Gold, oil and metals tumble after Warsh named next Fed chair

Anabelle Colaco

04 Feb 2026, 10:22 GMT+10

- A broad selloff swept through global commodities markets on Monday, dragging down prices of precious metals, energy, and industrial raw materials as investors reassessed risk following a shift in expectations for U.S. monetary policy

- Gold fell about five percent to its lowest level in more than two weeks, extending losses after both gold and silver hit record highs last week

- Silver slid more than seven percent, while oil prices dropped nearly five percent, retreating from multi-month highs

SINGAPORE: A broad selloff swept through global commodities markets on Monday, dragging down prices of precious metals, energy, and industrial raw materials as investors reassessed risk following a shift in expectations for U.S. monetary policy.

Gold fell about five percent to its lowest level in more than two weeks, extending losses after both gold and silver hit record highs last week. Silver slid more than seven percent, while oil prices dropped nearly five percent, retreating from multi-month highs. On the London Metal Exchange, copper declined around three percent.

The moves came after U.S. President Donald Trump selected Kevin Warsh to succeed Jerome Powell as head of the Federal Reserve in May, triggering a broad retreat from risk assets late last week and a lift in the U.S. dollar.

"The decision by markets to sell precious metals alongside U.S. equities suggests investors view Warsh as more hawkish," said Vivek Dhar, a commodities strategist at Commonwealth Bank of Australia.

A more hawkish Federal Reserve stance signals interest rates are likely to stay higher for longer, boosting the dollar and raising the opportunity cost of holding non-yielding assets such as gold and silver, dampening their appeal.

"A stronger U.S. dollar is also adding pressure on precious metals and other commodities, including oil and base metals," Dhar added, while noting he is still sticking with a gold price forecast of US$6,000 in the fourth quarter.

Asian equities tracked Wall Street futures lower, as the rout in precious metals set a jittery tone at the start of a week packed with central bank meetings, corporate earnings, and key economic data releases.

Selling pressure intensified after CME Group raised margin requirements on its metal futures contracts, effective from market close on February 2.

Higher margin requirements are typically bearish for affected contracts, as they increase capital costs for traders, curb speculative activity, reduce liquidity, and often force leveraged investors to unwind positions.

The slide began on January 30, when spot gold posted its steepest one-day decline since 1983, plunging more than nine percent. Silver fared even worse, tumbling 27 percent in its most significant daily fall on record.

"The scale of the unwind unfolding in gold today is something I haven't witnessed since the dark days of the 2008 global financial crisis," said IG market analyst Tony Sycamore.

He pointed to leveraged positions being flushed out, cascading stop-loss orders, and panic selling as hallmarks of the sharp moves.

Energy markets were also under pressure on February 2, partly due to easing geopolitical concerns. Prices retreated after Trump said over the weekend that Iran was "seriously talking" with Washington, lowering fears of conflict involving the OPEC member.

Those remarks, along with reports that Iran's Revolutionary Guards had no plans for live-fire exercises in the Strait of Hormuz, pointed to signs of de-escalation, Sycamore said.

Industrial metals faced additional headwinds from high inventories and soft demand ahead of the Lunar New Year holiday in China, the world's largest consumer of metals. Copper and iron ore prices weakened as buyers scaled back activity in the run-up to the break, which begins on February 15.

End-user demand and transaction volumes are expected to remain subdued before the holiday, analysts said.

Elsewhere in commodities markets, Tokyo rubber fell nearly three percent, while Chicago wheat and soybeans declined by about one percent.

"The key question is whether this marks the start of a structural downturn in commodity prices or merely a correction," Dhar said. "We see it as a correction and a buying opportunity rather than a fundamental shift.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

SectionJournalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

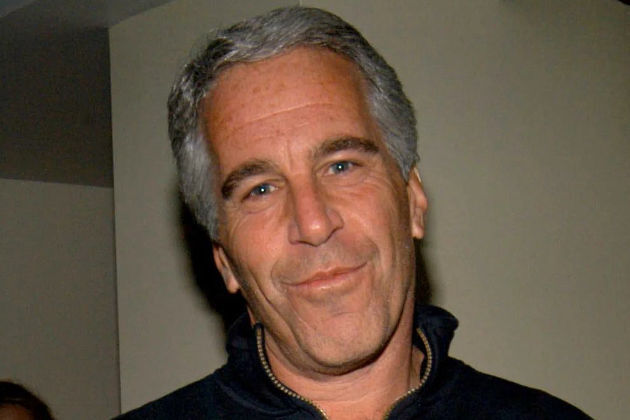

Epstein files dig up links to America’s wealthy and powerful

WASHINGTON, D.C.: A massive new tranche of files on millionaire financier and sex offender Jeffrey Epstein, released on January 30,...

After vape ban, cartels tighten control of Mexico’s e-cig market

MEXICO CITY, Mexico: Mexico's sweeping ban on electronic cigarettes is reshaping the country's vape market, driving legal sellers underground...

Israel, Saudi Arabia to receive weapons worth $15.67 billion from US

WASHINGTON, D.C: The Trump administration has approved a massive new series of arms sales to Israel totaling US$6.67 billion and to...

Kennedy Center screens Melania documentary before release worldwide

WASHINGTON, D.C.: First Lady Melania Trump capped her first year back in the White House with the global release of a documentary she...

11 members of Myanmar-based group executed by China

BANGKOK, Thailand: Eleven people who killed 14 Chinese citizens, and ran a financial scam and gambling operations worth more than US$1...

Wisconsin

SectionJournalist Don Lemon held for violating federal civil rights, released

LOS ANGELES, California: Journalist Don Lemon was released from custody on January 30 after being arrested and charged with violating...

Immigration crackdown could play role in midterms, Republicans feel

WASHINGTON, D.C.: With midterm elections looming, many Republicans fear that immigration enforcement by the Trump administration, which...

Amazon exits Go and Fresh stores to focus on delivery, Whole Foods

NEW YORK CITY, New York: Amazon is reshaping its brick-and-mortar grocery strategy, announcing it will shut down all Amazon Go and...

Celtics ride Jaylen Brown, clamp down on Mavericks

(Photo credit: Kevin Jairaj-Imagn Images) Jaylen Brown posted 33 points and 11 rebounds as the Boston Celtics extended their winning...

Bucks pound Bulls team in transition after trades

(Photo credit: Michael McLoone-Imagn Images) Kyle Kuzma scored 31 and grabbed 10 boards to lead the Milwaukee Bucks to a dominant...

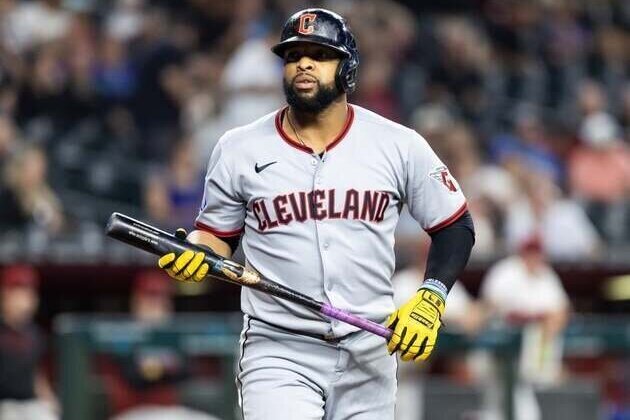

Reports: Diamondbacks signing veteran 1B Carlos Santana

(Photo credit: Mark J. Rebilas-Imagn Images) The Arizona Diamondbacks are signing free agent first baseman Carlos Santana to a one-year,...