Tech stocks dive, lead broader market lower

Lola Evans

04 Feb 2026, 02:38 GMT+10

- The Dow Jones Industrial Average declined 166.67 points, or 0.34 percent, closing at 49,240.99.

- The broader Standard and Poor's 500 (^GSPC) fell significantly, dropping 58.63 points (a loss of 0.84 percent) to finish the session at 6,917.81.

- The tech-heavy NASDAQ Composite (^IXIC) bore the brunt of the selling pressure Tuesday, tumbling 336.92 points, or 1.43 percent, to close at 23,255.19.

NEW YORK, New York - Wall Street finished well in the red on Tuesday as investors bailed out of tehnology stocks. The losses came despite a resolution in Congress to end the government shutdown.

"I think we have one or two of these periods every year. The cause is always different, but the effect is always the same. Some of the most popular trades of the previous uptrend just get absolutely nuked," Josh Brown, CEO of Ritholtz Wealth Management, told CNBC Tuesday.

"It tells you risk appetite is coming out of anything that has to do with technology," he said.

The tech-heavy NASDAQ Composite (^IXIC) bore the brunt of the selling pressure Tuesday, tumbling 336.92 points, or 1.43 percent, to close at 23,255.19.

The broader Standard and Poor's 500 (^GSPC) also fell significantly, dropping 58.63 points (a loss of 0.84 percent) to finish the session at 6,917.81.

The Dow Jones Industrial Average (^DJI) demonstrated relative resilience but still ended in negative territory. The blue-chip index declined 166.67 points, or 0.34 percent, closing at 49,240.99.

"Today's action was a classic rotation out of high-growth technology names, which have led the rally for months," said a chief market strategist. "Investors are showing caution ahead of key earnings reports and economic data, pulling money from the most sensitive sectors."

U.S. Dollar Weakens Against Major Rivals as Commodity Currencies Rally on Monday

The U.S. dollar faced broad-based selling pressure on Tuesday's foreign exchange session, notably falling against commodity-linked currencies as investors shifted away from the greenback.

The euro and British pound both posted moderate gains. The Euro/US Dollar (EURUSD) pair rose 0.21 percent, exchanging at 1.1814.

Similarly, the British Pound/US Dollar (GBPUSD) pair advanced 0.21 percent to tlast rade at 1.3691.

The most significant movements came from the Australasian currencies. The Australian Dollar/US Dollar (AUDUSD) pair was a standout performer, surging 0.97 percent to 0.7013. The New Zealand Dollar/US Dollar (NZDUSD) pair also recorded a strong gain, increasing 0.84 percent to 0.6048.

"The sharp appreciation in the Aussie and Kiwi points to a return of risk appetite and a reassessment of the global growth outlook, which typically weighs on the US dollar's safe-haven appeal," noted a senior currency strategist.

The dollar managed a slight gain against the Japanese yen, with the US Dollar/Japanese Yen (USDJPY) pair inching up 0.11 percent to 155.76.

However, the greenback lost ground against its North American counterpart and the Swiss franc. The US Dollar/Canadian Dollar (USDCAD) pair declined 0.30 percent to 1.3639. The US Dollar/Swiss Franc (USDCHF) pair experienced the day's largest drop, falling 0.53 percent to 0.7754.

Analysts suggest the dollar's mixed performance reflects ongoing adjustments to interest rate expectations among major global central banks, with commodity-driven economies perceived to have a firmer growth trajectory in the near term. Market participants are now awaiting key US economic data later in the week for further direction.

Stocks in Asia Pacific and Emerging Markets Surge While European Indices Stagnate on Tuesday

The broader global equity markets presented a split picture on Tuesday, with strong rallies across Asia Pacific, Canada, and emerging markets contrasting with muted, mostly negative performances in Europe.

The UK's FTSE 100 (^FTSE) closed at 10,314.59, declining 26.97 points, or 0.26 percent.

European Indices Dip at Close

The trading session in Europe ended with major benchmarks slightly in the red. Germany's DAX P (^GDAXI) finished at 24,780.79, down 16.73 points, a loss of 0.07 percent. France's CAC 40 (^FCHI) saw a marginal decrease, ending at 8,179.50, down 1.67 points or 0.02 percent.

Broader European indices followed suit. The EURO STOXX 50 I (^STOXX50E) fell 12.16 points to 5,995.35, a drop of 0.20 percent. The Euronext 100 Index (^N100) closed at 1,780.59, down 2.77 points or 0.16 percent. Belgium's BEL 20 (^BFX) was a notable exception in the region, gaining 40.19 points to 5,499.51, an increase of 0.74 percent.

Canadian Markets Rally Tuesday

In contrast, the S&P/TSX Composite index (^GSPTSE) in Toronto rallied, gaining 204.72 points. This represented an increase of 0.64 percent, closing the day at 32,388.60. The index was bolstered by strength in its heavyweight energy and materials sectors, which benefited from firmer commodity prices.

Asia Pacific and Emerging Markets Rally

Performance was decisively stronger in the East and in emerging economies. In Japan the Nikkei 225 (^N225) posted a substantial gain of 2,065.48 points, increasing 3.92 percent to close Tuesday at 54,720.66.

Hong Kong's HANG SENG INDEX (^HSI) rose 59.20 points to 26,834.77, up 0.22 percent. Singapore's STI Index (^STI) advanced 51.82 points, or 1.06 percent, closing at 4,944.09. China's SSE Composite Index (000001.SS) rose 1.29 percent to 4,067.74.

Australia's markets posted solid gains. The S&P/ASX 200 (^AXJO) climbed 78.50 points (0.89 percent) to 8,857.10, while the broader ALL ORDINARIES (^AORD) gained 80.50 points, also up 0.89 percent, to 9,149.30.

The most dramatic gains on Tuesday were seen in several emerging markets. India's S&P BSE SENSEX (^BSESN) soared by 2,072.67 points, a jump of 2.54 percent, closing at 83,739.13. Indonesia's IDX COMPOSITE (^JKSE) surged 199.87 points, or 2.52 percent, to 8,122.60. Malaysia's FTSE Bursa Malaysia KLCI (^KLSE) added 7.38 points, rising 0.42 percent to 1,748.26.

New Zealand's S&P/NZX 50 INDEX (^NZ50) inched up 9.08 points, a gain of 0.07 percent, to finish at 13,421.52.

Notable Standout Performances

Several markets recorded exceptional single-day gains. South Korea's KOSPI Composite Index (^KS11) exploded higher by 338.41 points, an extraordinary gain of 6.84 percent, to end at 5,288.08. Taiwan's TWSE Index (^TWII) rose 571.33 points, or 1.81 percent, to 32,195.36.

In the Middle East, Israel's TA-125 (^TA125.TA) gained 1.65 percent Tuesday, closing at 4,106.97. In Egypt the EGX 30 (^CASE30) was another top performer, climbing 1,372.20 points, a rise of 2.88 percent, to 48,978.50.

Other Key Markets

South Africa's Top 40 USD Index (^JN0U.JO) advanced 2.45 percent to 7,573.80.

The trading day underscored a clear divergence in investor sentiment, with money flowing into Asia Pacific and high-growth emerging markets while European indices struggled for direction ahead of key economic data later in the week.

(This report incorporates quotes retrieved with the assistance of artificial intelligence).

Related story:

Monday 2 February 2026 | Wall Street rallies despite meltdown in gold, silver, bitcoin | Big News Network.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Milwaukee Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Milwaukee Sun.

More InformationInternational

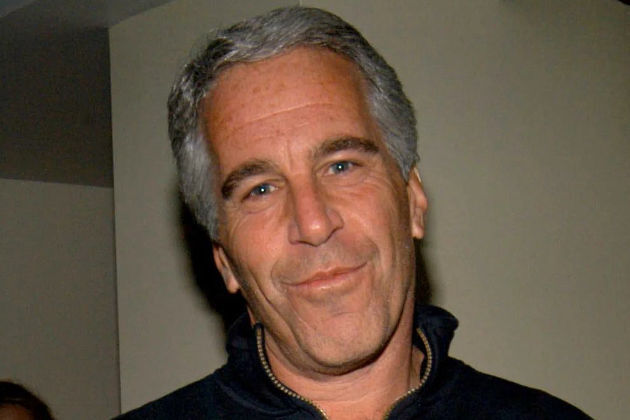

SectionEpstein files dig up links to America’s wealthy and powerful

WASHINGTON, D.C.: A massive new tranche of files on millionaire financier and sex offender Jeffrey Epstein, released on January 30,...

After vape ban, cartels tighten control of Mexico’s e-cig market

MEXICO CITY, Mexico: Mexico's sweeping ban on electronic cigarettes is reshaping the country's vape market, driving legal sellers underground...

Israel, Saudi Arabia to receive weapons worth $15.67 billion from US

WASHINGTON, D.C: The Trump administration has approved a massive new series of arms sales to Israel totaling US$6.67 billion and to...

Kennedy Center screens Melania documentary before release worldwide

WASHINGTON, D.C.: First Lady Melania Trump capped her first year back in the White House with the global release of a documentary she...

11 members of Myanmar-based group executed by China

BANGKOK, Thailand: Eleven people who killed 14 Chinese citizens, and ran a financial scam and gambling operations worth more than US$1...

WHO downplays cross-border risk after India Nipah cases

HYDERABAD, India: The World Health Organization (WHO) said on January 30 it sees a low risk of the Nipah virus spreading beyond India,...

Wisconsin

SectionImmigration crackdown could play role in midterms, Republicans feel

WASHINGTON, D.C.: With midterm elections looming, many Republicans fear that immigration enforcement by the Trump administration, which...

Amazon exits Go and Fresh stores to focus on delivery, Whole Foods

NEW YORK CITY, New York: Amazon is reshaping its brick-and-mortar grocery strategy, announcing it will shut down all Amazon Go and...

Report: Bulls add Jaden Ivey, Mike Conley Jr. in 3-team trade

(Photo credit: Rick Osentoski-Imagn Images) The Chicago Bulls are acquiring guards Jaden Ivey of the Detroit Pistons and Mike Conley...

Six more teams ask MLB to produce their TV broadcasts

(Photo credit: Dave Nelson-Imagn Images) Six more teams are turning to Major League Baseball to handle their broadcasts for the 2026...

Trade deadline looms as large as matchup for Bulls, Bucks

(Photo credit: Bob DeChiara-Imagn Images) Riding a five-game losing streak after an unsuccessful road trip, the Milwaukee Bucks start...

Mavs flagging despite Cooper Flagg; Celtics rolling with Jaylen Brown

(Photo credit: Troy Taormina-Imagn Images) The Dallas Mavericks hope Cooper Flagg's recent individual brilliance finally translates...