic data. While megacap technology stocks found support, other segments of the market, particularly industrials and financials, faced selling pressure, dragging the Dow and S&P lower.

"The market is taking a breather here, with investors locking in profits after a strong run and reassessing valuations," said one portfolio manager. "The Nasdaq's ability to stay positive is a sign that the growth narrative isn't dead, but the broader weakness indicates some near-term risk aversion."

Traders are now looking ahead to upcoming corporate earnings and inflation readings for clearer signals on the market's next directional move.

Key Wednesday Closing Figures:

-

S&P 500: 6,920.95 | -23.87 | -0.34 percent

-

Dow Jones Industrial Average: 48,996.08 | -466.00 | -0.94 percent

-

NASDAQ Composite: 23,584.28 | +37.10 | +0.16 percent

U.S. Dollar Shows Mixed Performance in Wednesday Trading as Euro Holds Near Key Level

The U.S. dollar traded higher against major rivals in Wednesday's foreign exchange session, firming against commodity-linked currencies and the Japanese yen while edging up against the Euro and the British Pound.

The Euro (EUR/USD) was a focal point, holding just above the 1.1680 level. The single currency edged down 0.06 percent on the day to buy $1.1681. Analysts noted the pair remained within a tight range as markets assessed diverging central bank outlooks between the European Central Bank and the Federal Reserve.

The British Pound (GBP/USD) saw more pronounced weakness, falling 0.26 percent to settle at $1.3464. The move lower came despite broader dollar softness against European peers, highlighting specific sterling pressures.

The greenback also gained ground against traditional safe-haven and commodity currencies Wednesday. The U.S. dollar (USD/JPY) rose 0.11 percent to 156.76 Japanese yen, continuing its ascent toward recent multi-decade highs. The U.S. dollar (USD/CHF) also advanced, climbing 0.22 percent to 0.7973 Swiss francs.

The dollar's strength was most evident against its Canadian counterpart. The U.S. dollar (USD/CAD) jumped 0.29 percent to C$1.3853, supported by stabilizing crude oil prices and broader market sentiment.

The commodity-linked Australian dollar (AUD/USD) declined 0.20 percent to $0.6723. The New Zealand dollar (NZD/USD) followed suit, softening 0.16 percent to $0.5774, as risk appetite in Asian-Pacific markets showed signs of fatigue.

Key Wednesday Foreign Exchange Rates:

-

EUR/USD: 1.1681 | -0.06 percent

-

USD/JPY: 156.76 | +0.11 percent

-

USD/CAD: 1.3853 | +0.29 percent

-

GBP/USD: 1.3464 | -0.26 percent

-

USD/CHF: 0.7973 | +0.22 percent

-

AUD/USD: 0.6723 | -0.20 percent

-

NZD/USD: 0.5774 | -0.16 percent

Global Markets Paint Mixed Picture on Wednesday; Europe and Asia-Pacific Show Divergence

Global equity indices delivered a mixed performance in Wednesday's trading session, with European markets showing resilience while several major Asian benchmarks closed lower amid lingering economic concerns.

The UK's FTSE 100 was a laggard, falling 74.52 points, or 0.74 percent, to settle at 10,048.21. The broader Euronext 100 Index declined 0.44 percent to 1,758.88.

Canada's main benchmark followed the downward trend. The S&P/TSX Composite index (^GSPTSE) fell sharply, losing 271.53 points, or 0.84 percent, to settle at 32,135.49.

In Europe, Germany's DAX P was a standout performer, climbing 230.06 points, or 0.92 percent, to close at 25,122.26. Belgium's BEL 20 also posted solid gains, rising 0.73 percent to finish at 5,220.95. The pan-European EURO STOXX 50 I saw a modest decline of 0.14 percent to 5,923.57. France's CAC 40 was nearly flat, edging down just 0.04 percent to 8,233.92.

The Asia-Pacific region presented a fragmented landscape. Australia's S&P/ASX 200 gained 0.15 percent to 8,695.60, while the broader ALL ORDINARIES rose 0.23 percent to 9,018.00. New Zealand's S&P/NZX 50 INDEX advanced 0.38 percent to 13,715.02. South Korea's KOSPI Composite Index added 0.57 percent, closing at 4,551.06.

However, gains were offset by significant losses elsewhere. Japan's Nikkei 225 fell sharply, down 556.10 points or 1.06 percent to 51,961.98. Hong Kong's HANG SENG INDEX dropped 0.94 percent to 26,458.95. Taiwan's TWSE index declined 0.46 percent to 30,435.47.

Other major Asian indices saw modest movements. India's S&P BSE SENSEX dipped 0.12 percent to 84,961.14. Singapore's STI Index inched up 0.16 percent to 4,747.62.

Indonesia's IDX COMPOSITE rose 0.13 percent, and Malaysia's FTSE Bursa Malaysia KLCI gained 0.27 percent.

In the Middle East and Africa, Israel's TA-125 was virtually unchanged, up a mere 0.08 percent. Egypt's EGX 30 was a notable outperformer, surging 2.13 percent. In South Africa the Top 40 USD Net TRI Index fell 1.36 percent.

Key Wednesday Closing Figures:

-

^FTSE (FTSE 100): 10,048.21 | -74.52 | -0.74 percent

-

^GDAXI (DAX P): 25,122.26 | +230.06 | +0.92 percent

-

^FCHI (CAC 40): 8,233.92 | -3.51 | -0.04 percent

-

^STOXX50E (EURO STOXX 50 I): 5,923.57 | -8.22 | -0.14 percent

-

^N100 (Euronext 100): 1,758.88 | -7.73 | -0.44 percent

-

^BFX (BEL 20): 5,220.95 | +38.08 | +0.73 percent

-

S&P/TSX Composite: 32,135.49 | -271.53 | -0.84 percent

-

HANG SENG INDEX: 26,458.95 | -251.50 | -0.94 percent

-

^STI (STI Index): 4,747.62 | +7.65 | +0.16 percent

-

^AXJO (S&P/ASX 200): 8,695.60 | +12.80 | +0.15 percent

-

^AORD (ALL ORDINARIES): 9,018.00 | +21.10 | +0.23 percent

-

^BSESN (S&P BSE SENSEX): 84,961.14 | -102.20 | -0.12 percent

-

^JKSE (IDX COMPOSITE): 8,944.81 | +11.20 | +0.13 percent

-

^KLSE (FTSE Bursa Malaysia KLCI): 1,676.83 | +4.48 | +0.27 percent

-

^NZ50 (S&P/NZX 50): 13,715.02 | +51.42 | +0.38 percent

-

^KS11 (KOSPI): 4,551.06 | +25.58 | +0.57 percent

-

^TWII (TWSE): 30,435.47 | -140.83 | -0.46 percent

-

^TA125.TA (TA-125): 3,893.87 | +3.07 | +0.08 percent

-

^CASE30 (EGX 30): 41,543.50 | +866.50 | +2.13 percent

-

^JN0U.JO (Top 40 USD): 7,184.65 | -99.15 | -1.36 percent

-

^N225 (Nikkei 225): 51,961.98 | -556.10 | -1.06 percen

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related stories:

Tuesday 6 January 2026 | Dow Jones and S&P 500 notch up new record highs Tuesday | Big News Network.com

Monday 5 January January 2026 | Dow Jones gains 595 points, oil stocks surge after Venezuela coup | Big News Network.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionAnonymous Polymarket trader nets $400,000 after Venezuela shock

NEW YORK CITY, New York: A little-known trader is drawing attention after a speculative wager tied to the fate of Venezuela's president...

Venezuelans pick up the pieces a day after US forces abduct Maduro

CARACAS, Venezuela: A little over a day after U.S. forces stormed the capital and whisked President Nicolás Maduro and his wife from...

Flights across Greece halted after radio frequencies collapse

ATHENS, Greece: Airport operations across Greece came to a virtual standstill for several hours following the collapse of radio frequencies...

Washington links debt recovery to fresh investment in Venezuelan oil

WASHINGTON, D.C.: Washington has delivered a blunt message to U.S. oil companies weighing a return to Venezuela: any chance of recovering...

Pilot removed from Air India jet after failing breath tests

NEW DELHI, India: Canadian aviation authorities have asked Air India to investigate an incident in which a pilot was removed from a...

Journalists, YouTubers among seven given life terms in Pakistan

ISLAMABAD, Pakistan: Seven people, including three journalists, two YouTubers, and two retired army officers, were sentenced to life...

Wisconsin

SectionSome US Supreme Court justices not enthused by Trump’s tariffs

WASHINGTON, D.C.: U.S. President Donald Trump's ability to unilaterally impose far-reaching tariffs has given rise to skepticism among...

Millions face steep health premium hikes after tax credits expire

NEW YORK CITY, New York: Millions of Americans are beginning 2026 facing sharply higher health insurance bills after enhanced Affordable...

Packers placing WR/CB Bo Melton on IR, ruled out for playoffs

(Photo credit: Sarah Kloepping/USA TODAY NETWORK-Wisconsin / USA TODAY NETWORK via Imagn Images) The Green Bay Packers' versatile...

Mavs halt road skid, increase Kings' losing streak to 6

(Photo credit: Cary Edmondson-Imagn Images) Brandon Williams connected on the go-ahead 3-pointer in the final minute and scored 14...

Wisconsin blitzes UCLA early, bounces back for Big 10 triumph

(Photo credit: Mark Hoffman/Milwaukee Journal Sentinel / USA TODAY NETWORK via Imagn Images) Nick Boyd scored 20 points and Nolan...

Warriors resume homestand vs. Giannis Antetokounmpo, Bucks

(Photo credit: Jim Dedmon-Imagn Images) Golden State Warriors fans will get a look at the prize atop their trade-deadline wish list...